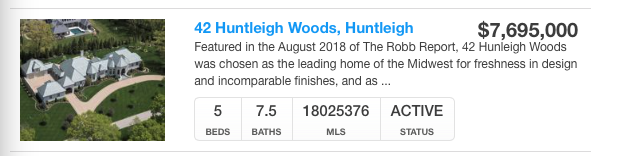

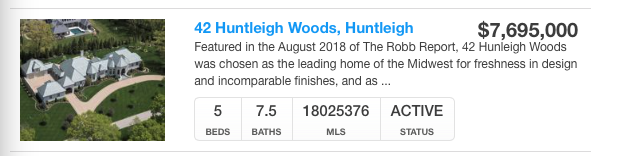

By Dennis Norman, on September 30th, 2018 One of the great things about living in St Louis is it is a very affordable place to live, including when it comes to home ownership. Home affordability in St Louis is certainly much better than the coasts but also beats many, if not most, metro areas. Having said that, we do have our share of expensive homes though. For example, there are currently 322 $1,000,000+ homes and condos listed for sale in the St Louis 5-county core market (City of St Louis and Counties of St Louis, St Charles, Jefferson and Franklin). The most expensive St Louis home listed for sale, at the time I wrote this article, is a home in Huntleigh listed for $7,695,000.

(Click on the image above to see complete details)

See the complete list by clicking here.

Of the 322 $1 million+ homes listed, nearly 82% of them are in St Louis County. Below is a breakdown of the listings by county:

- St Louis County – 263

- St Charles County – 25

- City of St Louis – 10

- Jefferson County – 9

- Franklin County – 15

See the list of the 30 cities in the St Louis 5-County Core market with the highest average home prices here.

[xyz-ips snippet=”St-Louis-Luxury-Homes-and-Condos—For-Sale-and-Open-House”]

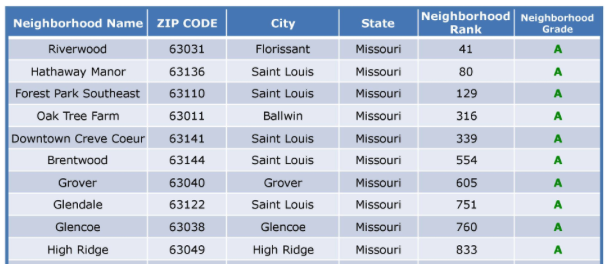

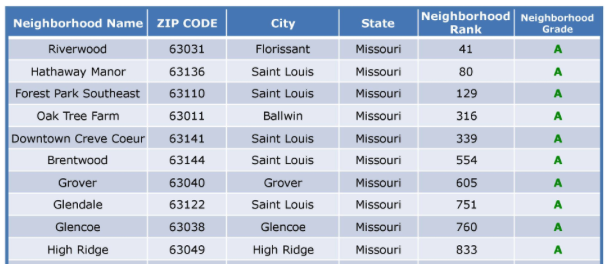

By Dennis Norman, on August 4th, 2018 In a neighborhood housing market report card just released by ATTOM Data Solutions, 10,950 neighborhoods across the nation were given a grade ranging from an A to an F. The neighborhood grades were based upon six factors related to the housing market: housing affordability, home price appreciation, public school scores, crime rates, unemployment rates and property taxes.

In all, 82 neighborhoods in the St Louis metro area received a grade with 28 of them receiving an A, 17 a B, 13 a C, 8 a D and 16 received an F. The list below shows the top 10 St Louis neighborhoods on the list (you can click on it for the complete St Louis list). As the list shows, the neighorhood of “Riverwood” in the 63031 zip code area of Florissant was ranked at the top of the list for St Louis, coming in at 41 nationally.

St Louis Neighborhood Report Card – Top 10

(click on list for complete list showing atll 82 St Louis Metro Neighborhoods That Received a Grade)

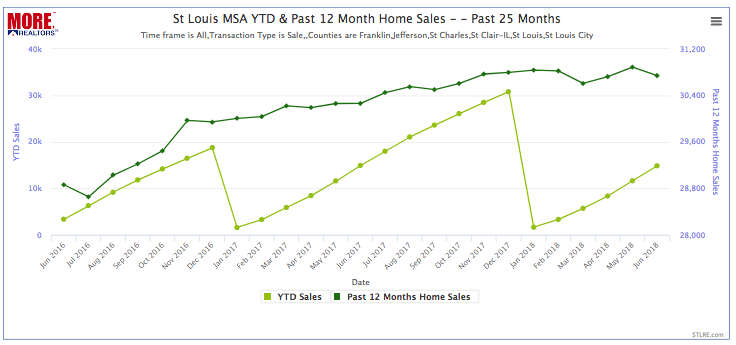

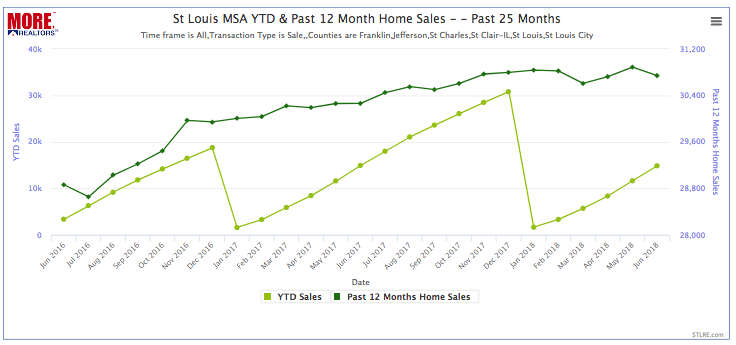

By Dennis Norman, on July 28th, 2018 On a national level, there have been reports lately of slowing home sales evidenced by both new home sales and existing home sales falling in June, housing affordability issues and the like. Here in St Louis, the real estate market continues to perform well, however, indicators are showing a slight downward trend in St Louis home sales.

As the chart below illustrates, there have been 14,268 homes sold through the end of June in the St Louis metro area, a decline of 4.4% from the same period a year ago when there were 14,925 homes sold in St Louis. The darker green line on the chart indicates the total sales for the past 12 months and is a good indicator of where things are headed. As you can see, there was a pretty good jump in this line 2 years ago with a steady rise but it has fluctuated around the same level for the past 8 or 9 months. Last month, as well as in two of the prior 5 months, it showed a downward trend.

St Louis MSA YTD & Past 12 Month Home Sales – June 2016 – June 2018

(Click on chart for live data)

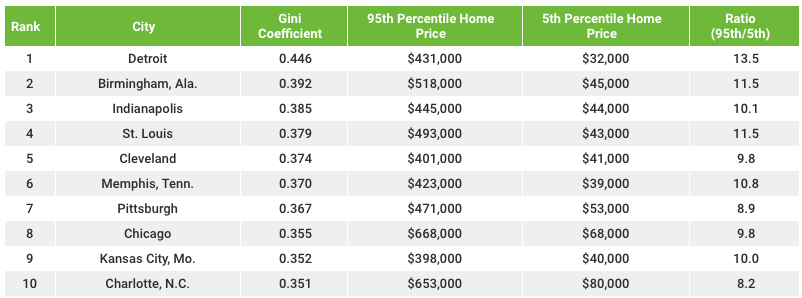

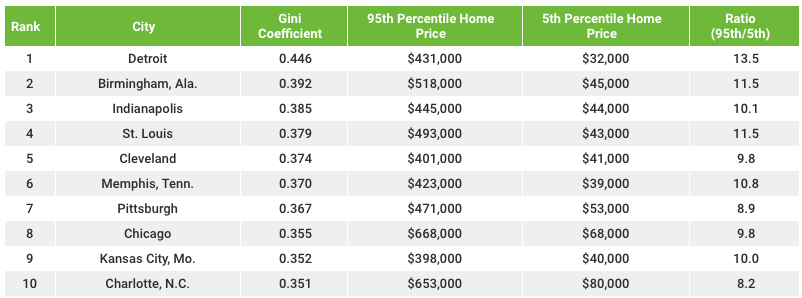

By Dennis Norman, on July 25th, 2018 Generally, when we think of inequality, such as income inequality, we perceive it as a bad thing however, when it comes to home prices, perhaps inequality is a good thing! A recent study of home price inequality by Lending Tree resulted in St Louis being ranked as the 4th highest metro area in the nation for home price inequailty. How Lending Tree ranked the cities was by using the GINI coefficient which is often used to measure income inequality. The way it works, in a nutshell, is a GINI Coefficient of 0 means everything is equal, so everything is at the same value and a 1 means nothing is equal and there is one value for one and everyone else has none. So the higher the number, the greater equality. St Louis has a GINI coefficient of 0.379.

Why is Home Price Inequality Good?

The reason I said home price inequality is a good thing for St Louis is that it means we have homes in a wide range of price ranges thereby making them affordable to people at widely different income levels. For example, as the table below shows, the 95th Percentile home price in St Louis is $493,000 while the 5th Percentile is only $43,000 which works out to a ratio between the 95th and 5th percentile of 11.5, a huge gap. By comparision, #50 on the list is Salt Lake City, Utah, where the 95th percentile home price is $597,000 and the 5th percentile $191,000 for a ratio of just 3.1.

Home Price Inequality In The U.S. – Top 10 MSA’s

By Dennis Norman, on July 21st, 2018 According to a recent report published by the Cato Institute, the state of Missouri ranks 9th in the nation for having the most restrictive zoning regulations. Many anti-development folks may applaud this fact and look at it as a victory. However, many people in the real estate industry, including yours truly, believe that overly restrictive zoning regulations greatly impact the cost of new home construction resulting in increased home prices and less affordable housing. Couple the increased costs along with the reduced density permitted by overly restrictive zoning and you have a real impediment to the development of affordable or “work-force” housing.

Zoning regulations first came about in the U.S. early in the 20th century first around 1908 when Los Angeles adopted municipal zoning and land-use laws. In 1916 the city of New York passed a comprehensive zoning code as well. Other municipalities followed suit and, according to the Cato report, 68 additional municipalities had adopted zoning by 1926. In 1926 the U.S. Supreme Court, in the case, Village of Euclid v. Ambler Realty Co., 272 U.S. 365 (1926) ruled that “If they are not arbitrary or unreasonable, zoning ordinances are constitutional under the police power of local governments as long as they have some relation to public health, safety, morals, or general welfare“. After the Supreme Court decision, zoning regulations exploded around the country and, just 10 years later, another 1,246 municipalities had adopted zoning.

Today, while much of the zoning, and the people that created it and enforce it, are well intentioned, in many cases it goes well beyond it’s original purpose of “health and human safety”. It is common for zoning and land use regulations to include minimum lot sizes that severly limit the development potential of the land thus driving up the cost of the housing. In addition, it’s common for zoning to include design requirements and features, driven by the personal preferences or ideology of elected and appointed officials with nothing to do with health or human safety, thus further driving up the cost of new housing.

It’s not just zoning and land use regulations however that are keeping new homes from being built at a faster rate in St Louis. There are other regulations that negatively impact new home construction and drive costs up such as the clean water act and similar environmental-related regulations which have caused the costs of lot development to more than double over the past few years.

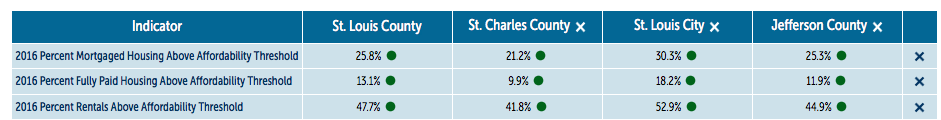

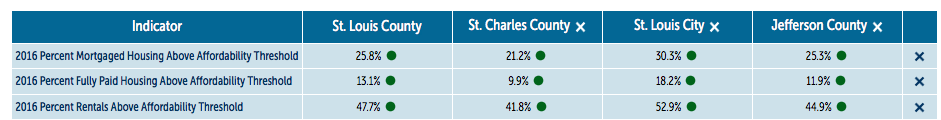

By Dennis Norman, on July 5th, 2018 Nearly 80 percent (78.8%) of the homeowners with a mortgage in St Charles County spend less than 30% of their household income for gross monthly housing costs, according to the U.S. Census Bureau’s latest data. As the table below shows, the 4-largest St Louis area counties are all within the green (good) level for housing affordability in all categories: Homeowners with a mortgage, homeowners without a mortgage and renters.

Of the three categories, St Louis renters have the worst housing affordability threshold with a median of 46.3% of St Louis renters spending more then 30% of their household income on housing costs. Conversely, a median of just 25.6% of St Louis homeowners with a mortgage, spend more than30% of their household income on housing costs.

Of the four counties reported on in the table below, residents of the city of St Louis fare the worst in all 3 categories in terms of their housing affordability threshold.

St Louis Area Housing Affordability Threshold

Source: NACo Analysis of U.S. Census Bureau – American Community Survey (ACS) 5 year estimates, 2016

By Dennis Norman, on June 8th, 2018 One of the things that often attract homebuyers to a new or expanding area is the availability of new homes at affordable prices. This is something that is hard to find in older areas that have mature real estate markets due to the lack of available ground and the cost of the ground when it does become available. This is, no doubt, one of the things that have been responsible for the population growth in Wentzville in spite of the fact it is in the farthest west most area of St Charles County. As a result, the city of Wentzville has seen its population grow from 5,733 in 1998 to 39,414 currently, a growth of 587% over the 20 year period.

One topic that often comes up in conversation about new and emerging markets, is whether homebuyers will benefit in those areas, as they mature and grow, from a higher appreciation rate than a typical established market. In order to examine this, I’m going to compare the Wentzville housing market with that of Ballwin, a municipality in St Louis County similar in size to Wentzville, with a current population of 30,161 which is just 15% greater than the 1998 population of 26, 205.

Wentzville Real Estate Listing Info & Resources:

Wentzville Homes For Sale

Wentzville Homes Sold in Past 12 Months Continue reading “Do Home Prices In A Growth Market Like Wentzville Perform Better Than An Established Market?“

By Dennis Norman, on May 23rd, 2018 According to a report just released by HSH, St Louis is the 8th most affordable metro area to buy a home in and one of just 17 metro areas where an income of less than $50,000 per year will buy a median-priced home. The report is based upon data from the 1st quarter of this year when the median-priced home in the St Louis MSA was $162,400 (a 4.84% increase from a year ago) and the average mortgage interest rate was 4.41% (an increase of 0.36% from the previous quarter) resulting in a house payment (principal and interest portion only) of $933.44. Depending upon the loan type and credit-worthiness of buyer, it will vary, but under typical circumstances, a person with an annual salary of about $40,000 would qualify for the house payment on a median-priced home in St Louis.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

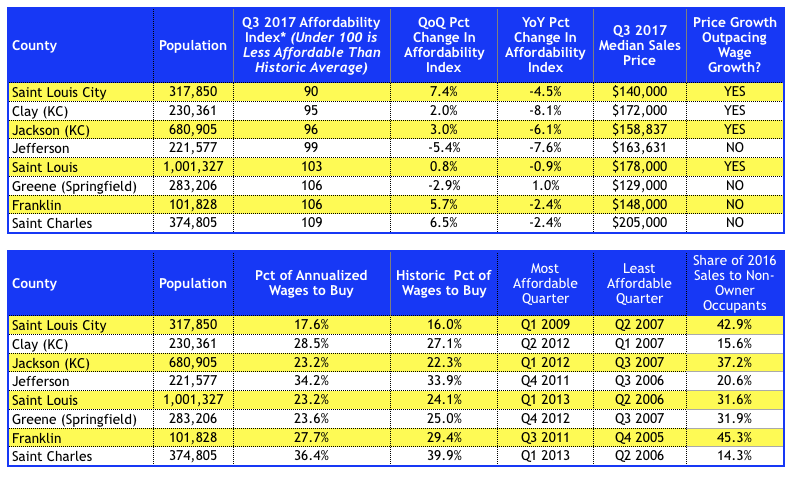

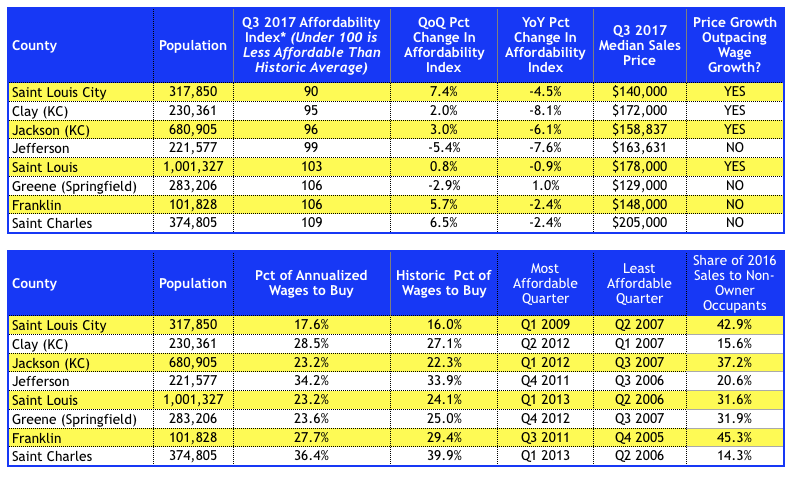

By Dennis Norman, on October 6th, 2017 St Charles County had the biggest improvement in the housing affordability index during the 3rd quarter of this year of any major County in the state of Missouri, according to a newly released report from Attom Data Solutions. St Charles County, with an affordability index of 109 (above 100 is more affordable than historic average, below 100 is less affordable), saw a 6.5% improvement in housing affordability from the prior quarter but a 2.4% decline from a year ago when the housing affordability index for St Charles County was 112.

The table below shows the housing affordability index for all of the major Counties in Missouri. As it illustrates, the percentage of a person’s annual income needed to make the payments on a home vary from a low of 17.6% in the city of St Louis to a high of 36.4% in St Charles County. The table also shows that home price growth is outpacing income growth in half the Counties listed.

Home Affordability In Missouri By County – 3rd Quarter 2017

Data Source: Attom Data Solutions – Copyright 2017 – St Louis Real Estate News – All Rights Reserved Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

By Dennis Norman, on July 18th, 2017 For the 12-month period ending June 20, 2017, as the table below shows, there were 36,447 homes sold in the St Louis MSA an increase in home sales of 2.08% from the prior 12-month period. The median price of homes sold in the St Louis MSA during the past 12 months was $169,000, an increase in home prices of 4.0% from the prior 12 month period.

St LouisHome sales and price summary by county (see tables below for details):

- St Louis City and County

- Home sales Up 3.67%

- Home prices Up 3.75%

- St Charles County

- Home sales Up 3.90%

- Home prices Up 7.50%

- Jefferson County

- Home sales Up 2.3%

- Home prices Up 7.26%

- Franklin County

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Find the value of your home (or any home) online in under a minute!

Continue reading “St Louis Home Prices And Sales Increase From A Year Ago“

By Dennis Norman, on July 14th, 2017 Yes, I often harp on the importance of having accurate information when it comes to the St Louis real estate market and, admittedly, am a data nerd, however, considering that a home sale or purchase is generally one of, if not the, largest financial transactions a person makes, I think it’s worth the effort to get it right. This is why at our company, MORE, REALTORS, we have spent thousands and dollars and thousands of hours of work over the course of several years to develop software for our agents, and clients, that provides what we feel is the most accurate and relevant information out there when it comes to St Louis home prices and sales information.

Yesterday, after I arrived at my destination for a lunch meeting with my business partner, I pulled out my iPhone and opened the RPR® (REALTOR® Property Resource®) app (only available to REALTORS) to see what it would show me about the real estate market for the area I was in, which was Sunset Hills (63127). The app correctly identified my location and then showed the information on my screen that I show below. While I liked the look of the screen, it was definitely ascetically pleasing, I immediately noticed the rather large “-19.2%” on the screen next to “Median Sales Price – 12 Month Change”. What??? Was I that out of touch I thought, could home prices in the Sunset Hills area really have fallen over 19% without me, the data nerd and, in some peoples opinions, “market guru”, even noticing? While I don’t know exactly what is meant by the label on the app, whether it is for the most recent month compared with the same month a year ago, what I do know is one way or the other they are indicating a big drop on home prices which would be very scary to me if I were a homeowner in that area, and very concerning to me if I were considering buying.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Find the value of your home (or any home) online in under a minute!

Continue reading “The Importance Of Accurate St Louis Home Price Data for Sellers and Buyers- Prices Down 19%?? Or Up 8%??“

By Dennis Norman, on July 6th, 2017 Yesterday, I did an article about the population shift in St Louis in which I included data showing the the city of St Louis has lost population every year for the past six years (the period covered in my article) while St Charles County and Jefferson County experienced population growth every year during the period. So, today, I decided to see what has happened with regard to home values in these counties and whether anything value-wise seems tied to the population shift.

Below is a 10-year chart, showing the median price per foot (one of the most accurate ways to look at home prices) for each of the 5-counties that make up the St Louis core-market. As the chart reveals, there doesn’t necessarily seem to be any correlation between home appreciation and population shift. Below is a quick analysis:

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Find the value of your home (or any home) online in under a minute!

Continue reading “Is There a Connection Between St Louis Population Shift and Home Prices?“

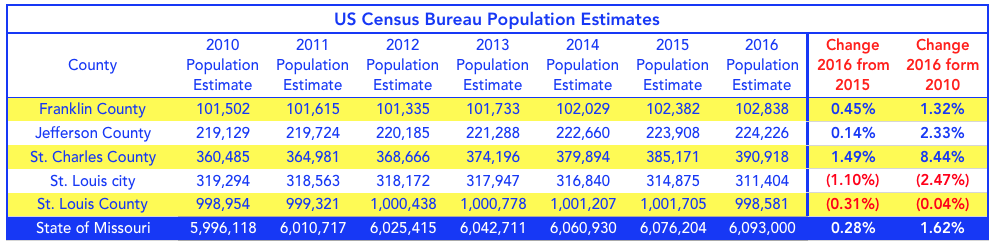

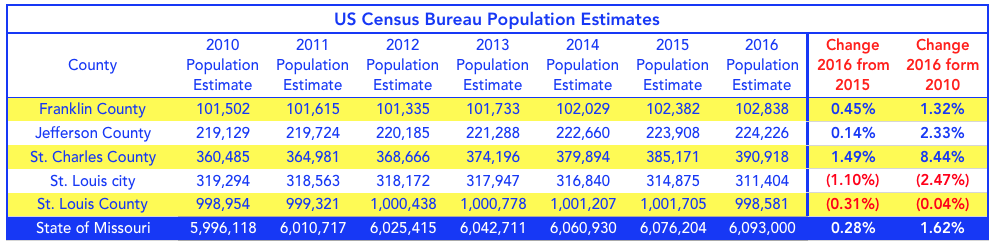

By Dennis Norman, on July 5th, 2017 Recently, the U.S. Census Bureau released the 2016 population estimates revealing that the city of St Louis continues to lose residents while outlying counties like St Charles, Jefferson and Franklin grow and St Louis county remains relatively stagnant.

As the table below shows, over the past 6 years the city of St Louis population declined almost 2.5% while St Charles County grew by nearly 8.5%. Both St Charles County and Jefferson County have enjoyed annual growth in population since 2010 while Franklin County grew every year but one. St Louis County has followed a different pattern than the rest with 3 years of growth, a small decline in 2014, 2015 went back to 2013 levels nearly then 2016 gave up everything gained in the prior years falling back to a population lower than in 2010. St Louis city has continued to decline in population year after year for the periods shown.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Find the value of your home (or any home) online in under a minute!

St Louis Population Trends 2010-2016

By Dennis Norman, on July 4th, 2017 It’s good when the value of your home increases, right? Yes, generally, most homeowners, look at their homes as an investment in addition to shelter for their families so they are generally happy to see the value of their investment increase. The flip side of it is, homebuyers, particularly first-time buyers, would, of course, like to see lower prices and better value in the home they buy. The thing that helps balance out these competing interests is inflation, but more specifically, the rate of income growth.

Not to get into an economics lesson here (which I’m not qualified to teach anyway) but if homebuyers incomes increase at about the same rate as home prices (ditto for interest rates) then, more or less, the “affordability” of a home to a buyer remains the same. Problems arise when those things get out of whack, such as in the period from about 2000 through 2007 when home prices were increasing at a much higher rate than incomes were (and interest rates rose too making it even more fun) which eventually led to the housing bubble burst in 2008 and the real estate market crash.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Find the value of your home (or any home) online in under a minute!

Continue reading “City of St Louis Has Best Home Affordability In St Louis Area“

By Dennis Norman, on June 15th, 2017 There are several ways to look at home prices and home affordability as well as to argue the merits of homeownership versus renting, however, one my favorite metrics to consider along these lines is the relationship between home prices and rental rates. Most home buyers, that are seeking a home to live in, never consider what the home they are considering purchasing would rent for, since that is not their intended use. However, there is a relationship between home values the potential rental income in that there is a tipping point reached when the cost of owning a home exceeds the cost of renting a comparable home in the same neighborhood by too much, there becomes an incentive to rent rather than buy. Along the same lines, if rental rates get so high that, for about the same money, or even less, one could buy the home they are renting, there exists a strong incentive to buy a home.

With this in mind, when you look at the chart below from the St Louis Federal Reserve, which shows the St Louis home price index, the blue line, and the Consumer Price Index for Rent, the red line, you can see there is a pretty significant gap between the two. The chart goes back to 1975 and, as you can see, historically the home price index and CPI for rents have increase at relatively similar rates, with home prices lagging slightly behind from about 1980 through around 2004 but, even then, there was a pretty similar trend. As the housing bubble in 2006 approached, you can see the home price trend shot upward and past rents only to fall sharply around 2008 after the housing bubble burst. Since hitting bottom around late 2011, home prices have been trending upward, but, as illustrated, there is a much larger gap between home prices and rents then is the historic norm which is a good thing with regard to home prices. Based upon what I see on the chart (you can click on the chart to be taken to our live, current version which is interactive) I would expect the gap between rents and home prices to close at some point in the near future. This can be accomplished in one of two ways: home prices can rise at a greater rate than rents rise, or rents can fall or remain flat, or, of course, some combination of the two. In either event I think this is good data to support sustained home prices and also shows that buying a home could well be a better investment than renting.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Want to flip property? Check out my video on how to buy foreclosures here. Continue reading “St Louis Home Prices Verses Rent Continues To Show Value In Home Prices“

By Dennis Norman, on April 27th, 2017 In many parts of the country it is typical for homes not to have a basement but here in St Louis, we love our basements and it is typically harder to sell a home without one. St Louisan’s like the safety offered by a basement in times of bad storms and during the threat of tornadoes, but also like the opportunity to add some additional, and fairly affordable, living space to their homes.

With this in mind, I decided to look at the value of a basement and just how much affect having one, or not, or having a finished one, has on the price of a home in St Louis and, here are my findings:

- For Homes Sold In St Louis County during the past 12 months, as the tables below shows:

- Homes with Full Finished Basements sold for a median price of $131.59 per foot

- Homes with Full Unfinished Basements sold for a median price of $119.83 per foot

- Homes Without a Basement sold for a median price of $84.22 per foot

So, to answer the question, what is a basement worth? While there are many other factors that affect price too, such as location of the home, size of the home, etc, and one could argue, for example, that homes without a basement are more likely to be in a lower priced area, we can still get an idea of the impact of a basement, or lack thereof, from the data, Based upon our data, it appears homes with a basement sell for 42% more per foot than a home without a basement, and a home with a finished basement sells for 10% more per foot than a home with an unfinished basement.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Find The Value Of Your Home In Under A Minute!

Continue reading “What is a basement worth in St Louis?“

By Dennis Norman, on March 31st, 2017 It seems almost crazy to even throw out the idea of an adjustment in St Louis home prices or, perhaps even, any sort of slow down in the rate of home price appreciation given that the inventory of homes for sale is so low in so many parts of the St Louis area, however, maybe it’s something to look at. For anyone that has been reading what I have written here over the past 8+ years, you will hopefully know that I am not a “gloom and doom” guy at at all, but I do share my honest outlook on the market. Having said that, I do feel home prices are something worth taking a look at.

What is causing the concern about home prices?

For starters, new housing affordability information was just released yesterday by ATTOM Data Solutions which shows home affordability in the St Louis area has eroded somewhat. The table below, based upon the ATTOM data, shows what percentage of the average wages for the area are needed to make monthly house payments on a median-priced home with a 30-year fixed rate mortgage and a minimal downpayment of 3%. It also shows how much, on a year over year basis, income has risen in that county versus how much home prices have increased. As the table shows, it takes a pretty big chunk of pay to pay for the typical median priced home today and, in most cases, home prices are rising at higher rates than income is rising. Even if the year over year income/home price increase looks ok, home prices have been on the rise here for several years so if we look at a 5 year period home price growth is outpacing income growth.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Find The Value Of Your Home In Under A Minute!

Continue reading “Home Affordability In St Louis Declining With Increasing Home Prices – Will Home Prices Suffer?“

By Dennis Norman, on March 17th, 2017 My headline is a rhetorical question and I personally don’t think landlords and tenants are bad people but, after seeing so many municipalities work so hard over the past few years passing ordinances that, in many cases, in my humble opinion, tramples the property rights of landlords as well as the rights of tenants, one would have to believe that landlords and tenants must be some pretty bad people. After all, if not, why would some municipalities work so hard to discourage them from entering their cities and work hard to chase them out?

For example, the most recent egregious example of this comes from the north-county city of Berkeley, where, last September, the city council passed an ordinance (#4320-bill can be seen at bottom) that put a “30-percent limitation of single-family rental homes per residential block“. Bill number 4456, which was the bill introduced that became the ordinance, gave the purpose of the new ordinance to be:

“The City (Berkeley) seeks to create a positive impact in city neighborhoods by creating an atmospher for residents to enjoy a good quality of life by creating a 30-percent limitation of single family rental homes per residential block”

Since the city of Berkeley seems to equate “a good quality of life” with a “limitation of single family rental homes‘ I think, by negative inference, we can come to the conclusion that Berkeley is saying rental homes, and I would guess either the people that own them, or the tenants that live in them, must negatively impact, or run counter to, “a good quality of life” in their neighborhoods which now brings us back to my initial question, are landlords and tenants bad people?

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

How to Buy Foreclosures – Advice From a 2,000+ Home Investor

Find The Value Of Any Home In Under A Minute!

Continue reading “Are Landlords and Tenants Bad People?“

By Dennis Norman, on March 9th, 2017 St Louis is known as an affordable place to live so it is not surprising that there is a fairly robust housing market for affordable and moderate priced homes. When it comes to luxury homes in St Louis however ($500,000 and above for the sake of discussion here), the market is much cooler. As the charts below for 2015 and 2016 illustrate, St Louis Luxury home prices have remained flat over the past two years, while more moderately priced homes have increased in price.

St Louis MSA Luxury Home Market…

On the chart below, the baby blue line representing the median price luxury homes sold for is flat-lined for the past two years at $650,000 while seller’s have become more realistic and the median list price fell from $674,900 in 2015 to $669,450 in 2016. On a positive note, luxury home sales have been on the rise increasing nearly 13 percent from 1,448 homes sold in 2015 to 1,636 homes sold during 2016.

St Louis MSA Affordable/Moderate Priced Home Market…

The chart for this market paints a pretty uplifting picture with all the chart lines on the rise over the period. As the chart below depicts, the median price of homes sold in this category increased nearly 6% from $155,000 in 2015 to $164,000 during 2016. The number of homes sold rose over 8% from 29,445 during 2015 to 31,987 in 2016.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Find The Value Of Your Home In Under A Minute!

Continue reading “Moderate Priced Homes In St Louis Out Perform Luxury Home Sales“

By Dennis Norman, on December 22nd, 2016 Home affordability throughout the St Louis area declined in the fourth quarter of this year from the same time last year according to a report released this morning by Attom Data Solutions. As the table below shows, the affordability of homes in the St Louis area, as well as every major county in Missouri (with the lone exception being Platte County), declined during the current quarter meaning that it now takes a larger percentage of a persons income (based upon average wages for the county) to buy the “typical” home in that county (based upon a median-priced home).

The table shows St Louis County with a 24% decline in home affordability from a year ago, however, I should point out that Attom Data Solutions actually chose to leave this information off their report released to the public due to concern about the underlying data. For example, their data showed a 33% increase in the median home price in St Louis County during the current quarter from the 4th quarter in 2015 however, as the two tables shows for St Louis County home prices below, there has really only been an increase of 5.7% in the price from last year. The median price of homes sold in St Louis County during 4th quarter of 2015 was $175,000, for the current quarter it is $185,000. I’m not sure how much the correct home pricing would change Attom’s affordability index for St Louis County but, given the fact their data for the current median home price is pretty close, that makes the current data fairly accurate in that regard. With that said, the current affordability index for St Louis County is an 89, the lowest of any of the counties in Missouri, which is not good. An index of 100 means that home affordability is at the historic “norm”, above 100 means it’s more affordable than the historic norm, below 100 means less affordable than the historic norm. Locally, Jefferson County has the best affordability index, with a 112, followed by St Charles County with a 109.

With affordability on the decline, and interest rates projected to increase to as high as 5% by the end of next year, if you are thinking about buying a home and, in a position to do so now, I would suggest consider buying sooner than later.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

5 Key Strategies To Assure A Quick Home Sale At The Maximum Price

Get a Market Report with LIVE up to date Home Sales, Prices and Inventory for ANY St Louis Area HERE

Continue reading “Home Affordability Falls Throughout St Louis Area“

By Dennis Norman, on October 26th, 2016 St Louis, with a current median home price of about $165,000 is one of the more affordable places to live in country, however, St Louis also has it’s expensive real estate as well. Granted, a couple of million bucks goes a lot further here than it does in, say, San Francisco, where the median home price is about $1.1 million and, at a median price of about $950/sq ft, only buys you a home with about 1,100 square feet. Here in St Louis, while even the most expensive homes don’t usually fetch anything close to $950/foot, we do have homes that sell for several million dollars.

What kind of house can you get for $5 million in St Louis?

Currently, there are 6 $5 Mil+ homes on the market in the St Louis with the most expensive one being the Dennis & Judy Jones home in Ladue for $10.75 million, followed by 3 more in Ladue, one home in Pacific and one in Augusta. See all of the $5Mil+ homes on the market below.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Continue reading “St Louis Area $5Mil+ Homes For Sale“

By Dennis Norman, on October 13th, 2016 Last month the median price of homes sold in the St Louis MSA was a very-affordable $169,000 however, during past 12 months, homes have sold for as much as over 50 times that amount in St Louis. That’s right, during the past year there was a home that sold for $9,000,000 in St Louis, over 53 times the median St Louis home price. The $9,000,000 St Louis home that was sold was at 2105 South Warson and sold in November of last year for $9,000,000. The next highest home sale was a $4,000,000 one at 760 Kent Road, followed by 2 more Ladue homes. In all, 13 of the 31 homes that sold in St Louis for more than $2,000,000 (based upon MLS data) were in Ladue, 7 were in Clayton (3 of those being condo’s), 3 in Town & Country, 2 in Huntleigh, 2 in Chesterfield, 2 in Creve Coeur and 2 in the Central West End (both were condos at the Private Residences in Chase Park Plaza). See below for addresses, photos and details.

Continue reading “Check Out St Louis’s $2Mil+ Home Sales From The Past Year“

By Dennis Norman, on June 28th, 2016 Mortgage interest rates have been falling since last Thursday when the referendum passed for the United Kingdom to exit the European Union. As the chart below shows, interest rates on a 30 year fixed-rate mortgage today averaged 3.44%, a new 52-week low and a decline of nearly 3/4 of 1 percent from a year ago when they were 4.20%. The payment on a $160,000 home loan at today’s rates would be $713 (principal and interest), a decline of nearly 9 percent from a year ago when the payment on the same loan amount would have been $782.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

LIVE Mortgage Interest Rates – Updated Daily Continue reading “Falling Interest Rates Make St Louis Homes Even More Affordable“

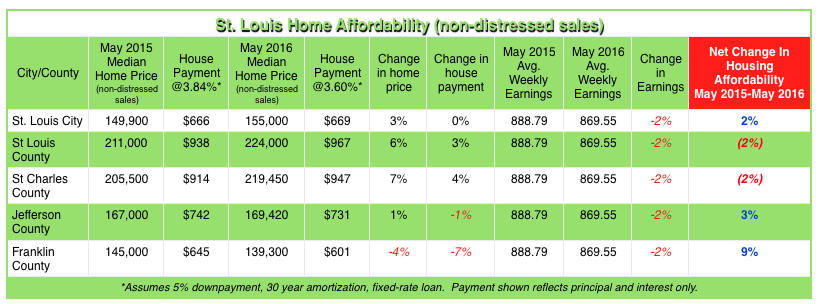

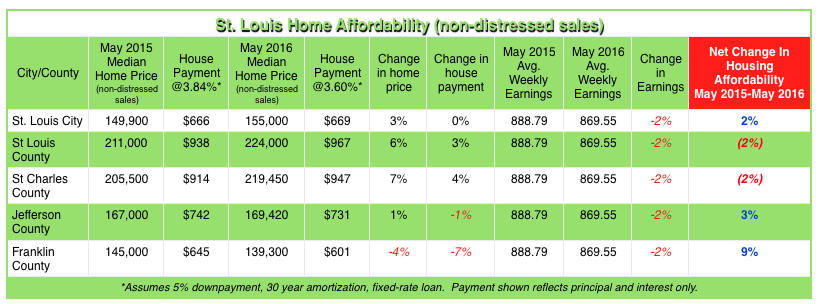

By Dennis Norman, on June 23rd, 2016 One of the many benefits to living in the St Louis area has long been the affordability of good homes in nice neighborhoods, but that has even gotten better in the past year in three of the 5 major counties that make up the St Louis market. As the table below shows, in Franklin County, due to lower home prices as well as interest rates, home affordability increased by 9 percent from May 2015 to May 2016. Jefferson County, as well as the city of St Louis, also saw improvements in home affordability during the period however, St Louis County and St Charles County saw affordability slip by about 2%.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

5 Key Strategies To Assure A Quick Home Sale At The Maximum PriceGet a Market Report with LIVE up to date Home Sales, Prices and Inventory for ANY St Louis Area HERE

Copyright 2016 – St Louis Real Estate News – All Rights Reserved

By Dennis Norman, on March 27th, 2016 A recent article by STL Today indicated that home affordability in St Louis had fallen, specifically noting that affordability in St Louis County had fallen below historic “norms”. As is always the case with stats, it depends upon which data you are taking into account and the accuracy of the data. I decided to take a look at the data and see if my data showed the same result as the STL Today article.

Affordability is UP in St Louis county, not DOWN…

As the table below shows, home affordability in St Louis county has actually increased in the past year, not decreased as reported in the aforementioned article. For the purposes of my analysis, I used home sales data for “non-distressed” sales only, so not including foreclosures or short sales, to get a more accurate picture of the true market.

Affordability has improved in Jefferson County as well but, as the table below shows, has declined in the past year in the city of St Louis, Franklin county and St Charles county.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

5 Key Strategies To Assure A Quick Home Sale At The Maximum PriceGet a Market Report with LIVE up to date Home Sales, Prices and Inventory for ANY St Louis Area HERE

Continue reading “Home Affordability Rises In St Louis County, Falls In St Charles County“

By Dennis Norman, on February 14th, 2016 For those that have been reading my articles for a while, you know I am not a Pollyanna when it comes to the real estate market, opting instead to tell it like it is, even when the news is not so encouraging. For that reason, as well as the data behind my opinion, I think my suggestion that now is a good time to buy a home in St Louis should be considered to be a credible opinion from an industry insider.

So, why buy a home in St Louis now?

- Interest rates are LOW. As the chart below shows, the current average 30 year fixed rate mortgage interest rate in the U.S. is 3.65%, almost an historic low. Interest rates are not forecasted to remain this low. Freddie mac, as the table below shows, is forecasting that mortgage interest rates will rise this year to 4.5% by year end and continue to rise in 2017 until hitting 5.25% by the end of 2017. An increase from the current rate, even to just the projected rate by year-end of 4.5% increases the payment on a typical St Louis home by over 10%, therefore, the same money buys less house!

- Home prices are on the rise. As the chart below shows, St Louis home prices have risen about 4% during the past year and the trend has been fairly consistent. As the median list prices show (the blue line on the chart) list prices of homes for sale is on the rise at a greater rate than the increase in recent sold prices. Granted, this may be the result of overly optimistic sellers that believe spring will bring increased home prices (as is the norm) but even if prices remain flat, increased interest rates will still make the home more costly.

- Gas prices are low and forecasted to remain the same. As the chart below from the U.S. Energy Administration illustrates, gasoline prices this year have hit the lowest price level in about 14 years and the forecast for the rest of this year and through 2017 shows gas prices remaining low. This, along with the other issues noted, should help the St Louis real estate market remain healthy and fairly strong in the short term which will most likely result in continued price appreciation, particularly for areas that are farther out and subject to gas prices.

- More affordable to buy than rent but may change soon. There are two charts at the bottom of this article that illustrate what I’m talking about here. The first is a chart from the St Louis Federal Reserve that shows the St Louis home price index and home rental rates from 1970 to present. The chart illustrates that rental rates increase at a very consistent rate and home prices follow along at a similar pace. Presently, home prices have fallen behind rental rates which, based upon history, will result in home prices increasing. Therefore, currently, in many markets it is more expensive to rent than it is to buy but the savings of homeownership will probably shrink, and perhaps disappear, as home prices rise going forward, particularly if home price appreciation begins outpacing rental rate appreciation, which is likely the happen. The next chart, the Housing Affordability Index from the St Louis Federal Reserve, also illustrates how affordable home ownership is presently. Granted, not as affordable as when home prices hit bottom in 2012, the result of the housing bubble burst in 2008, but illustrating that home ownership is more affordable now than at any time prior to the housing bubble burst in 2008.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

St Louis Home Price Trends By City/Municipality

2016 SMART Guide For Home Buyers

2016 SMART Guide For Home Sellers

Continue reading “4 Reasons Why You Should Buy A Home Now In St Louis“

By Dennis Norman, on December 28th, 2015 I have the honor of serving as chairman of the St Louis Industry Forum which consists of leaders of professional and trade associations that are engaged in some aspect of the real estate industry in St Louis (such as REALTORS, Builders, Mortgage Lenders, Bankers, etc) and at our bi-monthly meetings millennial’s are often the topic of conversation with regard to this generations thoughts on home ownership vs. renting, where they want to live and other related matters. It’s no surprise our industry would be so focused on the millennial generation since this group of teens to 30-something year-olds represents the largest generation (and group of future homeowners or tenants) we have seen.

In other articles I have addressed the issue of homeownership by the millennial generation so in this one I am instead going to look at where the millennials are moving. I prepared the table below which shows all of the major counties in the MSA’s in Missouri, home affordability in those areas as well as the change in population with regard to the millennial generation as well as their parents generation, the baby boomers.

Millennials are heading to the city of St Louis…

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Chart Showing St Louis Home Prices Versus St Louis Rents

Continue reading “St Louis Millennials Are Moving To The City and Their Parents Are Moving Out“

By Dennis Norman, on December 23rd, 2015 When trying to decide whether to buy a home or condo instead of continuing to rent, many would-be first-time home buyers compare the cost of buying a home or condo versus renting something similar. Granted, there are other benefits that come with ownership (along with some additional responsibilities and risks, of course) including potential return on the investment, stability, etc but, if the first thing often considered is the cost of a house payment versus rent…if difference is too large and, therefore, the sacrifice to buy is too great, the consideration of buying often ends at that point.

Is it more affordable to rent or buy a home in the St Louis area?

RealtyTrac just released a report this morning analyzing the cost of buying a home versus renting a home throughout the United States and found that buying a home is still more affordable than renting of 58 percent of U.S. housing markets in spite of the fact that home prices are rising at a greater percentage than rents in 55 percent of the markets analyzed.

Here is St Louis, of the 5 main counties that make up our market, as the table below shows, it is actually more affordable to buy a home in 3 of the five counties:

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Chart Showing St Louis Home Prices Versus St Louis Rents

Continue reading “Is It More Affordable To Buy Or Rent In St Louis?“

By Dennis Norman, on November 20th, 2015 St Louis County has 6 Elementary Schools that have tested at least 50% higher on standardized tests than the average for the state of Missouri and are located in neighborhoods where home prices are affordable, according to a report just released by RealtyTrac. According to the report, these 6 good elementary schools are surrounded by homes that with house payments that will take less than 30% of the families monthly wages to buy, making them very affordable. In fact, for McKelvey Elementary, in Maryland Heights, the average family will need to spend less than 18% on a house payment to live near by.

The table below shows good schools in affordable neighborhoods throughout the state. As you can see, Jackson County (Kansas City) tied St Louis county with 6 good elementary schools in affordable neighborhoods and St Charles County came in third with 4.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

5 Key Strategies To Assure A Quick Home Sale At The Maximum Price Continue reading “St Louis County Tied For Top Missouri County For Affordable Homes And Good Elementary Schools“

By Dennis Norman, on July 15th, 2015 Within the last few days, STL Today published an article titled “The affordability crisis in the St Louis rental market“, based upon a study recently released by the Urban Institute, revealing that “there is literally no affordable, non-subsidized housing available to St. Louis low-income families.” While the focus of the article was non-subsidized affordable rentals, it also discussed the increasing number of extra-low-income families forced to pay over 50% of their income on rent. I was surprised to hear this as I know federal spending on assistance programs has increased significantly over the last decade and I keep hearing that the economy is improving, unemployment is down, etc, so I would have expected a better report. This prompted me to look into it a little further.

Missouri’s Low-Income Families and Rental Housing-

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Continue reading “Only About One Third Of Low Income Missourians In Need Receive Federal Rent Assistance“

|

Recent Articles

|