By Dennis Norman, on June 26th, 2015 St Louis area homes are already affordable based upon the relationship between the median home price and median income for the area, but can become even more affordable when home buyers take advantage of down payment assistance programs that are available throughout the area.

Housing affordability is still good in spite of rising prices-

Data for April, from RealtyTrac, shows house payments on a median priced home in St Louis County required 23% of median income and in St Charles County required just 21% of median income while the national average was 23%. Even with the hot market we have been in, and rising home prices in St Louis, affordability for April in both St Louis County and St Charles County were still lower than their historic norms of 24% and 22% respectively.

Downpayment assistance programs make homes even more affordable –

There are several (over 50) down payment assistance programs in Missouri with many of them available in the St Louis area. To see a complete list of downpayment assistance programs available, along with complete program information, visit Downpayment Assistance Programs For Missouri. To give you an idea of the type of assistance that is available, below is some data from buyers that received down payment assistance in the St Louis area in April 2015:

- In St Louis County the average down payment help benefit received was $6,125.00 which represented 3.53% of the median sales price.

- In St Charles County the average down payment help benefit received was $5,000.00 which represented 2.5% of the median sales price.

- There are 24 down payment help programs available to people buying homes in St Louis County and 16 programs averrable to people buying in St Charles County.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Complete Information On Over 50 Down Payment Assistance Programs Available In Missouri

By Dennis Norman, on February 4th, 2015 Down payment help is available for 87 percent of the homes in the U.S., according to an analysis completed recently by RealtyTrac and Down Payment Resource. This analysis looked at the geographic location of homes to see if they were within areas where down payment assistance are available to purchasers meeting the qualifications of the program.

In the St Louis area, there are several down payment help, or down payment assistance programs, available, most of which are administered by the Missouri Housing Development Commission (MHDC). These programs include:

- Cash Assistance Loan Program (CAL)

- Qualified first-time homebuyers may receive a second mortgage equal to 3% of their mortgage amount which can be used for down payment or closing costs.

- The loan is a five-year loan at 0 percent interest with no monthly payments required. The loan will be forgiven after the buyer has occupied the home for 5 years.

- Non-Cash Assistance Loan Program (NON-CAL)

- Qualified first-time homebuyers that do not need down payment assistance can obtain a lower interest rate home loan than those that use the CAL program above.

- Because of the lower interest rates, borrower will have a lower monthly payment.

The best down payment assistance program in St Louis though is the BMO Harris Bank Affordable Housing Grant Program. This program is available to all qualified home buyers (not just first-tome buyers) and, instead of being a loan that may be forgiven after living in the home for a period of time, it is a no-strings attached grant that can be used for down payment or closing costs. Grants of up to $3,000 are available to home buyers that purchase homes in specified neighborhoods throughout St Louis. Click HERE to find out more about this great down payment help program!

By Dennis Norman, on January 9th, 2015 Yesterday, President Obama announced that he will, by executive order, direct FHA to lower the mortgage insurance premium charged on FHA loans to home buyer from 1.35 percent to .85 percent, lowering home buyer’s house payments by about $900 per year on average. Chris Polychron, the President of the National Association of REALTORS® (NAR) showed his organizations support of the President’s action and highlighted the positive impact NAR felt it would have on the housing market stating “we (NAR) are optimistic that more affordable FHA loans will have a positive impact on first-time buyers who have been entering the market at a lower than normal rate.” NAR has stated that the lower cost of an FHA loan would add 90,000 to 140,000 additional annual home purchases.

The cost of the mortgage insurance premium on an FHA loan was .90% back in 2010, increased to 1.15% in 2011, then to 1.25% in 2012 and finally 1.35% in 2013. NAR first addressed this issue back in April 2014 when, then President, Steve Brown wrote a letter to Carol Galante, the Assistant Secretary for Housing at the time, to draw her attention to the impact the higher fees were having on the housing market and urging her to take action to lower the premiums. In the NAR letter, it was pointed out in 2014 FHA fees accounted for nearly 20 percent of a homeowners monthly mortgage payment.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Continue reading “FHA To Lower Fees Opening The Door To Around 100,000 Home Buyers“

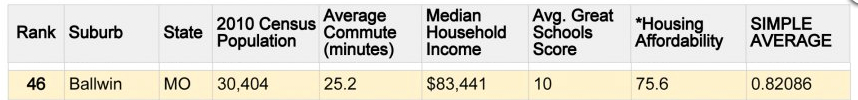

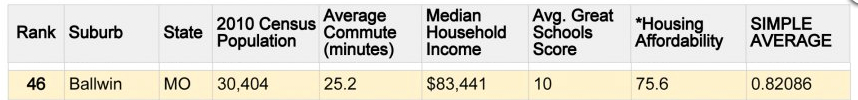

By Dennis Norman, on October 30th, 2014 Business Insider just produced it’s list of “The 50 Best Suburbs in America” and Ballwin made the list coming in at number 46. Ballwin was the only Missouri suburb on the list. To compile the top 50 list, Business Insider considered suburbs with populations between 5,000 and 100,000 within about 25 miles of the nearest metro area and then ranked the suburb on commute times, median household income, crime and poverty rates, housing affordability and school rankings.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

This is not Ballwin’s first time in the spot light as Money Magazine named Ballwin as one of America’s best places to live 3 times, most recently in 2013 when Ballwin came in at number 40 on the list.

By Dennis Norman, on August 7th, 2014 Today, RealtyTrac released a new report which revealed that, as of the 2nd quarter of 2014, affordable housing is on the decline in one-third of the largest counties in the U.S. In compiling the report, the historical average for income to price affordability percentages were analyzed and the results showed that one-third of the counties analyzed now have higher affordability percentages than their historical average now making homes in those counties less affordable now than they have been on average over the past 14 years. On the positive side, no St Louis area counties were on that list however, St Charles County, did make a “good” list! St Charles County was one of the 10 counties that made the list where, as the chart below shows, the percentage of monthly income needed to make the payment on a median priced home was less than 20% and the unemployment rate in May 2014 was less than 5%.

See ALL St Charles County Home For Sale HERE

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Charles County Makes List of Affordable Housing Markets With Jobs“

By Dennis Norman, on August 5th, 2014 A new study by the National Association of Home Builders (NAHB) reveals that, for each $1,000 increase in the price of a new home (median-priced new home) ,206,000 prospective home buyers are forced out of the market. The NAHB uses this point to illustrate the effect that building regulations can have on housing affordability citing that every $833 increase in fees paid during the home-building process, such as permit fees, impact fees, etc, adds an additional $1,000 to the final price of the home.

See St Louis New Homes For Sale – Click HERE

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on August 4th, 2014 Missouri, along with it’s affordable home prices, also has the 3rd lowest mortgage closing costs according to data just released today by BankRate. According to the report, in Missouri, the average mortgage closing costs on a $200,000 home loan are $2,387.00, almost 6% less than the national average of $2,539.00. Holden Lewis, senior mortgage analyst at Bankrate, said mortgage closing costs have risen 6 percent in the past year and says “new mortgage regulations are the biggest reasons why closing costs went up“.

Texas, at $3,046, had the highest closing costs in the nation, followed by Alaska at $2,897 and New York, at $2,892. Nevada had the cheapest mortgage loan closing costs in the country at $2,265 followed by Tennessee with $2,366 and then Missouri.

Find the latest St Louis Mortgage Loan Interest Rates Here.

Search ALL St Louis Homes For Sale Here

(We work hard on this and sure would appreciate a “Like”)

By Dennis Norman, on June 10th, 2014 New home construction is not keeping up with demand in most of the U.S. and could even lead to “persistent housing shortages and affordability issues unless housing starts increase to match up with local job creation”, according to a newly released analysis by the National Association of REALTORS® (NAR).

Lawrence Yun, NAR’s chief economist, discussed in the report the relationship between new jobs and increased demand for housing saying “Historically, there’s one new home construction for every one-and-a-half new jobs,”. Yun goes on to say “Our analysis found that a majority of states are constructing too few homes in relation to local job market conditions. This lack of construction has hamstrung supply and slowed home sales.”

Missouri is not one of the states the NAR report cites as having the biggest disparity between job creation and new homes, instead listing Florida, Utah, California, Montana and Indiana as the states where this issue is most prevalent, but I think we are going to see this, on a reduced scale, in St Louis as well.

See St Louis New Homes For Sale – Click HERE

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “New Home Construction Needs to Increase to Match Job Growth According to REALTORS®“

By Dennis Norman, on March 7th, 2014 One of the great things about St. Louis is the affordability of good homes in quality neighborhoods, however, St Louis does have it’s share of expensive homes as well. So, what are St Louis’ most expensive neighborhoods? The table below shows the 15 most expensive neighborhoods in St Louis, based upon median asking price of homes currently for sale.

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “What Are St Louis’ Most Expensive Neighborhoods?“

By Dennis Norman, on February 20th, 2014 St Louis home affordability has fallen significantly in the past year as a result of increasing home prices as well as rising interest rates, according to a report by MORE, REALTORS. As the table below shows, the hardest hit area was the city of St. Louis where a house payment on a median priced home has increased 50% from the 4th quarter of 2012 to the 4th quarter of 2013. Jefferson county and St Charles county, with the lowest increases in home prices (2% and 7% respectively) had the least amount of damage done to home affordability.

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Home Affordability Drops Dramatically From Year Ago“

By Dennis Norman, on December 9th, 2013

In the thirty year period from 1980 to 2010 the number of housing units in St Charles county tripled from 49,523 units to 141,016 units. St Charles’ growth has been fueled in part by an abundance of affordable new homes but that doesn’t mean St Charles county doesn’t have it’s share of luxury homes though! According to the latest housing data from the US Census Bureau, about 3 percent of the housing units in St Charles, or about 3,300 units, are valued at $500,000 or above. In the thirty year period from 1980 to 2010 the number of housing units in St Charles county tripled from 49,523 units to 141,016 units. St Charles’ growth has been fueled in part by an abundance of affordable new homes but that doesn’t mean St Charles county doesn’t have it’s share of luxury homes though! According to the latest housing data from the US Census Bureau, about 3 percent of the housing units in St Charles, or about 3,300 units, are valued at $500,000 or above.

Below is a slide show revealing St Charles County Most Expensive Homes For Sale:

Continue reading “St Charles County Most Expensive Homes For Sale“

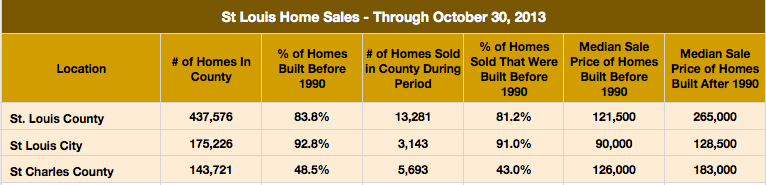

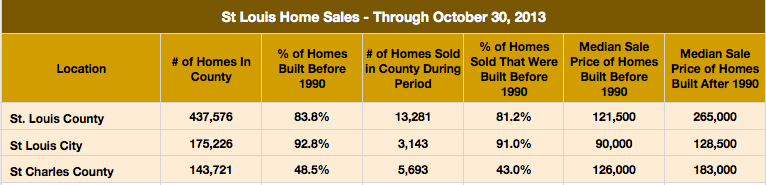

By Dennis Norman, on October 31st, 2013  I decided to take a look at the age of homes in the St Louis area and determine if older homes in St Louis sell for lower prices than newer homes. My idea to do this was prompted by a report RealtyTrac published this morning revealing that 71 percent of the homes in the U.S. were built before 1990 and that there was less demand for these older homes thereby making prices more affordable than on their newer counterparts. I decided to take a look at the age of homes in the St Louis area and determine if older homes in St Louis sell for lower prices than newer homes. My idea to do this was prompted by a report RealtyTrac published this morning revealing that 71 percent of the homes in the U.S. were built before 1990 and that there was less demand for these older homes thereby making prices more affordable than on their newer counterparts.

My research shows that the city of St Louis and St Louis county have a larger percent of older (pre-1990) housing stock than the national average, which is not surprising given the fact St Louis was founded almost 250 years ago. St. Charles county, on the other hand, has a much younger housing supply with less than half the homes in the county having been built before 1990.

Less demand, and lower prices, for pre-1990 homes: (We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

As the table below shows, the percentage of homes sold thus far this year in the St Louis area that were built before 1990 is a little disproportionate with the percentage of the existing homes built before 1990. This is consistent with the RealtyTrac report which showed more demand for the newer homes. Another interesting thing to note is the significant difference in median prices for homes built before 1990 versus built after 1990.

By Dennis Norman, on October 11th, 2013

St Louis is a pretty modest place as a whole and is very affordable when it comes to housing costs. This doesn’t mean that you can’t find a multi-million dollar estate if you are in the market for one. St Louis is a pretty modest place as a whole and is very affordable when it comes to housing costs. This doesn’t mean that you can’t find a multi-million dollar estate if you are in the market for one.

The proof is in the slideshow below…the most expensive homes currently on the market in the St Louis area: Continue reading “St Louis Most Expensive Homes For Sale“

By Dennis Norman, on August 11th, 2013

Ok, so you’re a guy, you went to church this morning with the family, came home and did a couple of “honey do” projects, played with the kids and walked the dog. Now it’s time for a little “ME TIME”, right? But…how do you get your peace and quiet to kick back and watch the game and yet still be at home with your family? The answer is simple…you need a MAN CAVE! What? No room in the house for one as the family has taken over? No problem! Here’s the answer, a Man Cave Shed! Best I can tell, they are very affordable, comfortable and provide you an instant man cave out in the yard…all the while having the appearance of a utility shed (albeit a rather nice one) from the exterior. Perfect cover! Let the wife, kids and neighbors think you are in the shed hard at work while you are actually in the recliner, eating bacon, watching the game and admiring your mounts at the same time! Check out the tour in the video below.. Continue reading “The Man Cave Shed“

By Dennis Norman, on August 8th, 2013

That’s right, along with very affordable home prices, Missouri also has almost the lowest closing costs in the nation at an average of $2,188 for lenders’ origination fees and third party fees, second only to the state of Wisconsin with average closing costs of $2,119, according to the 2013 closing cost survey by Bankrate.

See table below for survey results for all states:

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “Missouri has almost the lowest closing costs in the nation!“

By Dennis Norman, on July 26th, 2013

The truth on the Mortgage Interest Deduction

Currently, lawmakers in Washington D.C., while looking for ways to “close loopholes” and cut spending, are looking hard at something once considered “untouchable”, the mortgage interest deduction (MID). While there is probably little chance of totally eliminating the ability for homeowners to deduct the mortgage interest they paid on their homes, there is a possibility the deduction could be altered significantly or capped, and, perhaps, even phased out over time.

Like most current events, there are stories out there with varying degrees of accuracy about the benefit of the mortgage interest deduction as well as who it benefits. In response to the rhetoric out there, economists with the National Association of Home Builders have published a list of ten common claims about the MID and their findings as to the validity of those claims after researching data from the IRS, Census Bureau as well as other sources. The complete results are shown below:

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “The Mortgage Interest Deduction…Truth vs Fiction“

By Dennis Norman, on May 21st, 2013  The National Association of Home Builders released their housing affordability report for the 1st quarter of 2013 showing that in Mansfield Ohio, the median price for a home was $73,000 and, with the area median family income being $54,600, resulting in 97.5 percent of the new and existing homes for sale being affordable to an average family. At the other end of the list was San Francisco, with a median price of $675,000, median income of $102,000 and only 28.9 percent of its homes affordable to a family with a median income. St. Louis came in at 76 on the list with a median home price of $128,000 and median family income of $69,200 resulting in 85.8 percent of the homes being affordable to a family with a median income. See the complete list below: The National Association of Home Builders released their housing affordability report for the 1st quarter of 2013 showing that in Mansfield Ohio, the median price for a home was $73,000 and, with the area median family income being $54,600, resulting in 97.5 percent of the new and existing homes for sale being affordable to an average family. At the other end of the list was San Francisco, with a median price of $675,000, median income of $102,000 and only 28.9 percent of its homes affordable to a family with a median income. St. Louis came in at 76 on the list with a median home price of $128,000 and median family income of $69,200 resulting in 85.8 percent of the homes being affordable to a family with a median income. See the complete list below:

Continue reading “10 Most Affordable and 10 Least Affordable Places To Own A Home“

Tyler Frank,

Paramount Mortgage

NMLS ID 942420 Home Prices Nationwide Shooting Up Faster Than Anyone Thought Possible Not Long Ago

The US housing market has broken out of a deep slump, and prices are shooting up faster than anyone thought possible a year ago.

Prices of existing homes rose 10% in February nationally from a year ago. What is causing this increase?

Continue reading “Home Prices Set To Rise, Thanks To The Fed“ Continue reading “Home Prices Set To Rise, Thanks To The Fed“

By Dennis Norman, on March 14th, 2013  What to do if you are facing foreclosure and losing your home. What to do if you are facing foreclosure and losing your home.

If you are not able to make the payments on your home and are afraid you are going to lose your homje in foreclosure, there is free help available to you right here in St. Louis through HUD-approved counseling agencies that can provide you with information and assistance to avoid foreclosure. The agencies can also determine if you may be eligible for a special loan modification or refinance through the Federal Government’s “Making Home Affordable” plan which may help you keep your home by reducing your payments. These are not-for profit agencies that do NOT charge you but are funded, in part, by HUD. To find an agency closest to you, see the list below. Continue reading “Free Foreclosure Avoidance Help Is Available In St Louis“

By News Desk, on March 12th, 2013 Attorney General Chris Koster today filed a lawsuit against two related businesses that purported to provide loan modification and mortgage relief to desperate homeowners. Koster’s suit is against Legal Helpers Debt Resolution, LLC and Mortgage Law Group, LLC, as well as the companies’ managing partner, Jason Edward Searns; senior partner, Thomas Macey; and senior partner, Jeffery Aleman.

For tips on how to avoid loan modification scams click here

Continue reading “Attorney General Koster sues businesses that had promised foreclosure modifications and debt relief“

By Dennis Norman, on February 22nd, 2013

Over 84 percent (84.1) of the homes sold in St Louis during the 4th quarter of 2012 were affordable to a family earning the St. Louis median income of $70,400, according to the National Association of Home Builders/Wells Fargo Housing Opportunity Index (HOI) that was just released. This is actually the lowest the affordability index for St. Louis has been since the 3rd quarter of 2011 when it was 81.5 but is significantly better than it was a little over 5 years ago, in the 3rd quarter of 2007 when only 70.4 percent of the homes sold in St Louis were affordable to a family with a median income.

Not everywhere in the U.S. is so affordable though, such as San Francisco, at the top of the list of the least affordable metro areas in the U.S. where just over a fourth (28.4 percent) of all homes sold would be affordable to a family with a median income in spite of the fact that the median income in that area at $103,000 is over 50% higher than the U.S. median income. At the other end of the list is Ogden-Clearfield, Utah at the top of the list for most affordable metro areas for housing where a whopping 93.7 percent of the homes sold in the 4th quarter of 2012 were affordable to a family with a median income.

By Dennis Norman, on February 5th, 2013  Over 35 percent (35.1) of tenants were previously homeowners, according to a survey by Apartments.com conducted in the 4th quarter of 2012. This is a fairly significant increase from a year ago when 33.6 percent of tenants reported they were previously homeowners. The most common reasons given for the change from homeowner to tenant were affordability and the flexibility in location. While it was just 5th on the list, it is worth noting that the loss of a home due to foreclosure or divorce increased nearly 90 percent in the past year as a reason for converting from homeowner to renter. Over 35 percent (35.1) of tenants were previously homeowners, according to a survey by Apartments.com conducted in the 4th quarter of 2012. This is a fairly significant increase from a year ago when 33.6 percent of tenants reported they were previously homeowners. The most common reasons given for the change from homeowner to tenant were affordability and the flexibility in location. While it was just 5th on the list, it is worth noting that the loss of a home due to foreclosure or divorce increased nearly 90 percent in the past year as a reason for converting from homeowner to renter.

Top Five Reasons Why Previous Homeowners Now Rent: Continue reading “Number of homeowners becoming tenants on the rise“

By Robert Fishel, on December 26th, 2012  “Every single thing about housing is flashing green,” stated James Dimon, chief executive of J.P. Morgan Chase, in an interview with CNBC last month. “Household formation is rising, inventory is falling, and affordability is near a record high.” This should mean many potential homebuyers will be assessing their finances in 2013 to get ready to buy a home. Checking your credit score is at the top of the list, and in turn credit myths and credit misconceptions are plentiful. “Every single thing about housing is flashing green,” stated James Dimon, chief executive of J.P. Morgan Chase, in an interview with CNBC last month. “Household formation is rising, inventory is falling, and affordability is near a record high.” This should mean many potential homebuyers will be assessing their finances in 2013 to get ready to buy a home. Checking your credit score is at the top of the list, and in turn credit myths and credit misconceptions are plentiful.

Things You Should Know Before You Repair Your Credit:

Continue reading “Things You Should Know Before You Repair Your Credit; St Louis Mortgage Interest Rate Update“

By Robert Fishel, on December 6th, 2012  According to Lawrence Yun, Chief Economist for the National Association of Realtors, home prices nationally are up 11.1% in October compared to this point last year. The number of homes available for sale nationally fell reducing the available supply to a level below that of one year ago. The result is tighter supply of homes helping boost the national median existing-home price level to $178,600 in October; price increases have helped home owners regain equity lost during the housing crisis. According to Lawrence Yun, Chief Economist for the National Association of Realtors, home prices nationally are up 11.1% in October compared to this point last year. The number of homes available for sale nationally fell reducing the available supply to a level below that of one year ago. The result is tighter supply of homes helping boost the national median existing-home price level to $178,600 in October; price increases have helped home owners regain equity lost during the housing crisis.

Continue reading “Home prices on the rise; St Louis Mortgage Interest Rate Update“ Continue reading “Home prices on the rise; St Louis Mortgage Interest Rate Update“

By Dennis Norman, on November 21st, 2012  I’m sure I’m not the only person in St. Louis that has thought about what it would be like to move to New York, Los Angeles or even Paris or Madrid. If you are another dreamer like me, you will enjoy the widget below that will let you see what your money will buy you in terms of housing (gas, a movie, McDonalds combo meal and a few other things as well) in 30+ international destinations. I’m sure I’m not the only person in St. Louis that has thought about what it would be like to move to New York, Los Angeles or even Paris or Madrid. If you are another dreamer like me, you will enjoy the widget below that will let you see what your money will buy you in terms of housing (gas, a movie, McDonalds combo meal and a few other things as well) in 30+ international destinations.

I don’t want to burst your bubble, but I should warn you however, it’s going to be an eye-opener and you are going to see just how affordable it is to live in St. Louis. For example, in St Louis $250,000 will get you a very nice home, depending on location you can get a 2,000 – 3,000 square foot home pretty easy and gas prices are about $3.25/gallon. In Paris, for $250,000 you will get a 149 square foot home (well, small room actually) and will pay $8.54 for a gallon of gas. Aha, St. Louis is looking better by the minute, right? Continue reading “Want to know how your St Louis home stacks up to other cities around the world?“

By Dennis Norman, on November 14th, 2012  Annually, the National Association of REALTORS (NAR) conducts a survey of people that bought and/or sold a home in the past year to learn about their shopping habits, what motivated them to do what they did, etc. The NAR “Profile of Home Buyers and Sellers” for 2012 was just released and shows, among other things, that 90 percent of home buyers used the internet in finding the home they bought and, of those, about half used a local MLS site and/or agent/company site. Annually, the National Association of REALTORS (NAR) conducts a survey of people that bought and/or sold a home in the past year to learn about their shopping habits, what motivated them to do what they did, etc. The NAR “Profile of Home Buyers and Sellers” for 2012 was just released and shows, among other things, that 90 percent of home buyers used the internet in finding the home they bought and, of those, about half used a local MLS site and/or agent/company site.

What’s the best local St Louis website for searching homes for sale? For it’s ease of use, accuracy of content and and relevant information, “one-click” searches and the fact a real, live, professional agent is nearly always ready to respond to questions, I would have to say StLouisRealEstateSearch.com*

Continue reading “REALTOR Survey Shows 90 Percent of Buyers Use Internet To Search for Homes; What is Best St Louis site?“

By Robert Fishel, on October 24th, 2012

Over the past few years, ARM’s (adjustable rate mortgages) have received somewhat of a “bad name” however, there are truly benefits to utilizing an ARM, which include:

- ARM rates are now more attractive than ever before.

- Rates have fallen to 2.625% for a 5/1 ARM.

- Rates are capped so there are no surprises for borrowers.

- Rates adjust only on the remaining principal of the loan.

- Rate adjustments could decrease/increase, but the adjustments are limited to a prevailing market index in which the ARM is based.

- Most ARM’s do not have a pre-payment penalty

- Lower Monthly Payments which Increase your buying power.

Continue reading “The Benefits of ARM’s; St Louis Mortgage Interest Rate Update“ Continue reading “The Benefits of ARM’s; St Louis Mortgage Interest Rate Update“

By Dennis Norman, on October 19th, 2012  According to a report released this week by Interest.com, St. Louis is the 5th most affordable metro area in the U.S. with a median-income household having 23 percent more income than needed to buy a median priced home. Number one on the list is Detroit where a median-income household has 45 percent more income than needed to buy a median priced home and, at the opposite end of the spectrum, the least affordable metro is San Francisco where a median income is almost 33 percent less income than necessary to afford a home. Continue reading “St. Louis is the 5th most affordable metro area to buy a home“ According to a report released this week by Interest.com, St. Louis is the 5th most affordable metro area in the U.S. with a median-income household having 23 percent more income than needed to buy a median priced home. Number one on the list is Detroit where a median-income household has 45 percent more income than needed to buy a median priced home and, at the opposite end of the spectrum, the least affordable metro is San Francisco where a median income is almost 33 percent less income than necessary to afford a home. Continue reading “St. Louis is the 5th most affordable metro area to buy a home“

By Peter Wright, on October 3rd, 2012

If you are considering buying your first home you may very well be asking yourself if now is the time, have prices bottomed out and trying to weigh the risks of buying a home versus the rewards. Well, if this is the case, allow me to give you some things to put on the “rewards” side of the equation….

For starters, with mortgage rates at historic lows, your monthly mortgage payment in most cases should be much lower than what you are currently paying in rent! Remember this…”Your Landlord says Hi…& Thanks You for Paying His Mortgage.” Also, we have seen flexibility from sellers on negotiations and most are helping in paying for the buyers closings costs…so that just leaves the down-payment, and that may not be as much as you think…… Continue reading “Government funds of up to $25,000 available to assist first-time home buyers“

By Dennis Norman, on September 14th, 2012  Should I rent or buy a home in St Louis? This is a question that I’ve been asked dozens of times over the past couple of years and one that given the fact that home affordability is at an all time high and mortgage interest rates at an all time low, is generally easy to answer with “buy if you can”. I guess I many not have realized just HOW much sense that made financially, until a report came out a few days ago that looked to answer this very question and found that home ownership was 45 percent cheaper (on average) than renting in all 100 largest metro areas in the U.S. In St. Louis, with an average monthly cost of home ownership of $593 and rental cost of $1,251, according to Trulia1, there is 53 percent less cost owning a home versus renting a home. Should I rent or buy a home in St Louis? This is a question that I’ve been asked dozens of times over the past couple of years and one that given the fact that home affordability is at an all time high and mortgage interest rates at an all time low, is generally easy to answer with “buy if you can”. I guess I many not have realized just HOW much sense that made financially, until a report came out a few days ago that looked to answer this very question and found that home ownership was 45 percent cheaper (on average) than renting in all 100 largest metro areas in the U.S. In St. Louis, with an average monthly cost of home ownership of $593 and rental cost of $1,251, according to Trulia1, there is 53 percent less cost owning a home versus renting a home.

1Trulia looks at homes for sale and for rent and calculates the average rent and sale price across all listed properties in a metro area. Then, Trulia factors in the total costs of homeownership (e.g., closing costs, maintenance, insurance, taxes, etc) and total cost of renting (e.g., renter’s insurance and security deposit). The starting assumptions are that a prospective homebuyer can get a low mortgage rate of 3.5 percent, itemizes their federal tax deductions, is in the 25 percent tax bracket, and will stay in their home for seven years. People in the 35% federal income tax bracket are also assumed to pay 5% state income tax. To account for the opportunity costs, Trulia calculates the net present value of the payment streams for renting and owning.

|

Recent Articles

|

In the thirty year period from 1980 to 2010 the number of housing units in St Charles county tripled from 49,523 units to 141,016 units. St Charles’ growth has been fueled in part by an abundance of affordable new homes but that doesn’t mean St Charles county doesn’t have it’s share of luxury homes though! According to the latest housing data from the US Census Bureau, about 3 percent of the housing units in St Charles, or about 3,300 units, are valued at $500,000 or above.

In the thirty year period from 1980 to 2010 the number of housing units in St Charles county tripled from 49,523 units to 141,016 units. St Charles’ growth has been fueled in part by an abundance of affordable new homes but that doesn’t mean St Charles county doesn’t have it’s share of luxury homes though! According to the latest housing data from the US Census Bureau, about 3 percent of the housing units in St Charles, or about 3,300 units, are valued at $500,000 or above.

The National Association of Home Builders released their housing affordability report for the 1st quarter of 2013 showing that in Mansfield Ohio, the median price for a home was $73,000 and, with the area median family income being $54,600, resulting in 97.5 percent of the new and existing homes for sale being affordable to an average family. At the other end of the list was San Francisco, with a median price of $675,000, median income of $102,000 and only 28.9 percent of its homes affordable to a family with a median income. St. Louis came in at 76 on the list with a median home price of $128,000 and median family income of $69,200 resulting in 85.8 percent of the homes being affordable to a family with a median income. See the complete list below:

The National Association of Home Builders released their housing affordability report for the 1st quarter of 2013 showing that in Mansfield Ohio, the median price for a home was $73,000 and, with the area median family income being $54,600, resulting in 97.5 percent of the new and existing homes for sale being affordable to an average family. At the other end of the list was San Francisco, with a median price of $675,000, median income of $102,000 and only 28.9 percent of its homes affordable to a family with a median income. St. Louis came in at 76 on the list with a median home price of $128,000 and median family income of $69,200 resulting in 85.8 percent of the homes being affordable to a family with a median income. See the complete list below:

What to do if you are facing foreclosure and losing your home.

What to do if you are facing foreclosure and losing your home.

Over 35 percent (35.1) of tenants were previously homeowners, according to a survey by Apartments.com conducted in the 4th quarter of 2012. This is a fairly significant increase from a year ago when 33.6 percent of tenants reported they were previously homeowners. The most common reasons given for the change from homeowner to tenant were affordability and the flexibility in location. While it was just 5th on the list, it is worth noting that the loss of a home due to foreclosure or divorce increased nearly 90 percent in the past year as a reason for converting from homeowner to renter.

Over 35 percent (35.1) of tenants were previously homeowners, according to a survey by Apartments.com conducted in the 4th quarter of 2012. This is a fairly significant increase from a year ago when 33.6 percent of tenants reported they were previously homeowners. The most common reasons given for the change from homeowner to tenant were affordability and the flexibility in location. While it was just 5th on the list, it is worth noting that the loss of a home due to foreclosure or divorce increased nearly 90 percent in the past year as a reason for converting from homeowner to renter. “Every single thing about housing is flashing green,” stated James Dimon, chief executive of J.P. Morgan Chase, in an interview with CNBC last month. “Household formation is rising, inventory is falling, and affordability is near a record high.” This should mean many potential homebuyers will be assessing their finances in 2013 to get ready to buy a home. Checking your credit score is at the top of the list, and in turn credit myths and credit misconceptions are plentiful.

“Every single thing about housing is flashing green,” stated James Dimon, chief executive of J.P. Morgan Chase, in an interview with CNBC last month. “Household formation is rising, inventory is falling, and affordability is near a record high.” This should mean many potential homebuyers will be assessing their finances in 2013 to get ready to buy a home. Checking your credit score is at the top of the list, and in turn credit myths and credit misconceptions are plentiful.

I’m sure I’m not the only person in St. Louis that has thought about what it would be like to move to New York, Los Angeles or even Paris or Madrid. If you are another dreamer like me, you will enjoy the widget below that will let you see what your money will buy you in terms of housing (gas, a movie, McDonalds combo meal and a few other things as well) in 30+ international destinations.

I’m sure I’m not the only person in St. Louis that has thought about what it would be like to move to New York, Los Angeles or even Paris or Madrid. If you are another dreamer like me, you will enjoy the widget below that will let you see what your money will buy you in terms of housing (gas, a movie, McDonalds combo meal and a few other things as well) in 30+ international destinations.

Should I rent or buy a home in St Louis? This is a question that I’ve been asked dozens of times over the past couple of years and one that given the fact that home affordability is at an all time high and mortgage interest rates at an all time low, is generally easy to answer with “buy if you can”. I guess I many not have realized just HOW much sense that made financially, until a report came out a few days ago that looked to answer this very question and found that home ownership was 45 percent cheaper (on average) than renting in all 100 largest metro areas in the U.S. In St. Louis, with an average monthly cost of home ownership of $593 and rental cost of $1,251, according to Trulia1, there is 53 percent less cost owning a home versus renting a home.

Should I rent or buy a home in St Louis? This is a question that I’ve been asked dozens of times over the past couple of years and one that given the fact that home affordability is at an all time high and mortgage interest rates at an all time low, is generally easy to answer with “buy if you can”. I guess I many not have realized just HOW much sense that made financially, until a report came out a few days ago that looked to answer this very question and found that home ownership was 45 percent cheaper (on average) than renting in all 100 largest metro areas in the U.S. In St. Louis, with an average monthly cost of home ownership of $593 and rental cost of $1,251, according to Trulia1, there is 53 percent less cost owning a home versus renting a home.