By Dennis Norman, on October 23rd, 2014 Over 80,000 homeowners, or 27% of all homeowners with a mortgage, in St Louis County are seriously underwater on their mortgage meaning the total balance of their mortgages represents 125% or more of the current value of their home. In addition, there are 53,548 homeowners, or 18% of all homeowners with a mortgage, in St Louis County that have mortgage balances between 90% and 110% of the value of their home, according to data just released by RealtyTrac.

As the table below shows, for the St Louis MSA, 21% of homeowners with a mortgage are underwater and 19% have “resurfacing equity” (mortgage balances equal 90% – 110% of the value of their home). Of the 5-county core St Louis market, St Charles County has the lowest percentage of seriously underwater homeowners at 10% and St Louis County has the highest at 27%.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Find your home’s market value online in LESS THAN A MINUTE!

Search all St Louis Homes For Sale HERE

Continue reading “Almost half of St Louis County Homeowners With Mortgage Are Underwater or Nearly Underwater“

By Dennis Norman, on October 16th, 2014 Foreclosures in the St Louis area fell dramatically during the 3rd quarter of this year with 1,529 total foreclosure actions on property in the St Louis MSA, a decline of 28.05 percent from the prior quarter and a decline of 53.04 percent from the same quarter a year ago, according to the latest data from RealtyTrac. As our table below shows, during the 3rd quarter of this year all the counties in the core area of the St Louis market saw double digit declines in foreclosure activity from both the quarter before as well as the same period a year ago with the exception of Franklin County. Franklin County saw foreclosure activity increase over 300 percent from the quarter before and almost 50 percent (48%) from a year ago.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale

Continue reading “St Louis Area Foreclosures Plummet In 3rd Quarter Except in Franklin County“

By Dennis Norman, on October 7th, 2014 If you are one of the many parents of college-bound kids that is considering investing in a property to provide housing for your college student rather than waste money or dorms or rent, then this newly released info will help. Below is a list of the best college towns for renting property as well as the best college towns for flipping property, as compiled by RealtyTrac. St Louis didn’t make either list, actually nothing in Missouri did, however, many of the colleges and universities listed have plenty of kids attending from this area.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Want to find homes or condos that are available in college towns or get more detailed market information on one? Contact us and we’ll get you everything you need!

By Dennis Norman, on September 23rd, 2014 The City of St Louis was at the top of a list that you don’t really want to be on, the “Top 50 Counties with the Highest Prevalence of Man-Made Environmental Hazards“, just released this morning by RealtyTrac. The city of St Louis scored a 87.2, more than triple the score of Philadelphia (27.8) which occupies the number 2 spot on the list.

In scoring locations for this list, RealtyTrac only looked at counties with a population of 100,000 or more and then ranked them based upon the % of bad air quality days, the number of Superfund sites on National Priority List per square mile and other environmental hazards per square mile. The City of St Louis experiences bad air quality days 7.89% of the time, about 45% higher than the national average of 5.43%, has 5.35 Superfund sites on the the National Priority list, 178 times the national average of .03 and has 13.3 other environmental hazards per square mile, 147 times the national average of .09.

This is yet another example of how the City of St Louis, by not being part of St Louis County and instead being treated as it’s own county, ends up on the short end of the stick (or perhaps exhaust stack in this case) on national statistics. Normally, a city within a metropolitan area is going to be more likely to have environmental hazards than the suburbs but the stats don’t look as bad with the cities’ data is mixed in with that of the suburbs, which is not the case here in St Louis.

Speaking of St Louis County, as the table below shows, it made the list also, coming in at #15 on the list.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Continue reading “City of St Louis Tops List of Places with Man-Made Environmental Hazards“

By Dennis Norman, on September 11th, 2014 For the first time in a long time, there was an increase in St Louis Foreclosures with 497 foreclosure actions in August, equivalent to 1 foreclosure action for every 2,511 housing units, an increase of 2.47 percent from the month before. While up from the month before, St Louis Foreclosures in August 2014 were down 58.41% from August 2013. As the table below shows, St Charles County had a big decline in foreclosure activity in August and the city of St Louis a modest decline, but Jefferson County and Franklin County both saw increases in foreclosures over over 100% from the month before. With the exception of Franklin County, all the counties listed had a double digit decline in foreclosure activity from the year before.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale

(see a slideshow of all foreclosures for sale below)

Continue reading “St Louis Foreclosures Rise Slightly In August; Up over 100 Percent In Outlying Areas“

By Dennis Norman, on August 29th, 2014 Flipping property in the St Louis area has paid off for investors over the past year provided they have stayed out of the City of St Louis. “Flipping” or a “Flip” is a term used today to describe when a property is bought and then re-sold within a short time period. In St Louis County, the 3rd quarter of 2013 and the 3rd quarter of 2014, there were 658 properties flipped at an average gross profit of nearly 25 percent (24.56%) , according to a newly released report from RealtyTrac. During the same period there were 203 properties flipped in St Charles county with an average gross profit of 17.95%. It doesn’t look like investors in the City of St Louis fared so well though, with 184 flips during the period for an average loss of 3.85%.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Find St Louis Property to Flip

By Dennis Norman, on August 21st, 2014 Property flipping, which is basically buying a property and then reselling it immediately, or shortly thereafter, is occurring less frequently now in St Louis than it was, according to a report released today by RealtyTrac. According to the report, there were 289 houses flipped in the St Louis metro area during the 2nd quarter, down 44% from the first quarter and down 17% from the 2nd quarter of 2013. During the 2nd quarter of this year, 3.3% of all St Louis home sales were “flip” deals which, for the purpose of this report, were homes that were bought, then resold within a 12 month period.

The average gross profit on the properties flipped during the 2nd quarter of 2014 was $20,122, down significantly from the same period a year ago when the average gross profit was $36,858. Before you get too excited, I should point out, this is just the gross margin, the difference between the initial price paid and the resale price and does not take into account any repairs, improvements or other expenses related to that property or the transaction.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Find St Louis Property to Flip

By Dennis Norman, on August 14th, 2014 St Louis foreclosure activity was on the decline again in July with a total of 485 foreclosure actions taking place in the St Louis MSA during the month which equates to foreclosure activity on 1 of every 2,573 housing units, according to data released this morning by RealtyTrac. This represents a decline in St Louis foreclosure activity of 19.57% from the month before and a decline of 59.0% from July 2013. As the table below shows, with the exception of Franklin County, all of the major Missouri counties of the St Louis MSA saw a decline in foreclosure activity from both the month before as well as a year ago.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale

(see a slideshow of all foreclosures for sale below)

Continue reading “St Louis Foreclosure Activity Down Fifty-Nine Percent In Past Year“

By Dennis Norman, on August 7th, 2014 Today, RealtyTrac released a new report which revealed that, as of the 2nd quarter of 2014, affordable housing is on the decline in one-third of the largest counties in the U.S. In compiling the report, the historical average for income to price affordability percentages were analyzed and the results showed that one-third of the counties analyzed now have higher affordability percentages than their historical average now making homes in those counties less affordable now than they have been on average over the past 14 years. On the positive side, no St Louis area counties were on that list however, St Charles County, did make a “good” list! St Charles County was one of the 10 counties that made the list where, as the chart below shows, the percentage of monthly income needed to make the payment on a median priced home was less than 20% and the unemployment rate in May 2014 was less than 5%.

See ALL St Charles County Home For Sale HERE

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Charles County Makes List of Affordable Housing Markets With Jobs“

By Dennis Norman, on July 24th, 2014 Even though, for a while now, foreclosures have been on the decline in St Louis as well as in most parts of the country, there are still many St Louis neighborhoods that are being impacted significantly by foreclosure activity. While after the housing bubble burst in 2008 we foreclosures appeared in most every neighborhood in St Louis from areas with the lowest values to areas with the highest, there has been a concentration of foreclosure activity in a few areas of St Louis. The city of Florissant, for one, is an area that has had more than it’s fair share of foreclosure activity and has seen pretty severe impact on home values there as a result.

Which St Louis Neighborhoods Have The Highest Foreclosure Rates?

As I mentioned previously, Florissant has been pounded with foreclosures, however, as the table below shows, there are many areas throughout the St Louis area, including areas in St Louis City as well as the counties of St Louis, St Charles, Jefferson and Franklin, that are on the list of the 19 highest foreclosure rate areas of St Louis. Below the table is an interactive foreclosure map for Missouri where you can find foreclosure rates for any county in Missouri or, click on the county and find foreclosure rates for any area within that county.

See ALL Foreclosures for sale in St Louis

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “Areas With Highest Foreclosure Rates In St Louis“

By Dennis Norman, on July 17th, 2014 St Louis Foreclosure activity dropped in June to a rate of 1 foreclosure action on every 2,070 units, a decline of nearly 50 percent (49.58%) from June 2013, and down 13.11% from the month before, according to a report just released this morning by RealtyTrac. The table below shows the numbers for the St Louis metro area as a whole as well as a breakdown by county and, as the table shows, all the counties in the St Louis, Missouri core market saw declines of nearly 50% or better in the past year and all, except the city of St Louis, saw double-digit declines from May 2014.

On the national level there is good news as well as foreclosure activity declined in June 2014 to the lowest level since July 2006, before the housing market meltdown.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosure Activity Drops Nearly 50 Percent In Past Year“

By Dennis Norman, on July 15th, 2014 Looking to buy a home in St Louis at a BIG Discount?

Take it from someone that has been in the business over 30 years and during that time bought and sold over 2,000 homes; there is no silver bullet or magic formula to finding a great deal on a home or other piece of property. I wish it were that easy. You can however use information and resources that are available to help identify potential good deals and then, with a lot of driving and looking at homes, cull through the pile looking for the “deal”.

RealtyTrac just did some research trying to identify common characteristics of deals on homes that sold at a big discount (25% or more) and came up with property profiles that they feel identify those homes that have the greatest potential of being sold at a big discount.

What are the four profiles of “big discount” or bargain-priced homes?

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “How To Buy Homes in St Louis at a Big Discount“

By Dennis Norman, on June 24th, 2014 St Louis Foreclosures, and short sales, in May 2014 accounted for just 8.5% of all home sales in the St Louis core market (city of St Louis and the counties of St Louis, St Charles, Jefferson and Franklin), according to data released just this morning from RealtyTrac. This is a decline of 26.7% from May 2013 when foreclosures and short sales in St Louis accounted for 11.6% of all home sales.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosures and Short Sales Fall By Over 25 Percent“

By Dennis Norman, on June 3rd, 2014 The best places to flip property in the U.S. are, with the exception of Wright County Minnesota, all east of the Mississippi extending from as far north on the east coast as New York to as far south as Florida, according to a report just released by RealtyTrac. For this report, RealtyTrac looked at property that was “flipped” (bought and then resold within the same period…often times done by an investor for profit) during the one-year period from April 2013 through March 2014, and ranked the counties based upon the gross return on investment made in those flips. One thing to keep in mind, this is just a “gross margin” or simply the difference between what the house was bought for and then resold for during the period without taking into account the expenses involved in the acquisition and sale, cost of rehab and improvements that were done or carrying cost.

Here in St Louis there are only two counties that were including in the report, St. Charles County and St Louis County (in which they included the city of St Louis as well). For St Charles county there were 98 flips during the one-year period and the average gross return on investment was 66.95%. For St Louis County (and city) there were 399 flips with an average gross return on investment of 25.32%. There is a US interactive heat map below where you can look up info for counties around the country.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Find St Louis Property to Flip Continue reading “Where Are The Best Places To Flip Property?“

By Dennis Norman, on May 29th, 2014 Distressed home sales in St Louis accounted for just under eleven percent (10.7%) of all home sales in the St Louis MSA in April 2014, according to data released just this morning from RealtyTrac. This is a decline of 29.1% from April 2013 when distressed home sales in St Louis were responsible for 15.1% of all home sales. Distressed home sales include short-sales (when sellers sell for less than they owe with the agreement of their lender), REO’s (bank-owned real estate acquired through foreclosure and now being resold) and foreclosure auction sales (when homes are actually sold at foreclosure).

Since a big chunk of the St Louis MSA lies across the Mississippi river in Illinois, I like to focus on the 5-county area that makes up the bulk of the St Louis real estate market on the Missouri side of the river. These counties include St Louis, St Charles, Jefferson, Franklin as well as the city of St Louis. As the table below shows, distressed home sales in April 2014 were down from a year ago in all of the counties. For the 5 county core as a whole, on median, 10.1% of all home sales in April 2014 were distressed home sales, down 41.4% from a year ago when distressed sales accounted for 14.7% of the goal home sales in the 5-county core St Louis market.

Distressed home sales put a lot of downward pressure on home prices in St Louis, so this continued trend of fewer distressed sales is very much a positive for the St Louis housing market and should help the St Louis market sustain home prices as well as support home price increases when supported by market demand.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “Distressed Home Sales in St Louis Metro Area Fall Almost 30 Percent From A Year Ago“

By Dennis Norman, on May 16th, 2014 St. Louis Metro Foreclosure Activity declined in April with 1 of every 1,013 housing units in the St Louis metro area having a foreclosure action on it during the month, a decline of 16.56 percent from the month before and a decline of 20.36% from April 2014, according to the latest data released today by RealtyTrac.

As the table below shows, all the counties that make up the core of the St Louis real estate market (on the Missouri side of the river) had decreased foreclosure activity in April from the month before. Three of the five counties saw double digit decreases from a year about however, St Louis city and county both saw increases.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading "St. Louis Metro Foreclosure Activity Down 20 Percent From Year Ago"

By Dennis Norman, on April 24th, 2014 St Louis distressed home sales declined during the first quarter of this year with distressed home sales (foreclosures, REO’s and short sales) in the 5-county core St Louis market (city of St Louis and counties of St Louis, St Charles, Jefferson and Franklin) accounting for 15.0% of all home sales, This is down 18.5% from the first quarter of 2013 when St Louis distressed home sales accounted for 18.4% of all home sales, according to newly released data from RealtyTrac. As the table below shows, all the counties that make up the core of the St Louis real estate market (on the Missouri side of the river) saw short sales and REO’s decrease in the first quarter of 2014 from a year ago with the exception of REO sales in St Charles that increased 5% during the period. All counties saw an increase in foreclosure auction activity from the first quarter of 2013 to the first quarter of 2014.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Distressed Home Sales Down From a Year Ago“

By Dennis Norman, on April 17th, 2014 Almost 1 of every 4 St Louis homeowners with a mortgage (23%) are seriously underwater, meaning their mortgage(s) total at least 125% of their homes current value, according to a report for the 1st quarter of 2014 just released this morning by RealtyTrac. According to the report, there are 161, 310 St Louis homeowners that are underwater while 138,492 homeowners (19%) have “resurfacing equity” meaning their mortgage totals are 90% – 110% of their homes current value, allowing them to see the light at the end of the tunnel. Throughout the state of Missouri, 22% of homeowners with a mortgage are seriously underwater and 20% have resurfacing equity.

At the opposite end of the spectrum, 13% of St Louis homeowners with a mortgage are “equity rich” with more than 50% equity in their homes.

St Charles County Has Lowest Rate of Underwater Homeowners

Of the five counties that make up the bulk of the St Louis market on the Missouri side of the Mississippi, St Charles county has the lowest percentage of underwater homeowners at just 11%. The table below shows complete data for all 5 counties.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “Nearly 1 in 4 St Louis Homeowners with a mortgage are underwater“

By Dennis Norman, on April 10th, 2014 St Louis foreclosures increased during the first quarter of this year in the main areas of our St. Louis metro area market located on the Missouri side of the Mississippi with St Louis city foreclosures, St Louis County foreclosures and St Charles county foreclosures all increasing from the 4th quarter of 2013, according to information real eased this morning by RealtyTrac.

St Louis foreclosures for the MSA were down during the first quarter of 2013 1.6% from the 4th quarter of 2013 with a foreclosure action occurring on 1 out of every 452 housing units in the St Louis metro area. Foreclosures in the St Louis metro area, including all 5 counties that make up the core of the market on the Missouri side of the river, St Louis City and County, St Charles County, Jefferson county and Franklin County, decreased double digits from a year ago. Complete details are in the table below.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosures Increase In First Quarter 2014“

By Dennis Norman, on March 13th, 2014 St Louis foreclosures were on the rise in February with 1 of every 1,328 housing units in the St Louis metro area having a foreclosure action on it during the month, 24.17 percent higher than the month before, however still down 33.14% from February 2013, according to the latest data released today by RealtyTrac.

As the table below shows, all the counties that make up the core of the St Louis real estate market (on the Missouri side of the river) saw an increase in foreclosure activity in February from the month before with the exception of Jefferson county that had relatively little foreclosure activity but more than a year ago. All the counties saw a decrease in foreclosures from a year ago however.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosures Rise in February-Still Down From Last Year“

By Dennis Norman, on February 13th, 2014 St Louis foreclosures increased in January to the point where 1 of every 1,649 housing units in the St Louis metro area had a foreclosure action on it during the month, an increase of 21.70 percent from the rate in December 2013, however a decline of almost 50% (47.06%) from January 2013, according to the latest data released today by RealtyTrac.

As the table below shows, all the counties that make up the core of the St Louis real estate market (on the Missouri side of the river) saw declines in foreclosure activity from a year ago with the exception of Jefferson County which saw foreclosure activity spike in January, increasing 128% from the month before and over 13% from a year ago. Jefferson County also had the dubious distinction as having the highest rate of foreclosure activity during January 2014 of any county in Missouri.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosures Increase In January But Down Almost 50 Percent From Year Ago“

By Dennis Norman, on January 22nd, 2014

St Louis distressed home sales continue to fall, according to a report published by MORE, REALTORS based upon data released by RealtyTrac. This report supports other market data that indicates the St Louis real estate market is recovering from the devastation brought on it when the real estate market bubble burst back in 2008.

The market crash brought many institutional buyers into the market, buying up homes as prices fell, but the recovery of the St Louis real estate market has slowed this activity as well. Home sales fueled by institutional investors fell 23.6% in December 2013 from the year before, according to the report.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on January 16th, 2014 Foreclosures in the St Louis metro area during the 4th quarter of 2013 were down 13.79% from the prior quarter and down 40.64% from the 4th quarter of 2012, according to a report released today by RealtyTrac. As the table below shows, the foreclosure rate for 3 of the 5 core St Louis counties declined in the 4th quarter from the prior quarter and all declined from the year before.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “Foreclosures in St Louis Metro Area Down Over 40 Percent From Year Ago“

By Dennis Norman, on January 10th, 2014  Over 1 of every four St Louis homeowners (28%) with a mortgage are seriously underwater on their mortgages, meaning the current value of their home is at least 25 percent less than the total of their mortgages as of December 2013, according to a report just released by RealtyTrac. On a national level, in December 19% of the homeowners with a mortgage were considered seriously underwater. Over 1 of every four St Louis homeowners (28%) with a mortgage are seriously underwater on their mortgages, meaning the current value of their home is at least 25 percent less than the total of their mortgages as of December 2013, according to a report just released by RealtyTrac. On a national level, in December 19% of the homeowners with a mortgage were considered seriously underwater.

At the other end of the spectrum, 11 percent of St Louis homeowners with a mortgage are “equity-rich“, meaning their mortgages total less than 50% of the current value of their home. On a national level, equity-rich homeowners account for 18% of the homeowners with a mortgage.

The chart below shows St Louis homeowners equity.

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “More than 1 in every 4 St Louis homeowners still seriously underwater on mortgage“

By Dennis Norman, on December 12th, 2013 St. Louis foreclosures have declined roughly 50 percent from a year ago, according to the latest data from RealtyTrac. As the table below shows, the foreclosure rate for the 3 main counties of St Louis (city of St Louis, St Louis County and St Charles county) was down from the month before (or about the same for the city), however Franklin and Jefferson county saw an increase from the month before. All five counties have seen a significant drop in foreclosure rate from a year ago.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosures Down About 50 Percent From A Year Ago“

By Dennis Norman, on November 26th, 2013 St. Louis short sales accounted for just 1 percent of the overall home sales activity during October in the core market of St. Louis (the city of St Louis and counties of St Louis, St Charles, Jefferson and Franklin), according to the latest data from RealtyTrac. As the table below shows, Jefferson County had the largest percentage of short sales in October at 7% and St Charles and Franklin both the lowest at 0%. REO sales (prior foreclosures that are now bank owned) on the other hand, made up 7 percent of St Louis area home sales in October, an increase of 33.3% from a year ago.

St Louis has historically not seen much in the way of institutional investors buying homes in the area, however this has changed of late and, in fact, made up 10% of the overall area home sales a year ago. In St Charles County, 25% of home sales in October 2012 were sales involving institutional investors but this has fallen to 13% last month, a decline of almost 50%.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Short Sales Plummet While REO’s on the Rise“

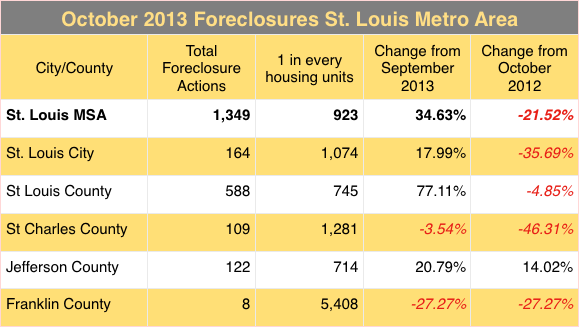

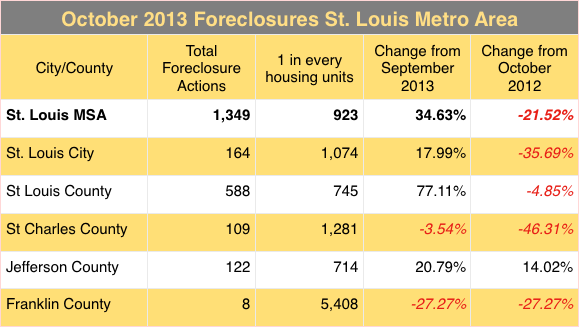

By Dennis Norman, on November 15th, 2013 St. Louis foreclosure activity shot up in October from the month before for the metro area as a whole with foreclosure actions occurring on 1 of every 923 housing units, according to the latest data from RealtyTrac. Even with the increase, October’s foreclosure activity rate for the St Louis metro area was down over 20% from a year ago. Foreclosure activity varied widely across the St Louis metro area with St Louis county seeing a 77% month over month increase and St. Charles and Franklin county both seeing declines in month over month as well as year over year rates.

Data Source: Realty/Trac – Copyright 2013 St Louis Real Estate News

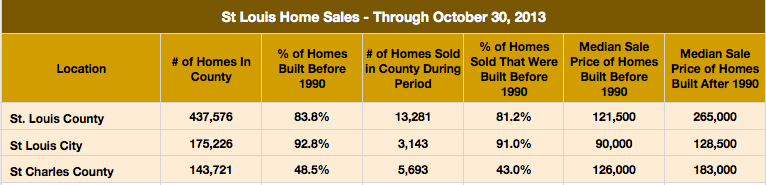

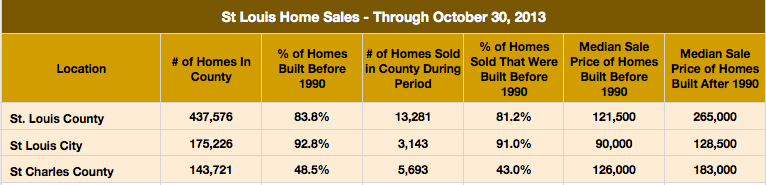

By Dennis Norman, on October 31st, 2013  I decided to take a look at the age of homes in the St Louis area and determine if older homes in St Louis sell for lower prices than newer homes. My idea to do this was prompted by a report RealtyTrac published this morning revealing that 71 percent of the homes in the U.S. were built before 1990 and that there was less demand for these older homes thereby making prices more affordable than on their newer counterparts. I decided to take a look at the age of homes in the St Louis area and determine if older homes in St Louis sell for lower prices than newer homes. My idea to do this was prompted by a report RealtyTrac published this morning revealing that 71 percent of the homes in the U.S. were built before 1990 and that there was less demand for these older homes thereby making prices more affordable than on their newer counterparts.

My research shows that the city of St Louis and St Louis county have a larger percent of older (pre-1990) housing stock than the national average, which is not surprising given the fact St Louis was founded almost 250 years ago. St. Charles county, on the other hand, has a much younger housing supply with less than half the homes in the county having been built before 1990.

Less demand, and lower prices, for pre-1990 homes: (We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

As the table below shows, the percentage of homes sold thus far this year in the St Louis area that were built before 1990 is a little disproportionate with the percentage of the existing homes built before 1990. This is consistent with the RealtyTrac report which showed more demand for the newer homes. Another interesting thing to note is the significant difference in median prices for homes built before 1990 versus built after 1990.

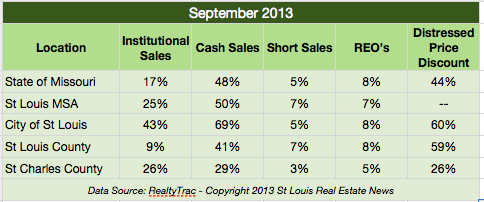

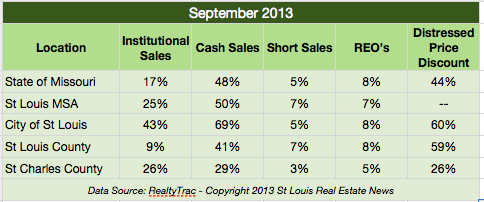

By Dennis Norman, on October 24th, 2013  Cash Home Buyers in St Louis were responsible for 50 percent of the home sales in September 2013 in the St Louis Metro area, according to a new report just released today by RealtyTrac. The report showed that state-wide, cash buyers accounted for 48 percent of home sales in Missouri during the month. As the table below shows (a St Louis Real Estate News Exclusive), in the city of St Louis 69 percent of the home sales in September were cash sales. Cash Home Buyers in St Louis were responsible for 50 percent of the home sales in September 2013 in the St Louis Metro area, according to a new report just released today by RealtyTrac. The report showed that state-wide, cash buyers accounted for 48 percent of home sales in Missouri during the month. As the table below shows (a St Louis Real Estate News Exclusive), in the city of St Louis 69 percent of the home sales in September were cash sales.

Cash sales are often associated with investors and, as the table shows, there is no lack of investor activity in the St. Louis metro area. In fact, institutional sales in September were over 50 percent higher in the St Louis metro area than for the state of Missouri as a whole.

For Advice on How to Buy St Louis Foreclosures From A 2000+ Home Buyer Investor click here. (would you consider a “LIKE” in exchange?)

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on October 17th, 2013  House flipping in St Louis is on the rise according to the 3rd quarter house flipping report just released this morning by RealtyTrac, the foreclosure tracking gurus. What is “house flipping”? Well, back when I entered the real estate business (1979) and began buying and selling homes, a “flip” was referred to as a house we sold and would close the our purchase, as well as our resale, on the same day. Today, “flipping” is applied to a home that is bought and then resold within a short period, for the purposes of the RealtyTrac report, 6 months. House flipping in St Louis is on the rise according to the 3rd quarter house flipping report just released this morning by RealtyTrac, the foreclosure tracking gurus. What is “house flipping”? Well, back when I entered the real estate business (1979) and began buying and selling homes, a “flip” was referred to as a house we sold and would close the our purchase, as well as our resale, on the same day. Today, “flipping” is applied to a home that is bought and then resold within a short period, for the purposes of the RealtyTrac report, 6 months.

The RealtyTrac report shows, during the 3rd quarter, there were 346 houses flipped in the St. Louis metro area, a slight decrease (10%) from the prior quarter, but a 68% increase from a year ago. The average price paid for a St Louis flip was $124,102 and the average price it was resold at was $142,370. The table below shows complete data for the metro area as well as for St Louis City & County and St Charles county.

Interested in Flipping Property?

Buying Foreclosures is a good place to start.

Search St Louis Foreclosures HERE

For Advice on How to Buy St Louis Foreclosures From A 2000+ Home Buyer Investor click here. (would you consider a “LIKE” in exchange?)

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “House Flipping In St Louis Up 68 Percent From Year Ago“

|

Recent Articles

|

Over 1 of every four St Louis homeowners (28%) with a mortgage are seriously underwater on their mortgages, meaning the current value of their home is at least 25 percent less than the total of their mortgages as of December 2013, according to a report just released by RealtyTrac. On a national level, in December 19% of the homeowners with a mortgage were considered seriously underwater.

Over 1 of every four St Louis homeowners (28%) with a mortgage are seriously underwater on their mortgages, meaning the current value of their home is at least 25 percent less than the total of their mortgages as of December 2013, according to a report just released by RealtyTrac. On a national level, in December 19% of the homeowners with a mortgage were considered seriously underwater.