By Dennis Norman, on July 6th, 2022 It’s no secret that the real estate market slows down in the winter and typically nearly screeches to a halt from shortly before Christmas to shortly after New Years. Therefore, when tracking showing activity in the St Louis area, the first week of January of each year is used as the base, or “0” value and then each rolling 7-day period afterward is compared to that first week.

As the chart below shows, in 2020 and 2021 all weekly averages of showing activity were above the baseline of January until getting close to Thanksgiving, with the one exception being late March and Early April of 2020 which was a result of the COVID-19 pandemic beginning. The orange line depicts this year and it shows showing activity all year has been below the levels of the prior two years for the most part, however, the gap has widened in the past couple of weeks. On July 4th, for the prior 7-day period the number of showings was less than the first week of January and it dipped further on July 5th to 6.9% fewer showings during that 7-day period than the first week of January. Granted, it is always going to dip around a holiday but last year for the period ended July 5th there were 9.1% more showings than the first week of January, for a difference of 16% from this year.

Rising interest rates and increased inflation are no doubt two of the big reasons for this along with a low inventory of homes for sale.

Continue reading “Showings Of St Louis Listings Fall To Levels Below January“

By Dennis Norman, on June 16th, 2022 For the first three weeks of June there were 1,475 new listings of homes for sale in the St Louis 5-county core market, according to the STL Real Estate Trends Report from MORE, REALTORS®. During the same period, there were 1,194 new contracts written on homes for sale resulting in a new listing to new contract ratio of 1.25. This ratio of listings to new sales is higher than it was 3 weeks ago when I shared the last update from the STL Real Estate Trends report and it was 1.05 at that time for the period reported which was the first 3 weeks of May.

It was at the end of last week that the mortgage bond market blew apart forcing mortgage interest rates up so when our new report for this week is release next Thursday we’ll see what effect that had on the market.

Continue reading “New Listings To New Contracts Ratio Increases This Month“

By Dennis Norman, on June 15th, 2022 After over 40 years in the real estate business in St Louis I’ve seen many times just how fast a good, or even great housing market can turn sour as well as the other way around. Two years ago, economic conditions relevant to the housing market included:

Today, the above conditions are:

Does this mean St Louis home prices will come crashing down?

First off, I’m not an economist, in fact I didn’t even attend college and I certainly don’t have a crystal ball showing me the future, but I am a data junkie that has lived through a variety of markets spanning more than 4 decades. My experience as well as my study of past markets as well as current indicators of things to come certainly give me an opinion. In times past, my opinions on the market have been spot on, almost to the point that I even surprised myself (such as in October 2006, at the peak of the housing boom when I predicted the collapse) and other times I’ve been wrong, sometimes way wrong. The reality is that the housing market is affected, or can be affected by so many different economic factors, as well as social issues, consumer sentiment and more that I don’t believe anyone can predict what it’s going to do accurately consistently.

Continue reading “Will Home Prices Come Crashing Down?“

By Dennis Norman, on June 12th, 2022 There have been 9,645 homes sold in the St Louis 5-county core market during the first 5-months of this year which, as the STL Market Chart below illustrates, is a decline of 8.8% from the same time last year when there were 10,579 homes sold.

2022 home sales outpacing 2020…

While this years St Louis home sales are lagging behind last years, as the chart below also shows, 2022 YTD home sales is 2.8% higher than in 2020 when there were 9,382 YTD home sales.

$1 Million+ home sales going strong…

The bottom chart shows there have been 189 one-million dollar+ homes sold in St Louis year-to-date through May 31st, a slight increase over last year when there were 187 homes sold during the period. This years $1,000,000+ home sales are 89% higher than they were during the period in 2020.

Continue reading “St Louis YTD Home Sales Down Nearly Nine Percent From Last Year“

By Dennis Norman, on June 10th, 2022 With the bidding wars we’ve seen on listings resulting in sold prices that exceed the asking price in St Louis over the past couple of years, it’s hard to imagine that home values could be lower today than a year ago. Now, before you call me crazy, I’m not saying that St Louis homes are SELLING for LESS now than a year ago. As our STL Market Chart below shows, the median price of homes sold in the St Louis 5-county core market was $254,950 in May 2021 and $270,000 last month, for an increase in sales price of 5.9%. However, given that, as the chart at the bottom shows, the inflation rate has increased 8.6% during the past 12-months, St Louis home prices have not increased as much as inflation, thereby leaving them worth less today than they were worth a year ago after adjusting for inflation.

Home prices last month would have needed to be $276,829 to keep pace with inflation…

In order to keep pace with inflation and make a median-priced St Louis home worth the same in today’s dollars as it was worth a year ago it would have be worth $276,829 today at the current rate of inflation.

If we look farther back it gets better….

Continue reading “St Louis Home Values Declined In Past 12-Months After Inflation“

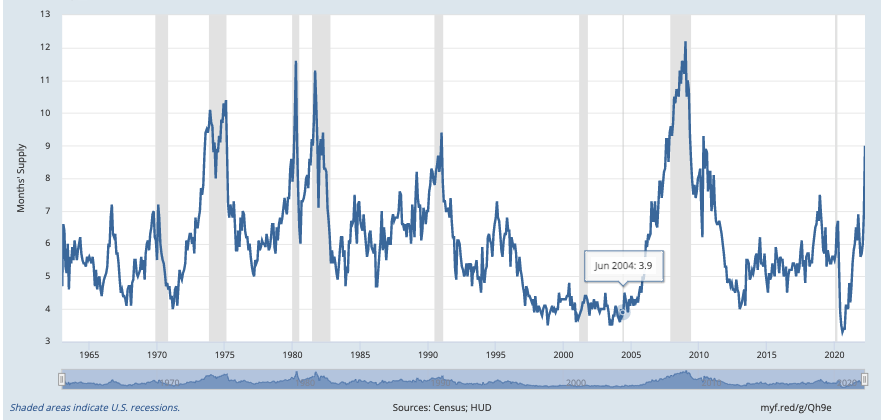

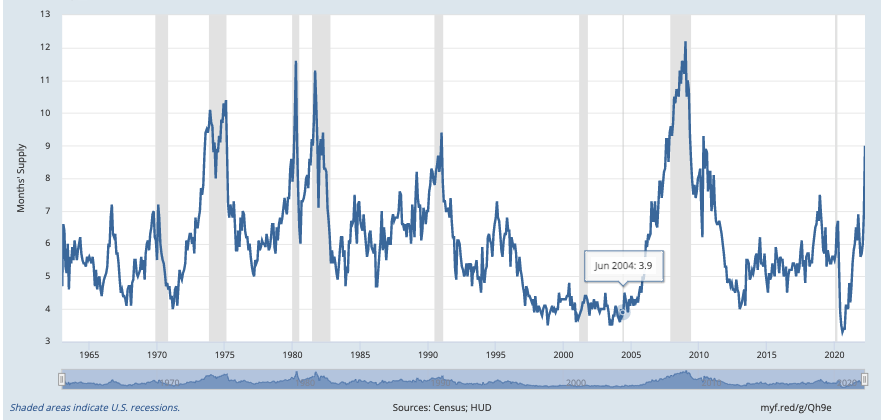

By Dennis Norman, on June 10th, 2022 Given the low-inventory of homes for sale that has existed for some time now, it may be hard to believe my next statement, but the latest data from the U.S. Census Bureau and HUD show that there is currently a 9-month supply of newly constructed homes in the U.S. As the chart below illustrates, this is the highest level the supply of new homes in the U.S. has reached since May 2010 when there was a 9.3 month supply.

The months supply of depicted below is calculated as the ratio of new homes for sale to the number of new homes sold. The resulting number represents the number of months it would take for the current new home inventory that is for sale to be depleted given the current sales rate if no new additional new homes were built.

Months Supply of New Homes In The U.S.

(click chart for live, interactive chart)

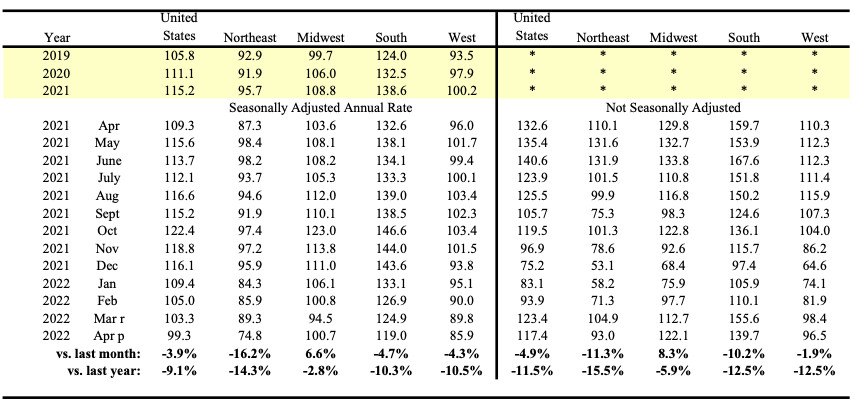

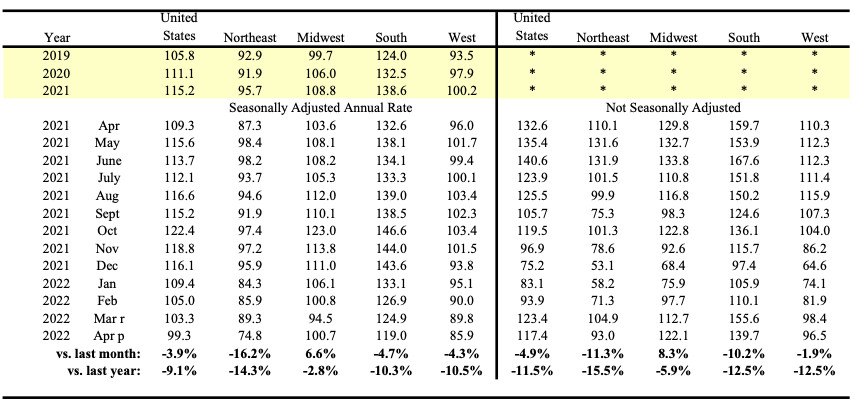

By Dennis Norman, on May 26th, 2022 The pending home sales index from the National Association of REALTORS® (NAR) was released showing the midwest region as the only region that had an increase from March to April. According to the NAR report below, the pending home sales index for the midwest increased 6.6% from March to April while declining 3.9% for the nation as a whole. As the table below shows, all while all four regions in the U.S. saw a decline in the pending home sales index from a year ago, the midwest fared the best again showing only a 2.8% decline while the other regions all saw a double-digit decline.

National Association of REALTORS®

Pending Home Sales Index (PHSI)

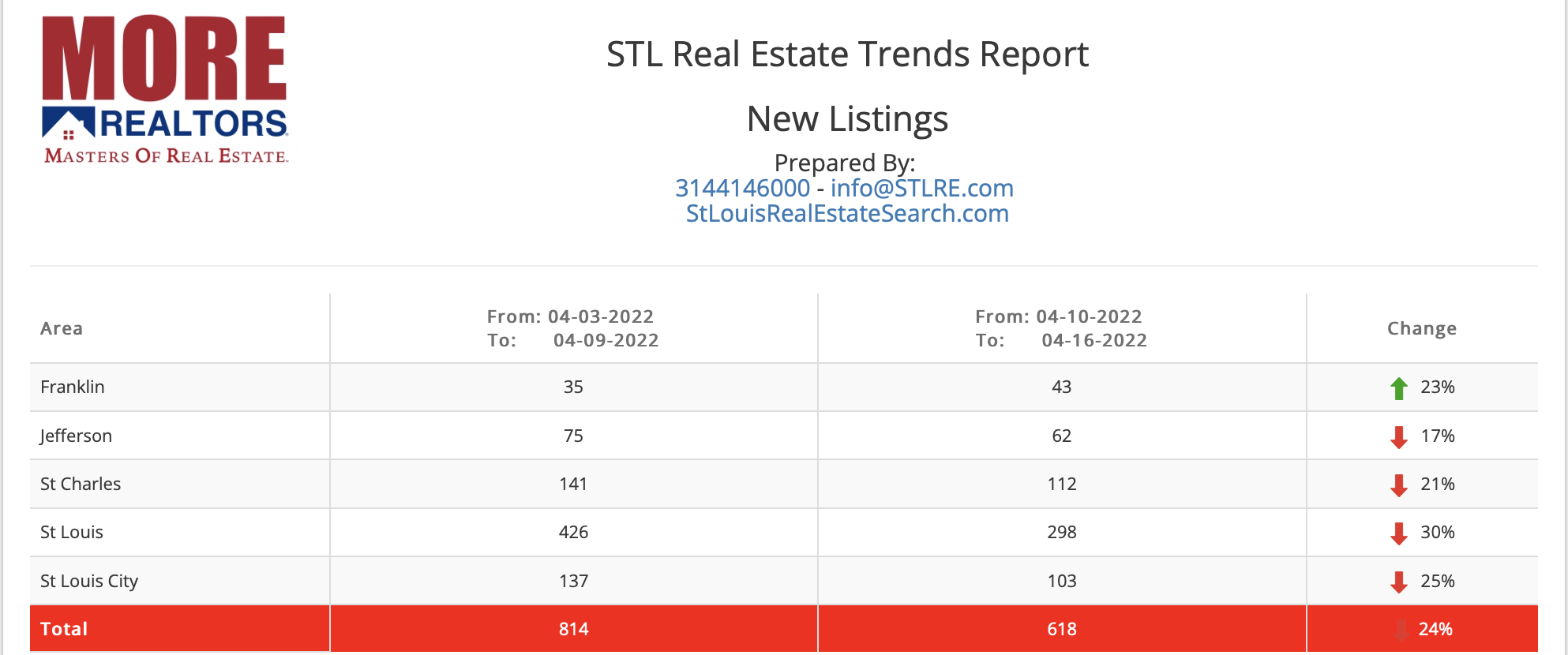

By Dennis Norman, on May 26th, 2022 For the first three weeks of May there were 2,115 new listings of homes for sale in the St Louis 5-county core market, according to the STL Real Estate Trends Report from MORE, REALTORS®. During the same period, there were 2,019 new contracts written on homes for sale resulting in a new listing to new contract ratio of 1.05. This is pretty consistent with the recent trend with new listings slightly outpacing new sales. As the tables at the bottom show, for April there were 3,470 new listings and 3,269 new contracts written for a new listing to new contract ratio of 1.06.

Continue reading “St Louis New Listings to New Contracts Trend Remains Steady“

By Dennis Norman, on May 9th, 2022 There have been a lot of reports over the past month about rising interest rates (mortgage rates on a 30-year fixed-rate mortgage hit 5.27% last week) as well as rising inflation rates (8.5% in March) and the effect these things will have on the housing market. It’s no doubt they will have some affect on home prices and sales and I have been watching the data on St Louis home prices and sales closely and so far there does not appear to be much impact.

St Louis home sales increase in April from March…

There are two ways we analyze home sales at MORE, REALTORS®; the traditional manner, which is what almost all public reports are based upon, closed sales (which are really indicative of what the market was like 1-2 months previously since that is when the contracts were typically written) and then by use of our STL Real Estate Trends Report, which gives us a better idea of the current activity. Our trends report shows the number of new contracts written on listings, so current sales activity as well as the number of new listings entering the market. The good news is, when looking at St Louis home sales activity for April, both closed sales and newly written contracts increased from the month before.

As our chart below shows, there were 2,134 homes sold in St Louis (5-county core market) during April, a 6.4% increase from March when there were 2,005 homes sold. As the STL Real Estate Trends Report shows, there were 3,279 new contracts written on homes during April in the St Louis 5-county core market, an increase of 5% from the prior month when there were 3,124 contracts written.

Continue reading “St Louis Home Sales Doing Well In Spite of Rising Interest Rates & Inflation“

By Dennis Norman, on April 29th, 2022 Last week there were 551 new contracts written for the sale of listings in the St Louis 5-county core market down over thirty-six percent (31.3%) from the week before when there were 802 new contracts written, according to the STL Real Estate Trends Report, exclusively available from MORE, REALTORS®. The new sales activity last week was down even more (nearly 36%) from the same week a year ago when there were 851 new contracts written on listings. There is no doubt this is the result of mortgage interest rates which have nearly doubled in the last 15 months.

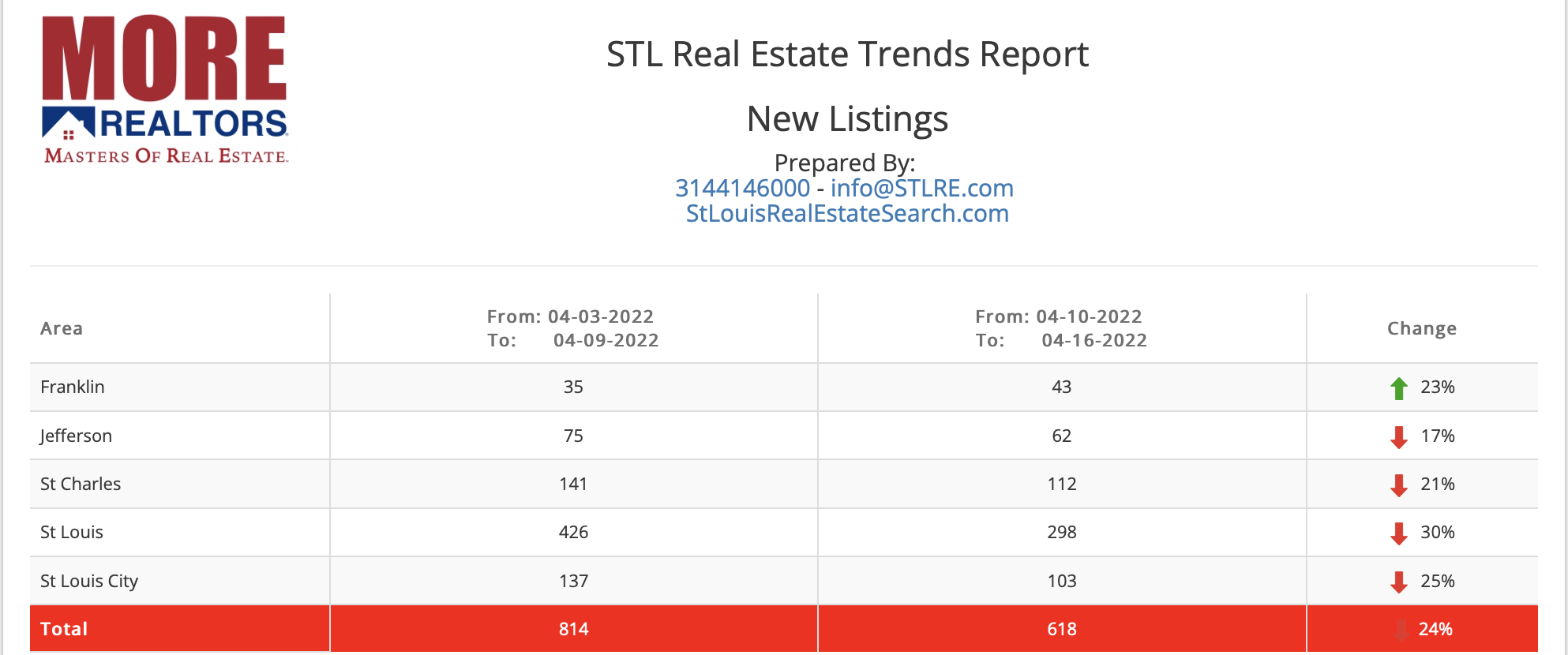

New listings on the other hand increased last week to 851 from 618 the week before. The new listing activity is pretty much in line with the same week a year ago when there were 858 new listings. If this trend continues the listing supply will likely increase significantly. Given that the for the 5-county core market its been under 1 month for a long time, it can afford to increase some.

The current week will be very telling. When we see data next week from this week, if the numbers are similar to what we saw last week, it’s a likely indicator of a market shift to some extent. Time will tell..

Continue reading “New Sales Last Week Declined Over Thirty Percent From The Week Before“

By Dennis Norman, on April 27th, 2022 The past several days have not been good for the National Association of REALTORS® (NAR) from a legal perspective at least.

First, last Friday, April 22, 2022, Stephen R. Bough, a Federal Judge for in the Western District of Missouri, certified a lawsuit against NAR as a class action suit.The suit, known as the “Sitzer” suit as the original plaintiffs were Joshua Sitzer and Amy Winger, alleges that the defendant, the National Association of REALTORS® “created and implemented anticompetitive rules which require home sellers to pay commission to the broker representing the home buyer“. The plaintiffs in the suit also allege that the other defendants, which include Realogy Holdings Corp, Homeservices of America, Inc., Re/MAX LLC and Keller Williams Realty, Inc., “enforce those rules through anticompetitive practices.” I believe this action by the court was expected and likely did not come as a surprise to anyone but it was not good news for NAR or the other defendants. In the coming days I’ll be doing an in-depth article on this one.

Then, yesterday, the United States Court of Appeals for the 9th Circuit delivered another and this time, a likely unexpected, blow to the National Association of REALTORS® in the form of a reversal of a suit against NAR that had been dismissed previously by a lower court. The suit, PLS.com v. the National Association of REALTORS®, is another suit alleging anti-trust violations by NAR and the other defendants which are all MLS’s. The suit was brought originally by PLS.com as a result of NAR enacting its “Clear Cooperation Policy” which for all intents and purposes, dictates to agents and brokers how and when they can market their listings. I’ve written several articles specifically on this policy in the past which can be found using the following links:

Continue reading “Appellant Court Overturns Lower Court Dismissal of Anti-Trust Lawsuit Against the National Association of REALTORS®“

By Dennis Norman, on April 19th, 2022 Even with the high rate of inflation, rising interest rates and general unrest in the economy, during the past two weeks there were more new contracts written on listings than there were new listings. According to the STL Real Estate Trends Report, exclusively available from MORE, REALTORS®, during the last two weeks there were 1,496 new contracts accepted on listings in the St Louis 5-County core market while there were 1,432 new listings during the same period. While there were only 4.5% more sales than listings, given the fact we are already in a low-inventory market, this is fairly significant.

STL Real Estate Trends Report

(click on report for current report)

By Dennis Norman, on April 15th, 2022 Yesterday, I wrote an article addressing the high rate of inflation just reported and its impact on the St Louis housing market. In it, I promised to take a deeper look into the effect of the current events related to the economy on St Louis home prices which I will do in this article.

Before I go further, I should mention I’m not an economist nor a fortune teller. I am, however, a real estate broker and data nerd that has spent over 40 years in the St Louis real estate industry. I try my best to use my knowledge and experience to anticipate changes in the market and use this to help our agents and clients use this information to their advantage.

History always repeats itself..

I find the above old adage to be pretty accurate when it comes to the real estate market. Therefore, in trying to get my head around what impact a high inflation rate may have on home prices, I started by going back to prior periods of high inflation rates.

The first chart below shows the rate of inflation, interest rates, and the St Louis home price index. I’ve made some notes on it to show prior inflationary periods and the effect on home prices. The first period, the early 80s was much worse than today as inflation was higher and interest rates were in the stratosphere hitting 18%. The more recent period around 2007-2009 was not as severe and therefore the impact on home prices was not as dramatic as the former either. As you can see on the far right side of the chart, home prices have increased in the past several months at a sharp rate with the change from a year ago being greater than the last inflationary period but not as great as the one from the early ’80s.

The next chart shows the relationship between home prices and rent. When home prices outpace rent, home prices decline, when rent outpaces home prices, prices rise. As the chart shows, these two lines have converged indicating a reasonable balance between home prices and rent.

During the period of 2007 – 2011 home prices fell over 17% during a four year period before finally bottoming out.

Today is different though…

Continue reading “How Much Will St Louis Home Prices Be Impacted By Inflation?“

By Dennis Norman, on April 8th, 2022 Every month Fannie Mae surveys consumers about owning and renting a home as well as about other issues related to the housing market and economy and from the results publishes its Home Purchase Sentiment Index (HPSI). One of the components of the index is what the sentiment is on whether now is a good time to buy a home or sell a home. In April 2022, HPSI consumers’ sentiment on whether now is a good time to buy a home hit an all-time low with just 24% of respondents saying now is a good time to buy a home. As the charts below illustrate, 73% of respondents said now was a bad time to buy a home.

By Dennis Norman, on January 14th, 2022 The home sales trend in St Louis is easing with 29,778 homes being sold in the St Louis 5-county core market during the 12-month period ended December 31, 2021, according to the chart below provided by MORE, REALTORS®. This 12-month rate of St Louis home sales has declined for the 3rd month in a row after peaking at 30,225 homes sold in the 12-month period ended September 30, 2021.

Leading indicator Reports Show a Downturn in Home Sales as well…

The STL Real Estate Trends Report, below the chart, shows new contracts written on listings for the most recent week reported, compared with the same week last year. As the report shows, contracts written during the most recent week were down 23% from the same week a year ago, with all 5 counties reported showing a double digit decline. Franklin County saw the biggest drop at 34% followed by St Louis City witha. 31% decline.

Continue reading “St Louis Home Sales Trend Declining“

By Dennis Norman, on January 12th, 2022 As the STL Market Report (available exclusively from MORE, REATLORS®) below illustrates, there were 30,197 homes sold in the St Louis 5-county core market during 2021, an increase of 3.86% from 2020 when there were 29,075 homes sold. The median sales price of homes sold in the St Louis 5-county core market was $250,000 during 2021, an increase of 9.17% from 2020 when the median price of homes sold in St Louis was $229,000. The 5-county core St Louis market is comprised of the city and county of St Louis, along with the counties of Jefferson, Franklin, and St Charles. The St Louis core market is responsible for over 7y0% of all homes sold in the 17-county St Louis MSA market.

Housing inventory remains low…

As the last row of the report shows, there is still just a 0.6 month supply of homes for sale in the St Louis 5-county core market and the median time on the market is 64 days.

Continue reading “St Louis Home Sales in 2021 Tops Year Before By Nearly 4 Percent – Prices Up Over 9 Percent“

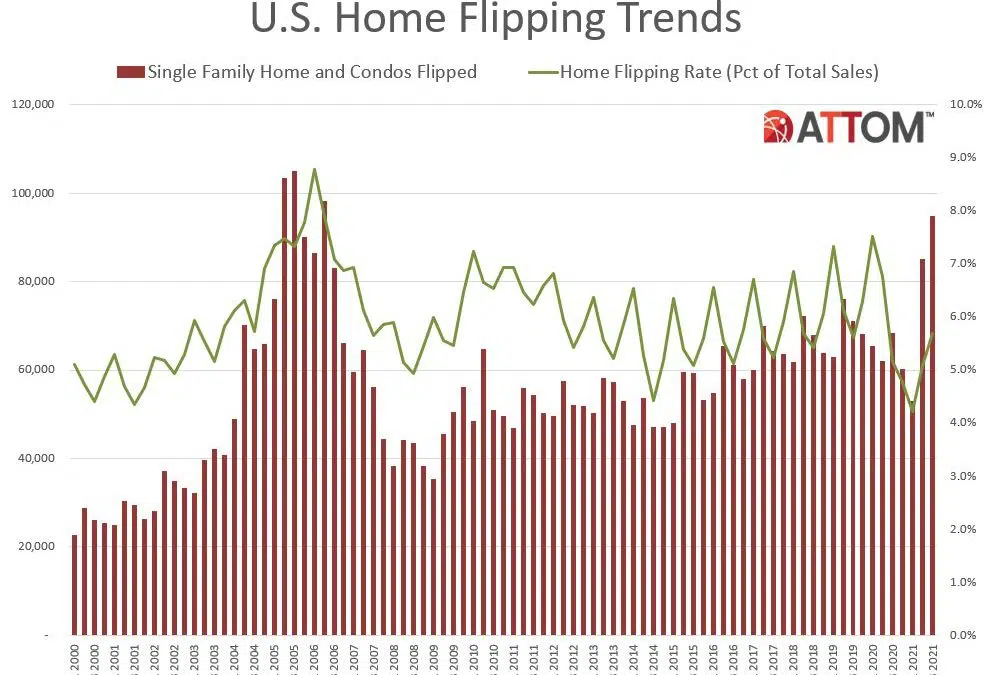

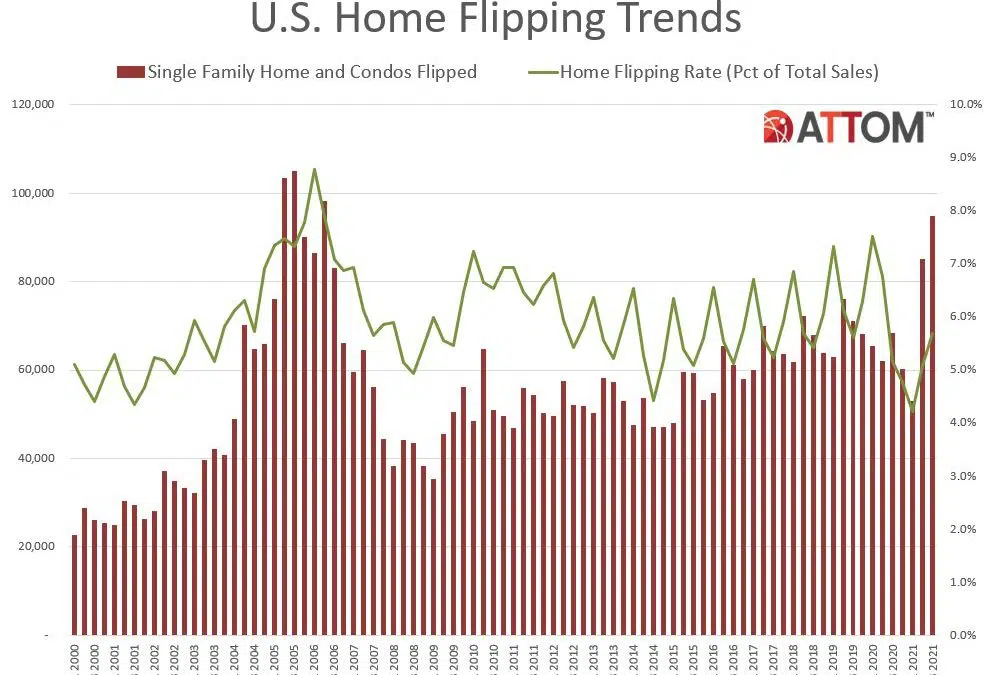

By Dennis Norman, on December 20th, 2021 There were 94,766 homes and condominiums “flipped” during the third quarter in the U.S., according to data just released by ATTOM Data Solutions. These flips represent 5.7% of all homes sales during the 3rd quarter of 2021, an increase of nearly 12% from the prior quarter when 5.1% of all homes sold were flips.

Gross profit margins dip to the lowest point since early 2011…

According to the report, the gross profit margin (the difference between the price paid for the flipped house when purchased versus the price paid by the new buyer when flipped) was $68,847. This represents a 32.3% gross margin, the lowest gross margin percentage since the first quarter of 2011.

[xyz-ips snippet=”Foreclosures-For-Sale-and-Homes-For-Sale”]

U.S. Home Flipping Trends – Chart

By Dennis Norman, on December 8th, 2021 Even though you wouldn’t know it by today’s forecasted high in St Louis of 50 degrees, we are entering the winter housing market. Every year, year after year, the St Louis winter housing market reacts pretty much the same way with home prices dropping a little and sales slowing followed by an uptick in both come spring. With that in mind, the declines we see in home prices in the chart and report below, available exclusively from MORE, REALTORS®, could be attributed to the seasonal change but are a little early for that, and different than last year.

Sold home price per square foot declined for 2nd month in a row in November…

The price per foot a home sells for is a relatively accurate indicator of rising home prices and typically will decline in the winter months as I mentioned above. However, if you look at the chart below, you will see the red line, which depicts the sold price per square foot of homes sold in the St Louis area, peaked in June at $172/foot, then dropped in July to $171/foot where it stayed though September before dropping to $165 in October and then remaining there in November. The result was a 4.0% decline in the price per foot of homes sold in St Louis from the peak in June to October.

If you look at the same period last year, you will see the price per foot peaked in July at $152 than stayed at $152 until dropping to $151 in October, then up to $153 in November and back to $152 in December. So, least year, the change from the peak to November was actually a slight increase compared with this year’s decrease of 4.%.

I’m not saying last years price behavior was the norm, I’m just pointing out that this years price activity is different than last year so it may be indicative of a change in the market.

Current listing prices reflect slower price appreciation…

Below the chart is the STL Market Report for November which shows home sales in the St Louis 5-county core market were up nearly 6% for the 12-month period ended November 30th from a. year ago and prices were up over 10% during the same period. However, if you look down to the second row of the report, you will see the price per foot homes sold at during the most recent 12-month period were sold at a price of $164.70 per foot (and in November as well) and the price per foot of homes currently listed is $168, so an increase of about 2% from the median price in the past 12-months. Granted, many of the current listings will likely sell for more than asking price, but this trend still indicates St Louis home price appreciation is slowing.

Continue reading “St Louis Home Price Appreciation Slowing“

By Dennis Norman, on November 26th, 2021 New sales of listings (an accepted offer) in St Louis in November are outpacing new listings with 1.06 new sales for every 1 new listing. As the leading indicator reports below illustrate (available exclusively from MORE, REALTORS®), for the first 3 weeks in November, there have been 2,139 new sales of listings and 2,026 new listings. At the same time a year ago, new sales outpaced new listings at 1.24 to 1, so the current trend is down 15%.

Worth noting in the data is that new sales of St Louis homes in the first three weeks of November 2021 are up 4.5% from the same period a year ago, new listings for the same period this year are up 23% from a year ago. This is a trend worth watching and if it continues, could help with the low inventory problem that has made the St Louis real estate market a brutal market for home buyers for the past couple of years.

Continue reading “St Louis New Contracts On Listings Outpacing New Listings But By 15 Percent Less Than Last Year“

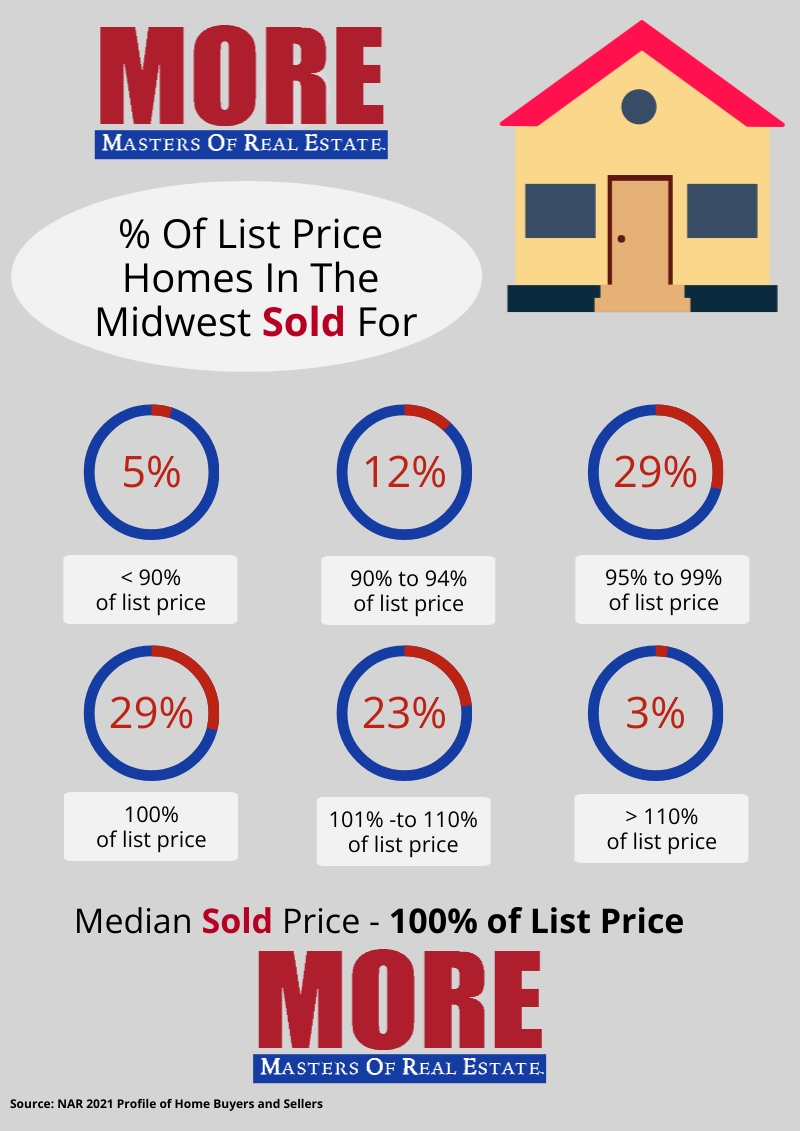

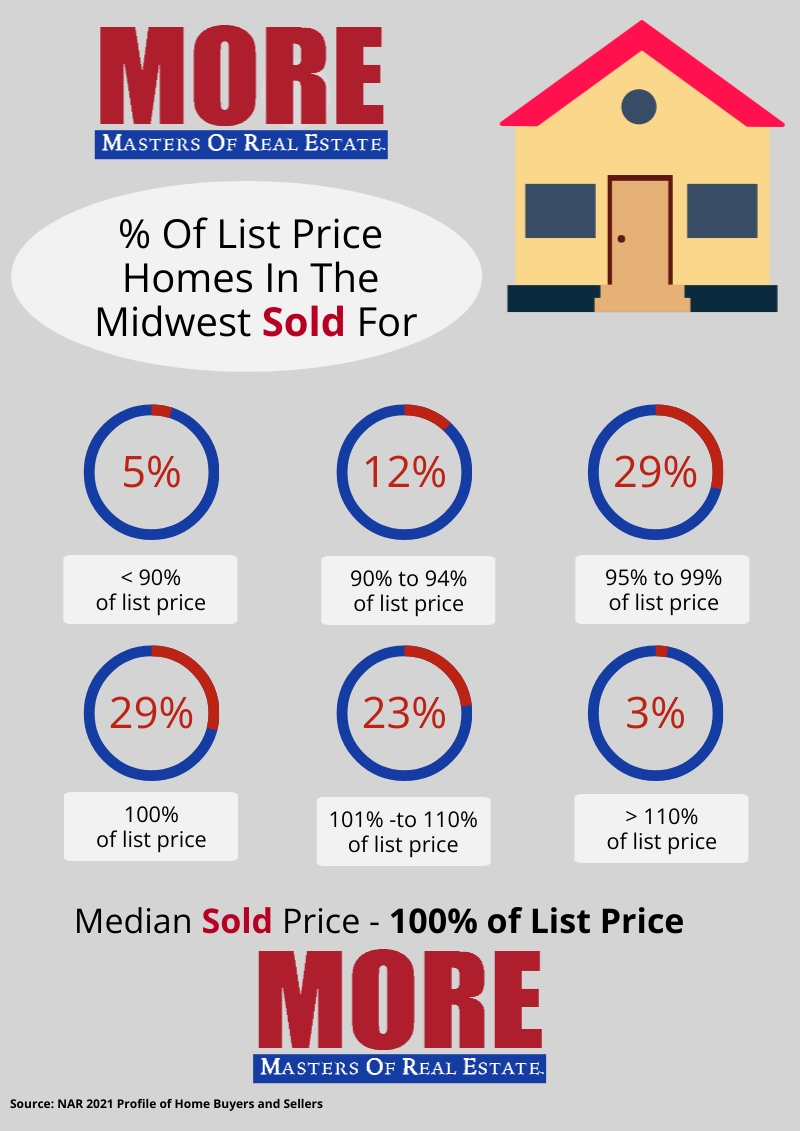

By Dennis Norman, on November 17th, 2021 Last week I published an infographic in an article illustrating that 65% of the homes sold in St Louis sold at or above the list price. As the infographic below shows, this is a significantly higher percentage than was experienced in the midwest region as a whole where 55% of the homes sold at or above full price.

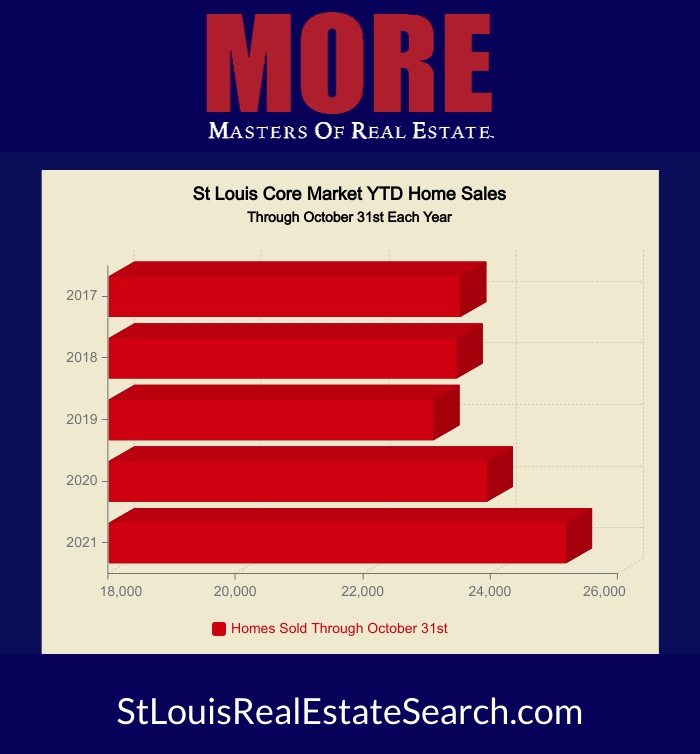

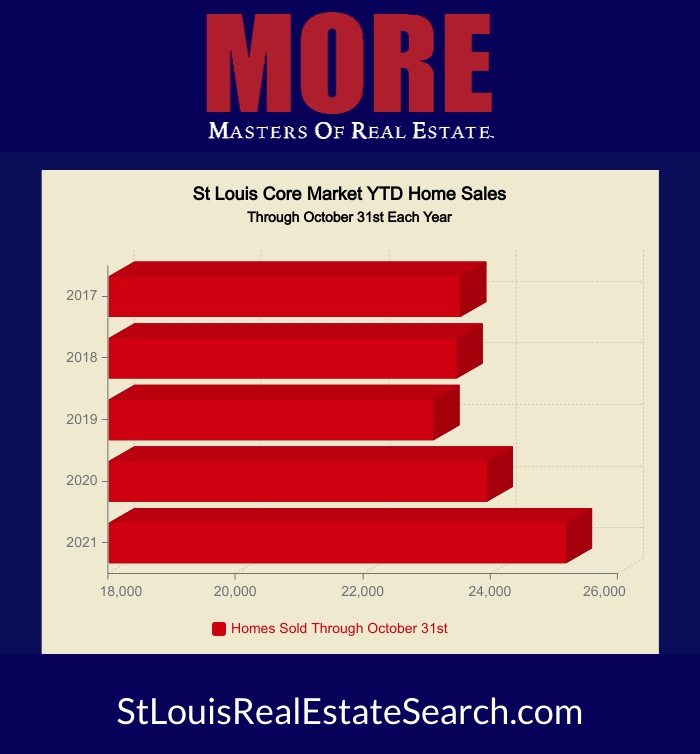

By Dennis Norman, on November 14th, 2021 In spite of the challenges of a low-inventory market as well as the threat of inflationary pressure on the economy, St Louis home sales still remain strong. As the infographic below shows (exclusively available from MORE, REALTORS®) year-to-date home sales through October of this year are outpacing last year by over 5% and the prior 3 years as well by an even larger margin!

By Dennis Norman, on October 18th, 2021 I’ve written a couple of articles lately addressing the news reports about the housing market cooling down. As I’ve addressed in those articles, there has not really been much data supporting a significant cooling in the St Louis real estate market. Additionally, I’ve noted that, due to the seasonality of the housing market, and the fact we are headed toward winter, a cooling of the market would be the seasonal norm.

So today, I decided to pick an easier question to answer, “has the St Louis real estate market peaked?” The short answer is yes, I believe it has. This statement, by itself, is not all bad as it would NOT be good for St Louis home prices to continue to increase at the rates they have over the past couple of years. Not to mention, if we stay in this low-inventory market strongly favoring sellers much longer, many buyers are going to just give up and shelf the idea of buying for a while.

As usual, I’ll let the data speak for itself. I have several charts and tables below (available exclusively from MORE, REALTORS®) that I believe support that we have probably seen the St Louis market peak.

Continue reading “Has the St Louis Real Estate Market Peaked?“

By Dennis Norman, on October 13th, 2021 The St Louis housing market appears to be cooling off slightly with fewer home sales last month than a year ago in 3 of the 5 St Louis area counties that make up the St Louis 5-county core real estate market. As the charts below illustrate, the decline in the overall St Louis market was very slight, with 3,164 homes sold last month just 11 sales fewer than September last year when there were 3,715 homes sold in the St Louis5-county core market. The charts have complete details but below is a recap of home sales and prices by county for last month versus September 2020:

- St Louis City & County – These two counties combined are the only in the core market to see an increase in sales last month from a year ago. Last month there were 1,710 homes sold, an increase of 4.6% from a year ago when there were 1,634 homes sold. Last month the median price of homes sold was $247,000 and increase of nearly 7.5% from last year when it was $229,900.

- Franklin County – Last month there were 127 homes sold, a decrease of 13.6% from a year ago when there were 147 homes sold. Last month the median price of homes sold was $227,050 and increase of nearly 14.5% from last year when it was $198,300.

- Jefferson County – Last month there were345 homes sold, a decrease of 6.8% from a year ago when there were 370 homes sold. Last month the median price of homes sold was $229,000 and increase of nearly 9.0% from last year when it was $210,000.

- St Charles County – Last month there were 617 homes sold, a decrease of 10.8% from a year ago when there were 684 homes sold. Last month the median price of homes sold was $303,000 and increase of nearly 12.2% from last year when it was $270,000.

[xyz-ips snippet=”Homes-For-Sale”]

Continue reading “St Louis Area Housing Market Report For September“

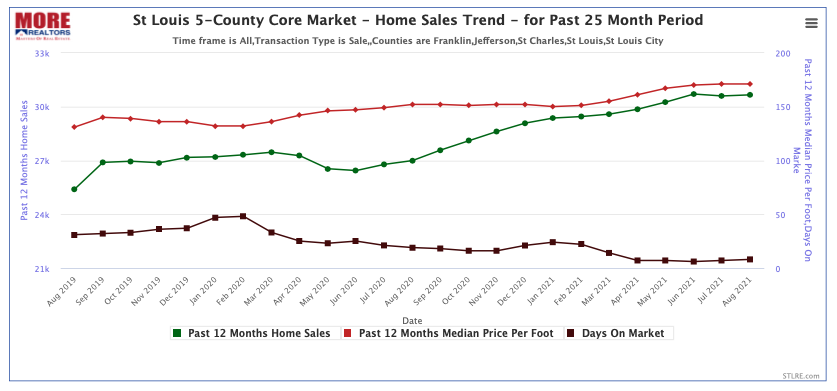

By Dennis Norman, on September 24th, 2021 More and more today I’m seeing reports in the media about the housing market cooling down and sales slowing which, quite frankly, I have expected and keep watching for signs of it in the St Louis real estate market. However, in spite of a few blips on the radar, all the data I’m reviewing still shows pretty steady and consistent home sales in St Louis. Don’t get me wrong, I fully expect us to see a cooling of the St Louis market if for no other reason, winter will be here soon and then we’ll be headed toward year-end when the market always cools down. There are many factors that could come into play to further impact the market such as higher interest rates, a weaker economy as well as an influx of foreclosed homes hitting the market in the month ahead. For all of this, we will have to wait and see, but for now, things are pretty steady. Below are some charts and data that I feel support my thoughts on the market.

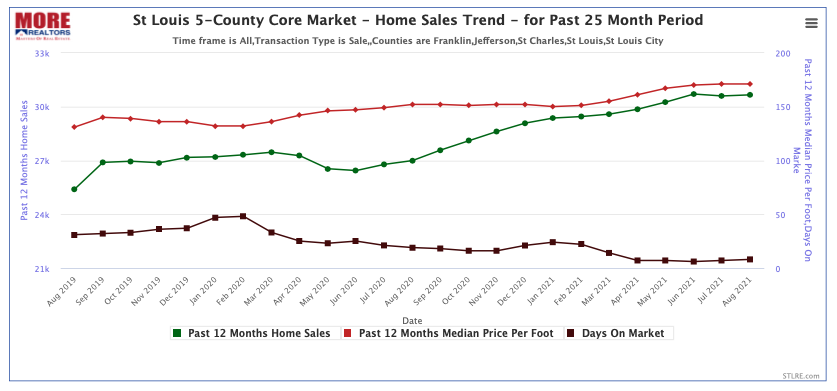

St Louis 5-County Core Market – Home Sales Trend

(click on chart for live, interactive chart)

As the chart above illustrates, the time it takes for a home to sell (days on market, represented by the brown line at the bottom) has been consistent the last four months, ranging from a low of 6 days to a high of 8 days. The green line shows the 12-month home sales trend and it has been fairly consistent the last 4 months as well, actually increasing in June, then dipping slightly in July only to rise again in August to nearly June’s level. Finally, the red line shows the median price per foot of the homes sold and that has also been consistent the last 4 months with a slight increase from $167/foot in May to $170 in June and then $171 in July and August.

St Louis Real Estate Trends Report

New Listings & New Sales (click on report for live report)

The above reports show that in the most recent week new contracts written for the sale of homes increased 29% from the week before and new listings increased 3% from the week before. During the week there were just about the same number of new listings as new sales at 764 and 767 respectively.

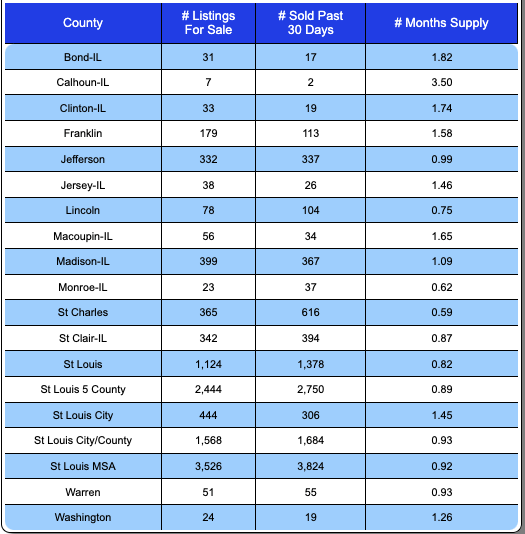

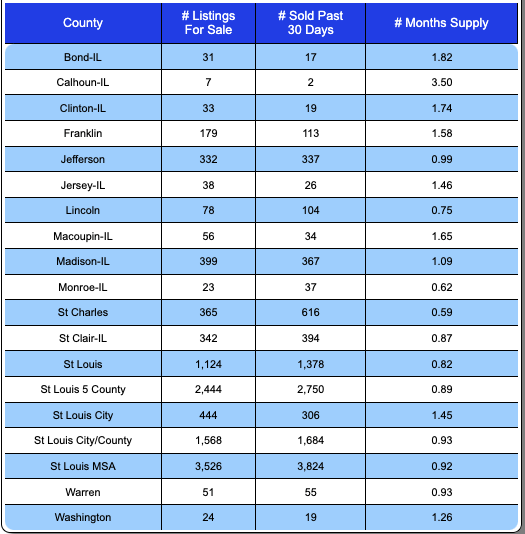

St Louis Area Supply of Listing Inventory

(click on report for live report)

The report above shows there is currently a 0.89 month supply of homes for sale in the St Louis 5-County market. This is only slightly higher than it has been in past months. Of the 5-counties in the core market, St Charles County has the lowest inventory of homes for sale with an inventory of just over half a month.

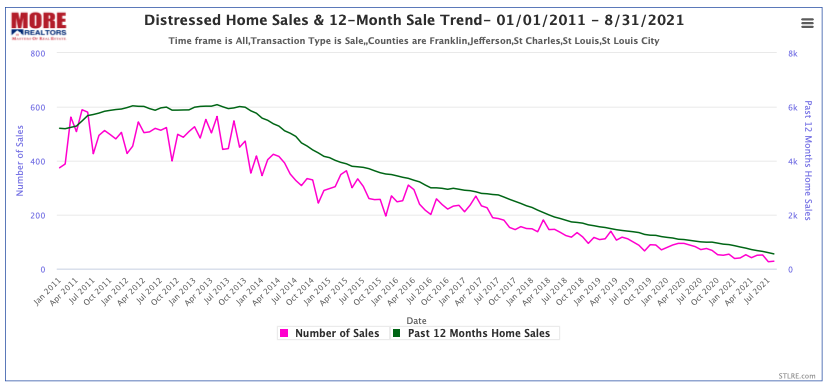

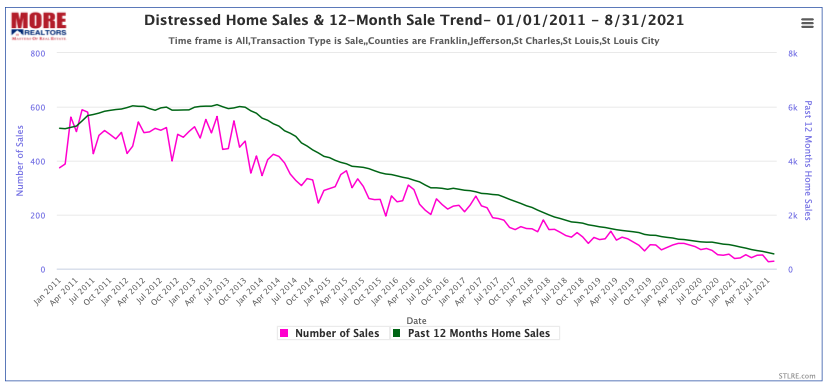

By Dennis Norman, on September 23rd, 2021 There were a total of 550 home sales in the St Louis 5-County core market during the 12-month period ended August 31, 2021, a decline of over 90 percent (90.5%) from the same period 10 years earlier. As the chart below (available exclusively from MORE, REALTORS®) illustrates, the St Louis distressed home sales 12-month trend peaked in May 2013 with 6,078 distressed home sales in the prior 12-month period and has fallen to just 550 distressed home sales for the 12-month period ended August 31, 2021. For the purposes of this report, distressed home sales include the sale of homes previously foreclosed on and being sold by banks or a government entity (such as FHA/VA) and short sales. Given that there has been a foreclosure moratorium in place for several months during the past year it’s not surprising the current trend is down but as the chart shows, the trend has been steadily downward since late 2013.

[xyz-ips snippet=”Foreclosures-For-Sale-and-Homes-For-Sale”]

St Louis 5-County Distressed Home Sales – 01/01/2011 – 8/31/2021

(click on chart for live, interactive chart)

By Dennis Norman, on September 14th, 2021 There continue to be conversations by St Louis REALTORS® as well as other industry professionals as to whether or not the market is cooling off somewhat or slowing down. I keep watching the data closely to look for signs of a substantive change and while there are some, the market adjustments appear to be somewhat insignificant at this point. Last month, in an article about July’s market, I pointed out a slight slowing of the trend in July. Now, I’m taking a look at August, specifically, the number of new listings that came on the St Louis real estate market during that month versus the number of new sales during the month.

More new listings in August than a year ago, fewer new sales:

As the STL Real Estate Trends Reports below show (exclusively available from MORE, REALTORS®) 3,702 new listings came on the market in the St Louis 5-County core during August, an increase in new St Louis listings of 3.2% from a year ago when there were 3,586 new listings. Conversely, there were 3,861 new sales of homes last month, a decrease in St Louis home sales of 2.2% from a year ago when there were 3,949 new contracts written.

New contracts written exceeded listings again but not by as much margin:

During August 2020, the number of new contracts written on listings exceeded new listings in St Louis by about 10 percent (10.1%). Last month, new sales of St Louis listings only exceed the number of new listings by just over 4 percent (4.2%).

So, as I mentioned, the change in trend is slight, but something worth keeping an eye on.

[xyz-ips snippet=”Homes-For-Sale”]

Continue reading “St Louis Home Sales Trend Slows Slightly In August“

By Dennis Norman, on August 19th, 2021 There has been talk of “the market slowing down” and while there hasn’t been a lot of data to support that, we did see the sales trend slow slightly in July. As the home sales trend chart below shows, exclusively available from MORE, REALTORS®, the home sales trend for the 12-month period ending has increased every month of this year over the prior month through June. For the 12-month period ending in June, there were 30,055 homes sold marking the highest record since we’ve been tracking the data, however, for the 12-month period ending in July home sales decreased slightly to 29,974 homes.

More new listings than new sales…

A change I’ve also noticed lately is that the number of new listings hiring the St Louis market is outpacing the number of new sales, a reversal of the trend we saw until recently. As the STL Trends Reports below show, there were 881 new listings in the most recent week and 816 new sales. For the prior week, the trend was the same with 895 new listings and 807 new sales.

[xyz-ips snippet=”Homes-For-Sale”]

Continue reading “St Louis Area Home Sales Trend Slows Slightly After Setting Record in June“

By Dennis Norman, on July 30th, 2021 For the past couple of years now you’ve heard how low the inventory of homes for sale is, and, if you are a buyer, you have no doubt experienced some grief or hardship in buying a home as a result. However, this may be changing. As the table below shows, there are currently 3,565 active listings in the St Louis 5-county core market (city of St Louis and counties of St Louis, St Charles, Jefferson and Franklin) which based upon the rate of home sales, works out to a supply of 1.41 months. This is a 50% increase from the supply (inventory) from June of 0.94 months. Granted, at 1.41 months, it is still VERY LOW from a historical perspective, but this is something to watch as it could be indicative of a change in the market.

What do the leading indicators show?

We don’t want to base too much on just one report for one month so to drill down a little further lets look at the STL Trends Reports, available exclusively from MORE, REALTORS®. Below the table is the New Listings Trends Report which shows for the most recent week reported, new listings were up 23% from the same period a year ago. There were 885 new listings in the St Louis 5-county core market during the week 7/18/21 – 7/24/21 as compared with 718 new listings for the same period last year. On the other side of the deal, so to speak, as the New Contracts Trends Report shows, there were 890 new contracts written during that same week, a decline of 1% from the same period the year before.

Don’t sound the alarm yet..

As I’ve said, even with the increase in inventory it is still low and the trend reports are just for one week so we need to give it more time and watch the trend in the coming couple of weeks before we can determine that there is possibly a significant trend indicating a change in the market. Stay tuned…

[xyz-ips snippet=”Homes-For-Sale-and-Listings-With-Virtual-Tours”]

Continue reading “St Louis Listing Supply Increases 50 Percent in July from June…still low“

By Dennis Norman, on July 27th, 2021 In the past couple of days there have been many news reports about new home sales in the U.S. declining and reaching a 14-month low based upon the latest report from the U.S. Census Bureau. As the table below shows, the reports are accurate as new home sales for June 2021 in the U.S. were at a seasonally-adjusted annual rate of 676,000 homes, the lowest annual rate in 14-months and a rate that is 6.6% lower than May and 19.4% lower than June 2020.. However, the good news for us here in the Midwest Region is, the same table shows that for our region new home sales in June 2021 were at a seasonally-adjusted annual rate of 92,000 homes, an increase of 5.7% from the rate for May 2021 and an increase of 7.0% from June 2020. All of the other regions, as well as the U.S. as a whole, saw a decline in annual rate from the month before as well as the year before.

[xyz-ips snippet=”Homes-For-Sale-and-Listings-With-Virtual-Tours”]

Continue reading “New Home Sales In Midwest Outperforming Other Regions“

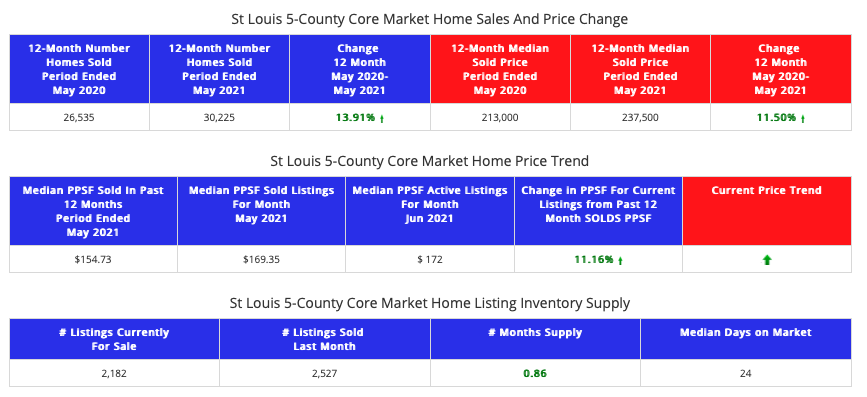

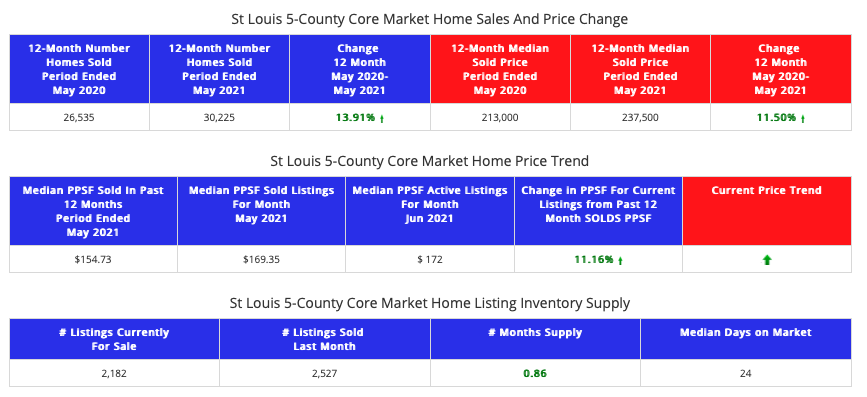

By Dennis Norman, on June 18th, 2021 For the 12-month period ended May 31, 2021, there were 30,225 homes sold within the St Louis 5-County core market, an increase in home sales of 13.91% from the prior 12-month period, according to the STL Market Report below, available exclusively from MORE, REALTORS®. During the same period, St Louis home prices increased 11.5% from a median of $213,000 to $237,500. As the report also shows, the current supply of listings for sale is low at 0.86 months.

[xyz-ips snippet=”Homes-For-Sale”]

STL Market Report For the St Louis 5-County Core Market

(click on report for live, complete report)

|

Recent Articles

|