By Dennis Norman, on December 30th, 2009  St. Louis mortgage rates inreased again this week bringing 30 year rates above 5 percent according to St. Louis-based Paramount Mortgage Company. St. Louis mortgage rates inreased again this week bringing 30 year rates above 5 percent according to St. Louis-based Paramount Mortgage Company.

Lower interest rates, low prices and the extension and expansion of the home-buyer tax credit should be pretty tempting to buyers out there.

St. Louis Mortgage Rates – December 30, 2009 *

- 30-year fixed-rate mortgage 5.25% no points

- 15-year fixed-rate mortgage 4.75% no points

- 3/1 adjustable rate mortgage 4.25% no points

- 5/1 adjustable rate mortgage 4.50% no points

For more information or if you have questions on mortgage rates in St. Louis you may contact John Frank by phone at (314) 372-4300, email at hjfrankjr@paramountmortgage.com or you can visit his company website at http://www.paramountmortgage.com.

*Note- The above rates are based upon a typical sale price of $187,500 with a 20% percent down payment leaving a loan amount of $150,000 to a borrower with a 720 credit score for a loan with no discount points charged. Rates and terms will vary depending upon loan amount, home value, credit and income of borrower.

This information is provided by this author and this site for informative purposes only and is not warranted or guarteed in any way.

By Dennis Norman, on December 28th, 2009  Dennis Norman

To answer this question I turned to the housing forecast just released by Fannie Mae to see what their economists were predicting. Here are the highlights from the report, showing actual numbers for the 3rd quarter of this year as well as Fannie Mae’s projection for 4th quarter of this year as well as 4th quarter of 2010:

- New Home Starts (seasonally adjusted annual rate)

- 3rd quarter actual- 499,000

- 4th quarter 09 projection – 502,000 (+0.06 % from 3rd quarter)

- 4th quarter 10 projection – 650,000 ( +29.4% from the year before)

- New Home Sales (seasonally adjusted annual rate)

- 3rd quarter actual- 413,000

- 4th quarter 09 projection – 442,000 (+7.02 % from 3rd quarter)

- 4th quarter 10 projection – 510,000 ( +15.38% from the year before)

- Existing Home Sales (seasonally adjusted annual rate)

- 3rd quarter actual- 5,290,000

- 4th quarter 09 projection – 5,623,000 (+6.29 % from 3rd quarter)

- 4th quarter 10 projection – 5,492,000 ( -2.32% from the year before)

- Median Home Prices-New Homes

- 3rd quarter actual- $210,400

- 4th quarter 09 projection – $214,600 (+2.0 % from 3rd quarter)

- 4th quarter 10 projection – $211,400 (-1.5% from the year before)

- Median Home Prices-Existing Homes

- 3rd quarter actual- $178,300

- 4th quarter 09 projection – $175,200 (-1.73 % from 3rd quarter)

- 4th quarter 10 projection – $172,600 (-1.48% from the year before)

- Mortgage Interest Rates (fixed-rate mortgage)

- 3rd quarter actual- 5.16 percent

- 4th quarter 09 projection – 4.88 percent

- 4th quarter 10 projection – 5.32 percent

So there you have it. A somewhat encouraging forecast for the housing industry for next year. A prediction of increased new home sales, a little bump in existing home sales at the end of this year (from the homebuyer tax credit no doubt) and then a slight drop in sales next year from that rate, a slight drop in home prices in the next year and interest rates that are still attractive. If all this pans out 2010 will no doubt end up being a kinder year to the housing industry than 2009 was.

Ah, but wait…I know what you’re thinking…same thing as me. What do these guys know? After all wasn’t it Fannie Mae that had accounting issues, management problems and has been blamed by some to be a contributor to the housing bust? Well, lets take a look at their housing forecast from a year ago and how accurate their projections were then. For the sake of this comparison we will compare their forecast for the 3rd quarter of 2009 with the actual numbers from above:

New Home Starts (seasonally adjusted annual rate)

3rd quarter 2009 actual- 499,000

3rd quarter forecast – 526,000 (over by 5.41%)

New Home Sales (seasonally adjusted annual rate)

3rd quarter2009 actual- 413,000

3rd quarter forecast – 472,000 (over by 14.29%)

Existing Home Sales (seasonally adjusted annual rate)

3rd quarter 2009 actual- 5,290,000

3rd quarter forecast – 5,003,000 (under by 5.42%)

Median Home Prices-New Homes

3rd quarter 2009 actual- $210,400

3rd quarter forecast – $208,600 (under by 0.85%)

Median Home Prices-Existing Homes

3rd quarter 2009 actual- $178,300

3rd quarter forecast – $186,600 (over by 4.66%)

Mortgage Interest Rates (fixed-rate mortgage)

3rd quarter 2009 actual- 5.16 percent

3rd quarter forecast – 5.44 percent (over by 5.42%)

Considering all the factors that affect the housing market I actually think Fannie Mae did pretty good in their forecast last year. They overshot new home sales a fair amount but undershot existing home sales by a much smaller percentage. Overall on combined home sales they got within 4% of predicting the number of sales. I also think they did pretty good on median home prices.

So, since Fannie Mae’s projections last year were fairly accurate lets hope the current projections will prove to be as well. If so, then it will be clear that the worst is behind us.

By Dennis Norman, on December 25th, 2009

By Dennis Norman, on December 24th, 2009  Dennis Norman NAR’s “seasonally-adjusted” numbers show sales up 7.4 percent for the month…”actual” numbers show a 5.2 percent decrease….Sales up 44 percent from last year, lest we not forgot last year was the worst in over 10 years…

According to the latest report from the National Association of REALTORS(R), existing home sales in November increased 7.4 percent to a seasonally adjusted-annual rate of 6.54 million units in November from a revised level of 6.09 million units in October, and are 44.1 percent higher than the 4.44 million-unit pace in November 2008. Existing home sales are now at the highest level since February 2007 when it hit 6.55 million.

NAR’s Chief Economist, Lawrence Yun, said of the increase in existing home sales “This clearly is a rush of first-time buyers not wanting to miss out on the tax credit…”. I agree but would describe the effect of the homebuyer tax credits on the housing market like a kid’s sugar rush; the same analogy I used in a post about the spike in new home sales, which was followed a report earlier this week of new home sales taking a dive the following month.

I don’t like “seasonally adjusted rates of sales”:

If you have been reading my posts for a while you know by now I don’t like “seasonally adjusted” numbers, particularly when artificial stimuli, such as homebuyer tax-credits, can cause an unseasonal spike in sales activity. I much prefer to see the actual numbers and try to garner from them what is going on in the housing market.

When looking at the ACTUAL Existing Home sales reported by NAR I found that home sales actually declined 5.2 percent from October’s sales of 498,000 units to 472,000 units in November. Comparing sales for November 2009 to the year before there was an increase of 46.6 percent but don’t forget, buyers we’re racing the clock to buy a home before the credit expired (it has since been extended).

Through November 30, 2009, there have been 4,743,000 homes sold compared with 4,552,000 at the same time last year for an increase of 4.2 percent. Now, while this is good, to keep it in perspective we have to remember we are comparing our current numbers to a year that saw the lowest number of existing homes sold in over 10 years. I’m not being a pessimist, I’m just saying we need to take this for what it is…baby steps toward a leveling-off of the market.

Other highlights of the NAR Report:

- Median price of homes sold in November in the US was $172,600, ab about the same as October’s revised median price of $172,200 and down 4.3 percent from November, 2008 when the price was $180,300.

- Distressed sales accounted for 33 percent of all home sales in November, up from 30 percent in October.

- Total housing inventory at the end of November was 3,520,000 homes for a 6.5 month supply (based upon “seasonally adjusted rate of sale”) – by my calculations, based upon my estimate of sales of 5.143 million homes for 2009, I say the supply is equal to about 8.2 months. (Beware of the growing “shadow inventory” though…more on that later)

By Dennis Norman, on December 23rd, 2009

Dennis Norman

New homes were started in November at an annual rate of 482,000 homes and I asked why in my post last week since new home construction was already outpacing sales….well, today the gap got worse..

This morning the U.S. Department of Commerce released a report showing the sale of New Homes in November were at a seasonally adjusted annual rate of 355,000, an 11.3 percent decrease from the revised October rate of 400,000 and is 9.0 percent below a year ago.

My Mantra

As has been my long-running mantra, I don’t like “seasonally adjusted” numbers and “rate” of sales. Why, for one I can’t figure out how in the world they compute the numbers. Second, I just don’t think discussing  the “rate” of new home sales paints a realistic picture of the market. I think this holds especially true when we have artificial forces affecting the housing market such as tax credits and other incentives. This can create unseasonal bursts or declines in sales that don’t really have anything to do with the underlying fundamentals of the housing market. the “rate” of new home sales paints a realistic picture of the market. I think this holds especially true when we have artificial forces affecting the housing market such as tax credits and other incentives. This can create unseasonal bursts or declines in sales that don’t really have anything to do with the underlying fundamentals of the housing market.

Effect of tax credits on homebuyers like kid’s “sugar-rush”?

Last month I described the effect of the homebuyer tax credits on the market like a kid’s sugar rush and said “come December we may very well see new home sales slow significantly and lose the momentum that was a result of the “sugar rush affect” on homebuyers of the tax credits that gave them that quick surge of energy and motivation to buy, but then quickly wore off as the urgency subsided with the extension of the credits.” Well, December is here and look what happened to new home sales. Kind of makes it appear I’m “in the know”, huh? Nah, just lucky and also predicting something that appeared to be obvious.

Here is the raw data, the ACTUAL new homes sold- no fluff, no “adjusting”

- 25,000 new homes sold in November, a 24.2 percent decrease from October’s 33,000 new homes sold and a 7.4 percent decrease from November 2008 when there were 27,000 new homes sold

- 48 percent (15,000) of the new homes sold were in the South region- an decrease of 25.0 percent from October’s 20,000 new homes sold

- the west region had 5,000 new homes sold, a decrease of 28.5 percent from October’s 7,000 homes sold

- the Midwest held steady with 5,000 new homes sold, the same as October.

- The Northeast had 2,000 new homes sold, a decrease of 33.3 percent from October’s 3,000 new homes sold.

- 349,000 new homes sold this year through the end of November which is a 23.9 percent decrease from this time last year when there were 459,000 new homes sold.

- on YTD new home sales all four regions of the US have seen a decrease from the year before

- Midwest decrease of 23.2 percent

- South decrease of 25.0 percent

- West decrease of 24.5 percent

- Northeast decrease of 15.2 percent

- Median sale price of new homes in the US in November was $217,400, an increase of 2.4 percent from October’s median price of $212,200.

- For the new homes sold in the US in October the median time they have been on the market for sale is 13.6 months.

- Inventory of new home in US at end of October is 234,000 a 2.0 percent decrease from October’s inventory of 239,000 – this is very good news…

My prediction

For some time I have been predicting new home sales for 2009 would end up around 385,000 – 395,000…last month I pinned the number down at 390,000…I was feeling somewhat optimistic because of the tax credits but now I can see the numbers are probably going to fall short of my prediction. If you have been reading any of my posts for a while it’s kind of hard to believe I was overly optimistic, isn’t it?

Merry Christmas

By Dennis Norman, on December 22nd, 2009 According to NAR 51 percent of recent homebuyers are first-time buyers and 39 percent of recent home sales have relied on an FHA loan Dennis Norman

The National Association of REALTORS just released a report showing that 51 percent of the homes sold recently have been to first-time home buyers and that 39 percent of all recent buyers have turned to an FHA loan for financing for their home purchase.

I think this clearly illustrates that the first-time home buyer tax credit, coupled with record low interest rates and drastically reduced home prices, is giving buyers, at least first-time home-buyers, the confidence to move forward in their decision to purchase a home. Oh what I wouldn’t give to be a first-time home-buyer today!

“FHA helps provide affordable mortgage financing to homeowners, particularly first-time home buyers who are so important in drawing down inventory to help stabilize the current housing market,” said NAR President Vicki Cox Golder, owner of Vicki L. Cox & Associates in Tucson, Ariz. “These recent survey results reaffirm that, despite its current challenges, FHA is a critical part of the American housing fabric.”

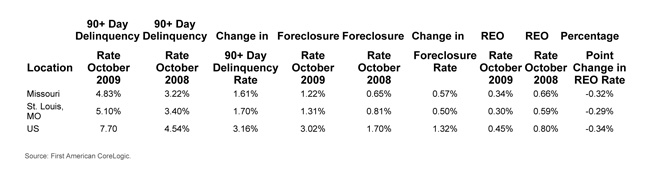

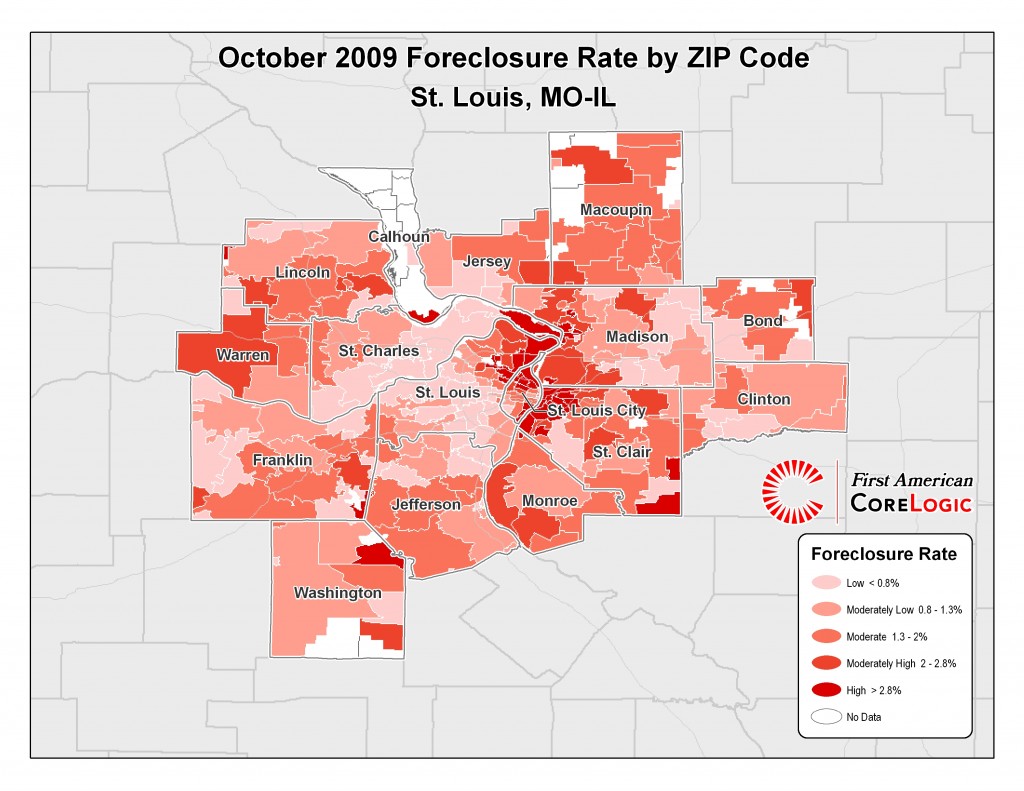

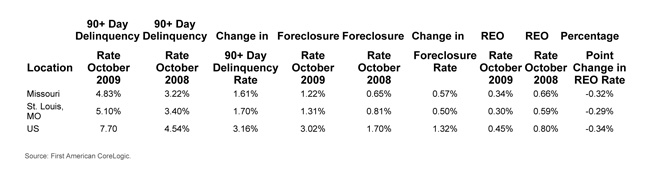

By Dennis Norman, on December 21st, 2009  Dennis Norman Foreclosure rates in St. Louis increased for the month of October over the same period last year according to a report released by First American CoreLogic. The report showed the St. Louis metro area to have a foreclosure rate of 1.31 percent in October, up just slightly from September’s rate of 1.25 percent, but up 61.7 percent from a year ago when the rate was 0.81 percent.

The national foreclosure rate for October was over double the rate of St. Louis at 3.02 percent and was an increase of 77.6 percent from a year ago when the national foreclosure rate was 1.70 percent.

It doesn’t appear the rate of foreclosures is going to slow down anytime soon as mortgage delinquency rates rose again in October. In St. Louis 5.1 percent of borrowers were 90 days or more delinquent on their mortgage in October, an increase of 50.0 percent from a year ago. The 90 day mortgage delinquency rate for the state of Missouri in October was 4.83 percent, an increase of 50.0 percent from a year ago. The US mortgage delinquency rate for October was 7.70 percent, up from 7.27 percent in September and an increase of 69.6 percent from a year ago.

By Dennis Norman, on December 18th, 2009  Dennis Norman UPDATE June 7, 1010 – Here are links to the Forms from MHDC to claim the tax credit as well as some sample forms they have provided showing how to fill them in:

Program Application

Home Purchase Affidavit

Promissory Note

Hope Program Information and Instructions

Sample Forms

******

Just moments ago, the Missouri Housing Development Commission passed at $35 million economic development initiative. Part of this initiative (to the tune of $20 million worth) is aimed toward helping stimulate home sales in Missouri.

The initiative includes: The initiative includes:

- $15 million to pay the first year of property taxes for qualified homebuyers who purchase a new or existing home after January 1, 2010. According to Missouri Treasurer, Clint Zweifel, this has the opportunity to help between 9,000 and 11,000 Missouri families making less than $100,000 a year.

- $5 million in assistance to qualified homebuyers to help with down payments and closing costs. This helps potential homebuyers overcome the obstacle of coming up with enough cash for a down payment and closing costs.

- In addition, there is assistance to homebuyers who purchase an energy-efficient home or purchase energy-saving appliances.

I have not seen the plan that was actually approved, however below are the details of the plan that was proposed to MHDC by Missouri Governor Jay Nixon and State Treasurer Clint Zweifel (remember, some things could have been changed when approved today) from a press release issued in November.

If approved by the commission, Missouri families making less than $98,000 a year who enter into a contract to purchase a new or existing Missouri home after Jan. 1 would have their property tax paid up to $1,250. Those families would be eligible to have an additional $500 paid towards the tax bill if the homeowner purchases a energy efficient home or items, such as Energy Star appliances, to make the home more energy efficient.

Who is eligible?

Income eligibility is based on previously adopted MHDC guidelines. Depending on the county of the home sale, household income limit guidelines for low to moderate income persons or families approved by MHDC last spring range from $58,300 to $98,560. These grants are for owner-occupied purchases only.

When would it start?

If approved by the MHDC at its next meeting on Dec. 18, 2009, funds would be available for contracts entered into after Jan. 1, 2010, on a first-come, first-served basis.

How much of the property tax bill could be paid?

Eligible homeowners could have up to $1,750 of their property tax bills paid. According to the State Tax Commission, the average residential real estate tax bill for a Missouri homeowner is $1,160. An income-qualified individual or family is eligible to receive $1,250 or the amount of their first year’s real estate tax bill, whichever is highest, when they purchase a new or existing residential home. An income-qualified individual or family can enhance this base amount, up to $1,750, if they purchase an energy-efficient new home or make energy efficient improvements to an existing home that is purchased. These improvements must be made prior to closing or within 60 days of closing.

How do Missourians apply for these funds?

Forms and affidavits will be part of documents executed at the home sale closing. Additional receipts and documentation will be required for proof of energy efficient improvements.

What energy-efficiency upgrades would be eligible for the additional incentive?

Eligible improvements would include installing high-performance windows, house wraps, programmable thermostat controls, water-efficient toilets and faucets, and energy-efficient water heaters, lighting and appliances; sealing heating and air conditioning ductwork; caulking; insulating water heater pipes; increasing the R-value of insulation in crawl spaces and attics; and conducting on-site energy efficiency inspections and tests, including a blower door test, which tests the overall energy efficiency of the house, and a duct blaster test, which tests how much the air ductwork leaks.

By Dennis Norman, on December 17th, 2009

- Dennis Norman

Last week I did a post about the Obama Administrations’ Home Affordable Modification Program (HAMP) and showed how it really has not been effective in helping keep families in their homes and avoid foreclosure as was the intention by the administration. When my kids tell me they don’t like the way I want them to do something I usually challenge them with “if you don’t like my way, tell me a better way to do it“. So with this in mind I went looking for an answer to this question.

-

Why Do Homeowners Default on Mortgages?

-

Issues With Current Solutions to Mortgage Default

-

An Alternative Approach to Mortgage Default

I focused primarly on number two as it addressed the problem I was looking for the answer to. Their (Loan Value Group) analysis of the situation was consistent with my post last week in that they determined that government programs to provide solutions to borrowers defaulting on mortgages “have so far proven to be ineffiective for two main reasons…first, certain solutions are founded on the idea that default occurs becasuse households have no choice due to insufficient income, and thus fail to address deafult that is a rational choice that depends on the homeowner’s balance sheet. Second, certain solutions face substantial practical hurdles to implementation.”

Translation:

-

Some borrowers choose to default as they are underwater and tired of throwing good money after bad, not because they cannot make the payments.

-

Government programs have too much red tape.

The report goes on to assess the effectiveness (or lack thereof) of various government programs that were supposed to be the answer. Here are the results:

- Tax Credits. These improve the homeowner’s income, but are ineffective for balance sheet driven strategic default. First, the effect of tax credits is very small compared to the amount of negative equity, and so does little to repair the homeowner’s balance sheet. Second, the homeowner can use the tax credits to rent a new property, allowing him to default on his existing mortgage. In addition, if they fail to prevent default, they are simply a cost to the government. Finally, while the most recent plan to provide tax credits is relatively new, there is increasing evidence that fraud is being used to secure those credits.

- HOPE for Homeowners Act of 2008. This involved the FHA insuring lenders that refinancetroubled loans into fixed-rate mortgages. As of February 2009, only 451 applications had been received and 25 loans finalized, compared to the expected participation of 400,000. The low participation has been mainly attributed to two issues of loan modifications discussed in the prior subsection: the fees associated with a modification, and the need for the lender to reduce loan principal to 90% of a property’s current value.

- Home Affordable Modification Program (HAMP). This is similar to a payment reduction: the servicer modifies the loan to reduce monthly payments to 31% of a homeowner’s pre-tax income. As of August 2009, only 9% of delinquent borrowers (235,000 loans) were in trial modifications, compared to the goal of having 500,000 participants by November 2009.

This low take-up has been attributed to a number of causes. From the borrower’s side, the confusion and disclosure requirements described above have been an impediment; the New York Times (“Winning Lower Payments Takes Patience, and Luck”, 11/29/09) discusses “the confusing and frustrating ways of the Obama administration program aimed at keeping millions of troubled American borrowers in their homes.” One large institution tasked with using a third party to modify loans through HAMP has found that in Q2 2009, nearly 42% of loan modifications that would have resulted a monthly payment reduction were never completed by the borrower.

So what is the answer?

Almost 11 million homeowners underwater on their mortgage (they owe more than their homes are worth) and this is leading to the “strategic mortgage defaults” that are addressed in this report. In order to curtail these defaults there must be new thought given to how to prevent them. Since these underwater homeowners will be choosing to default there must be incentives for the homeowner to choose not to dafault and instead enable the borrower to make payments. In addition, since this decision is driven by negative equity rather than the inability to make payments, there must be something done to address the principal balance.

While reducing the principal balance of an underwater borrower’s loan (principal forgiveness) seems to be the answer to the problem the report does point out problems associated with principal forgiveness including:

- It triggers a full and immediate accounting write-down to the value of the loan.

- It is irreversible and cannot be subsequently “clawed back” for those who redefault or had committed fraud (e.g. when applying for the principal reduction).

- The lower balance reduces the interest received by the lender. Thus, if the homeowner still ends up defaulting, the lender has been made worse off by the loan modification.

- It creates a “moral hazard” problem: the homeowner may attempt to make further risky housing investments in the future, believing that he will receive principal forgiveness if he falls into negative equity

- The impact on homeowner behavior may be limited for two reasons.

- Even a large dollar reduction in absolute terms is small relative to the size of an existing mortgage. If the homeowner “frames” the reduction together with the mortgage (i.e. compares its magnitude to the size of the mortgage rather than evaluating it in isolation), he may feel that his overall position has changed little – for example, a $10,000 reduction on a $200,000 mortgage is only a 5% decrease.

- The loan modification is “non-salient”: it is a one-time event which may be subsequently forgotten, and thus have little ongoing incentive effect.

The above practical and conceptual issues with a principal reduction are serious in reality. As a result, banks have been very reluctant to write off mortgage principal: only 10% of loan modifications involve principal forgiveness. Considering all types of loan modification, 58% of the modifications made in Q1 2008 ended up redefaulting.

So while we have identified the problem, negative equity, and even the solution, principal forgiveness, you can see from this report by Loan Value Group there are many hurdles along the way. What will happen first? Will the government figure out a way to address this issue without so much red tape that the program is actually successful? Or, will the real estate market come back to the point that underwater borrowers see light at the end of the tunnel? I hate to be pessimistic, and I am not pessimistic by nature, however I don’t have confidence in either of these things happening any time soon which is very unfortunate for all the homeowners that have found themselves underwater.

By Dennis Norman, on December 16th, 2009

New home construction is on the rise in November…. WHY??? They aren’t selling as fast as they are being built…didn’t we learn our lesson?

The U.S. Census Bureau and US Department of Housing and Urban Development (HUD) issued a their report on New Residential Construction for November 2009 showing an increase in new home construction activity from October.

The report shows the following:

- Building permits issued for single-family residences in November were at an annual rate of 473,000 which is 5.3 percent above the revised October rate of 449,000 and down 12.1 percent from a year ago.

- For the third consecutive month the Northeast region had the best numbers of the regions with an increase in permits of 6.4 percent from the prior month, and an increase of the same amount from a year ago. The other three regions also saw an increase in building activity in November from October, the south was up 6.0 percent, the west 5.3 percent and the midwest 2.7 percent. The largest increase from a year ago was the West at 16.3 percent, then the South at 15.3 percent and the Midwest at 1.4 percent.

- Housing starts for single-family residences in November were at an annual rate of 482,000 which is 2.1 percent above the revised October rate of 472,000 and 5.5 percent above a year ago.

- The west and south regions had increases in building starts from October at 5.4 percent and 4.4 percent respectively. The midwest and northeast both had decreases in building starts from October at 6.2 percent and 2.1 percent respectively. The midwest is the only region that has a decrease in housing starts from a year ago (13.6 percent) the south had an increase of 12.9 percent, the northeast and increase of 12.2 percent and the west an increase of 2.1 percent from a year prior.

- Single-family homes completed in November were at a rate of 524,000, even with the revised rate for October of 524,000.

- The midwest saw a 13.0 percent increase in completions followed by the west region with a 2.3 percent increase. The south and northeast saw declines of 0.8 percent and 18.3 percent respectively. All regions are down significantly in completions from a year ago. The south is down 35.3 percent, the midwest down 28.7 percent and the northeast and west are both down 25.8 percent.

Something to remember is all the numbers above are “seasonally adjusted” annual rates and the year over year comparisons are just comparing the numbers for November 2009 versus November 2008. Another way I like to look at where things stand is to simply look at the year to date data; actual numbers, not seasonally adjusted, compared to last years ytd numbers at this same time. I think this may give a little better comparison so those numbers are below:

- Through November 2009 there have been 401,000 permits issued for new homes compared with 545,000 this time last year for a decline of 26.4 percent (October YTD numbers were down 29.0 percent).

- Through November 2009 there have been 414,400 new homes started compared with 595,900 this time last year for a decline of 30.5 percent (October YTD numbers were down 32.5 percent).

- There have been 467,900 new homes completed through November 2009, compared with 752,500 this time last year for a decline of 37.8 percent (October YTD numbers were down 38.5 percent)

OK, last month I said it was good to see new home permits and sales drop as I don’t think we need to increase inventory yet. Obviously no one listened to me and everything was up this month. Granted, these “up” numbers are seasonally-adjusted rates, and you know how I feel about that, but they are up none the less.

The problem is, new home permits, starts and completions are still outpacing new home sales even when we use all the seasonally-adjusted annual rates. The new home “seasonally-adjusted” sales rate in October was 430,000 homes….however, as I have reported here, new home permits, starts and completions are still out-pacing sales, and by a pretty signifcant margin.

Let’s do one of my favorite things and look at the raw numbers and not seasonally-adjusted numbers to compare construction activity to sales:

Through the end of October there have been 328,000 homes sold and there have been 467,900 new homes completed, outpacing sales by 42.6 percent. At the end of October there were 240,000 new homes for sale, a 6.7 month supply based upon the October seasonally adjusted sales rate. October added 68,800 completed new homes to inventory and it is very unlikely (I’ll even say impossible) that we will see that many sales in November so we are going to see inventory increase. This is the same statement I made last month when there were 49,000 new homes completed…I ended up being right, there were only 35,000 new homes sold in October (btw, my projections called for 32,000 new homes sold…not bad for an amateur).

I do realize that once we truly get into a recovery of the housing market we will, at some point, need to see the rate of new home construction increase to meet demand but I don’t think the time is now. I also feel the recovery is going to be VERY gradual when it comes and we are not going to see a big, and rapid spike, in sales necessitating the same in home starts, but instead a slow, gradual increase in sales which will sustain a slow, gradual increase in new home construction.

By Dennis Norman, on December 15th, 2009  St. Louis mortgage rates inched up slightly this week but remained at near record-lows according to St. Louis-based Paramount Mortgage Company. St. Louis mortgage rates inched up slightly this week but remained at near record-lows according to St. Louis-based Paramount Mortgage Company.

Lower interest rates, low prices and the extension and expansion of the home-buyer tax credit should be pretty tempting to buyers out there.

St. Louis Mortgage Rates – December 15, 2009 *

- 30-year fixed-rate mortgage 5.00% no points

- 15-year fixed-rate mortgage 4.75% no points

- 3/1 adjustable rate mortgage 3.75% no points

- 5/1 adjustable rate mortgage 3.875% no points

For more information or if you have questions on mortgage rates in St. Louis you may contact John Frank by phone at (314) 372-4300, email at hjfrankjr@paramountmortgage.com or you can visit his company website at http://www.paramountmortgage.com.

*Note- The above rates are based upon a typical sale price of $187,500 with a 20% percent down payment leaving a loan amount of $150,000 to a borrower with a 720 credit score for a loan with no discount points charged. Rates and terms will vary depending upon loan amount, home value, credit and income of borrower.

By Ted Gayer, on December 14th, 2009

Ted Gayer, co-director of Economic Studies, Brookings Institute According to this article, the Joint Committee on Taxation (JCT) has scored a Senate homebuyer tax credit at $16.7 billion. How does the JCT $16.7 billion cost estimate square with my previous back-of-the-envelope calculation of the cost of the tax credit of $73.9 billion?

For my calculation, I assumed a tax credit of $15,000, available for one year. The Senate proposal scored by JCT is for an $8,000 tax credit. I also assumed the tax credit would be available for one year, whereas the Senate proposal scored by JCT is for seven months (December 1, 2009 to June 30, 2010).

In my article, I computed a range of estimates, each assuming different parameter inputs. But let’s consider one of my estimates, which is based on a price elasticity of -0.65, baseline sales of 5.5 million houses annually, take-up of 85 percent (since high-earners are not eligible), and a median home price (for non-high-earning buyers) of $180,000. Using these assumptions, I arrived at an estimate of 253,000 additional houses sold due to the credit at a cost of $73.9 billion, for a cost-per-additional home of $292,000.

If we use the same parameter inputs, but change the credit to $8,000 from $15,000, and assume baseline sales of 2.8 million rather than 5.5 million (based on existing and new homes sales from December 2008 through June 2009), then we get an estimate of 69,000 additional sales at $19.6 billion. The $19.6 billion is higher than JCT’s estimate of $16.7 billion, but I would say within the ballpark. Part of the difference is due to JCT’s estimate that there will be a revenue gain of $1.8 billion from 2012 to 2014, since homebuyers must pay back the credit if they sell their house within three years. Even assuming the $1.8 billion in additional revenues, the point remains the same – an estimated $258,000 per additional house sold (i.e., $17.8 billion divided by 69,000) is a poorly targeted subsidy!

By News Desk, on December 12th, 2009

Department of Justice Press Release

|

Scam Involved Lawyers, Mortgage Brokers, and More Than $14.6 Million in Loans

PHILADELPHIA—A 15-count indictment was filed today against five defendants charged in a $14.6 million mortgage fraud scheme that resulted in at least 35 fraudulent mortgage loans, announced United States Attorney Michael L. Levy, Special Agent-in-Charge of the FBI Janice K. Fedarcyk, and Pennsylvania Secretary of Banking Steven Kaplan. Charged are Edward G. McCusker and John Alford Bariana, owners of Axxium Mortgage, Inc., McCusker’s wife, Jacqueline, and Jeffrey A. Bennett and Stephen G. Doherty, owners of the Doylestown law firm Bennett & Doherty, P.C.

According to the indictment, the defendants targeted financially distressed homeowners facing foreclosure, falsely promised them help in saving their homes, engaged in real estate transactions with straw purchasers, and obtained dozens of fraudulent mortgages. The defendants took whatever equity the homeowner had left, funneled it through various shell corporations they controlled, used some of it to pay the new mortgages, and put the rest of the equity into their own bank accounts.

“Unfortunately, the downturn in the economy has given rise to unscrupulous predators looking to cash in on the misfortune of others,” said Levy. “This sort of fraudulent activity not only preys on desperate homeowners, it weakens our financial institutions, destroys neighborhoods by leaving properties abandoned, and devalues the homes of innocent neighbors. This office will investigate and prosecute those who victimize financially distressed homeowners.”

The indictment alleges that the defendants promised financially distressed homeowners that they would find an “investor” who would help them save their home. The defendants would then arrange for a straw purchaser to obtain a fraudulent mortgage and then transfer of the title of the homeowner’s residence to the straw purchaser. Using their company Axxium Mortgage, Edward McCusker and Bariana, along with Jacqueline McCusker obtained the fraudulent mortgages by submitting false documents to mortgage lenders and making false claims about the straw purchasers’ finances. The defendants also concealed from the lender the fact that the homeowner was going to continue to reside in the home and that the mortgage payments were going to continue to be made, in part, by the distressed homeowner and funneled through the straw purchaser. Bariana and Jacqueline McCusker each acted as straw purchasers for 10 homes. The defendants also recruited at least seven other persons to act as straw owners in order to obtain additional fraudulent mortgages.

Bennett and Doherty participated in the scheme at the front and back end. Doherty solicited and referred distressed homeowners to Edward McCusker and used fraudulent bankruptcy filings for some of the distressed homeowners to delay foreclosure until McCusker had obtained an investor and a mortgage. Bennett handled the closings for the real estate transfers, manipulating the information provided to the lender in order to hide the nature of the scheme until after the loan was funded.

“Governor Rendell and I are pleased when state and federal agencies can cooperate to protect consumers and deter improper and criminal activity,” said Pennsylvania Secretary of Banking Steve Kaplan. “U.S. Attorney Levy’s announcement today helps underscore our respective commitments to consumer protection and the Department of Banking’s ability to bring financial expertise to criminal prosecutions.”

“The type of criminal activity alleged in this indictment is particularly despicable in that it targeted those victims who were the most vulnerable financially and the most desperate for some type of assistance to avoid foreclosure on their properties,” said Special Agent-in-Charge Janice K. Fedarcyk of the Philadelphia Division of the FBI. “It also represents an affront to the millions of hard-working Americans who struggle every day to meet their mortgage obligations and keep their families in their homes. The FBI is committed to aggressively pursuing those who engage in schemes designed to illegally profit from the current economic situation of many of our fellow Americans.”

The defendants are charged with conspiracy to commit mail and wire fraud, mail and wire fraud, and conspiracy to commit money laundering. Doherty is also charged with bankruptcy fraud.

INFORMATION REGARDING THE DEFENDANTS

| NAME |

ADDRESS |

YEAR OF BIRTH |

| EDWARD G. MCCUSKER |

New Hope, PA |

1964 |

| JEFFREY A. BENNETT |

Springfield, PA |

1966 |

| STEPHEN G. DOHERTY |

Doylestown, PA |

1966 |

| JOHN A. BARIANA |

Mullica Hill, NJ |

1972 |

| JACQUELINE D. MCCUSKER |

New Hope, PA |

1964 |

Defendants Edward and Jacqueline McCusker, Jeffrey Bennett, and John Bariana face maximum sentences of 240 years’ imprisonment, $3.25 million in fines, three years supervised release, and a $1,200 special assessment. Defendant Stephen Doherty faces a maximum sentence of 385 years’ imprisonment, $4 million in fines, three years supervised release, and a $1,500 special assessment. These are the maximum sentences that may be imposed if the defendants are convicted; the advisory United States Sentencing Guidelines call for a sentence less than the statutory maximum.

The indictment seeks forfeiture of the proceeds of the fraudulent scheme, which is alleged to be approximately $14.6 million.

This case was investigated by the Federal Bureau of Investigation and the Pennsylvania Department of Banking. It is being prosecuted by Assistant United States Attorney Nancy Rue.

By Dennis Norman, on December 11th, 2009  Dennis Norman This week the Treasury Department issed a report which included stats on the Home Affordable Modification Program (HAMP) which is part of the Obama administrations’ Making Home Affordable Program and “is a loan modification program designed to reduce delinquent and at-risk borrowers’ monthly mortgage payments”. The HAMP program got underway around March of this year and is set to expire December 31, 2012. According to the government website HAMP is intended to help keep “3 to 4 million Americans in their homes by preventing avoidable foreclosures.”

So is the Loan Modification plan working?

To try to find an answer to this, let’s look at the data in the Treasury Department report (data is through November, 2009): Continue reading “Is the Obama Administrations’ Home Affordable Modification Program (HAMP) working?“

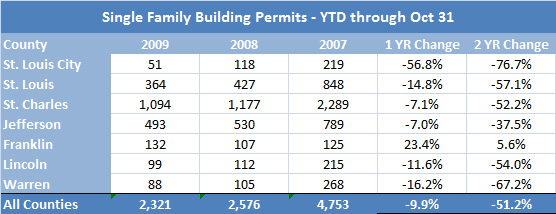

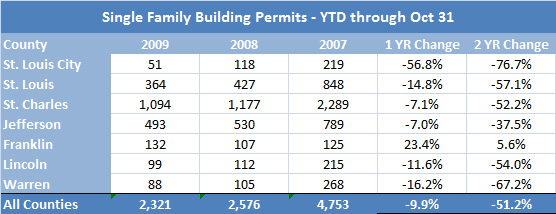

By Dennis Norman, on December 10th, 2009  Dennis Norman Not surprisingly, builders in St. Louis (those that have managed to survive thus far) are not racing out to build homes. According to the latest data reported by the Home Builders Association of St. Louis, there were 228 permits issued in October for new homes in the St. Louis metro area (St. Louis City and the Counties of St. Louis, Jefferson, St. Charles, Franklin, Lincoln and Warren) down almost 19 percent from September when there were 281 permits issued.

Year-to-date, through October 31, 2009, there have been 2,321 permits issued for new homes in the St. Louis metro area, down almost 10 percent from the same time in 2008 and down a whopping 51 percent from the same time in 2007 when 4,753 permits had been issued ytd. Below are the numbers broken down by county:

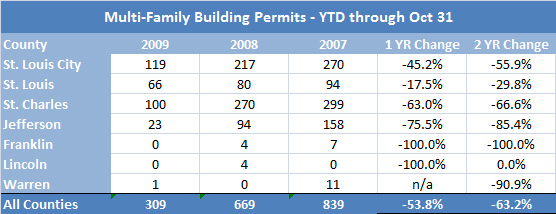

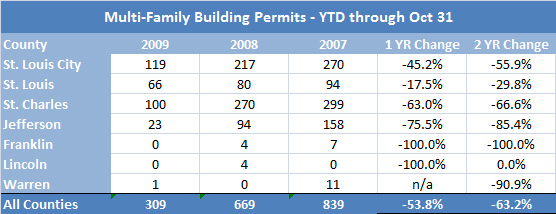

Date source: Home Builders Association of St Louis The numbers are worse for building permits for multi-family buidlings with only 36 permits for multi-family dwellings being issued in October, which is actually a 125 percent increase from September when there were only 16 permits isued, however it only puts the St. Louis metro area at 309 permits year-to-date which is down 53.8 percent from the same time last year and down 63.2 percent from the same time in 2007.

Below are the numbers broken down by county:

Date source: Home Builders Association of St. Louis

By Dennis Norman, on December 9th, 2009  St. Louis mortgage rates remained at near record-lows this week, with only the 30 year fixed rate mortgage rates increasing slightly, according to St. Louis-based Paramount Mortgage Company. St. Louis mortgage rates remained at near record-lows this week, with only the 30 year fixed rate mortgage rates increasing slightly, according to St. Louis-based Paramount Mortgage Company.

Lower interest rates, low prices and the extension and expansion of the home-buyer tax credit should be pretty tempting to buyers out there.

St. Louis Mortgage Rates – December 9, 2009 *

- 30-year fixed-rate mortgage 4.875% no points

- 15-year fixed-rate mortgage 4.375% no points

- 3/1 adjustable rate mortgage 3.625% no points

- 5/1 adjustable rate mortgage 3.875% no points

For more information or if you have questions on mortgage rates in St. Louis you may contact John Frank by phone at (314) 372-4300, email at hjfrankjr@paramountmortgage.com or you can visit his company website at http://www.paramountmortgage.com.

*Note- The above rates are based upon a typical sale price of $187,500 with a 20% percent down payment leaving a loan amount of $150,000 to a borrower with a 720 credit score for a loan with no discount points charged. Rates and terms will vary depending upon loan amount, home value, credit and income of borrower.

By Dennis Norman, on December 8th, 2009

- Dennis Norman

Laurie Goodman, the Senior Managing Director at Amherst Securities, testified today before the House Financial Services Committee hearing on “The Private Sector and Government Response to the Mortgage Foreclosure Crisis“. Amherst Securities specializes in the trading of residential mortgage backed securities and charges Goodman with keeping them and their customers abreast of trends in the market.

Today, in her testimony, Goodman told the committee she hoped to make two primary points in her testimony:

-

“The housing market is fundamentally in very bad shape. The single largest problem is negative equity.”

-

“The current modication program does not address negative equity, and is therefore destined to fail. It must be amended to explicitly address this problem. And there is no single solution; it is a combination of policy measures. Clearly, the arsenal of solutions must include principal reduction and must explicitly address the loss allocation between first lien investors and second lien investors.”

In her testimony Goodman cited some very interesting (albeit it depressing) facts and figures, including:

As a reason for estimating failure on such a large percentage (88.6 percent) of the 7.9 million borrowers that were delinquent, Goodman said;

“The real problem is that default transition rates are high and cure rates are low because the borrower has negative equity in their home. Most borrowers do not default because of negative equity alone. Generally, a borrower experiences a change in financial circumstances. If the home has substantial negative equity, they will choose to walk.”

To prove her point, Goodman cited a study that was done by Amherst which looked at Prime borrowers that were 30 days delinquent on their mortgage 6 months ago. They then sorted the loans by the amount of equity the borrowers had, then came back 6 months later to see which borrowers were at least 60 days delinquent. For borrowers with 20 percent equity, only 38 percent had become 60+ days delinquent. For borrowers with substantial negative equity (owed 41-50 percent more on their homes than the value) 75 percent had become 60+ days delinquent.

During her testimony, Goodman said “there is a substantial group of people who have argued that the primary problem is not negative equity, it is unemployment. This argument is not supported by the evidence. First, the increase in delinquencies for subprime, Alt-A and pay option ARM mortgages began to accelerate in Q2, 2007. By contrast, we did not begin to see large increases in unemployment until Q3, 2008.”

Goodman goes on to point out the results of another study done by Amherst Securities entitled “Negative Equity Trumps Unemployment in Predicting Defaults” which included the following:

- The combined loan-to-value ratio or CLTV plays a critical role. For prime and Alt-A loans in low unemployment areas the default frequency was at least 4 times greater for borrowers underwater by 20 percent than it was for borrowers with at least a 20 percent equity position.

- If a borrower has positive equity, unemployment plays a negligible role. We found that all borrowers with positive equity performed similarly no matter the local level of unemployment.

- If a borrower has substantial negative equity, unemployment plays a role, but less than CLTV. If the borrower has a CLTV greater than 120, the default frequency was 50 percent to 100 percent higher in a high unemployment area versus a low unemployment area.

“The evidence is irrefutable. Negative equity is the most important predictor of default,” said Laurie Goodman.

In addition to Laurie Goodman, there was testimony today from Dr. Anthony B. Sanders, Distinguished Professor of Real Estate Finance, Professor of Finance School of Management, George Mason University. Dr. Sanders also paints a pretty dismal picture of the success of the Obama administration loan modification program. Dr. Sanders said “it is a real challenge to servicers to make loan modifications succeed when 70 percent of modifications that have only interest rate cuts have gone into re-default after 12 months.

Dr. Sanders goes on to state that “only 12.5 percent of eligible borrowers receiving permanent loan modifications are able to keep them current. And it is entirely possible that the “success” rate could enve fall below 10 percent of eligible loans.” Dr. Sanders says the reason for this is:

“the degree to which many residential loans in the United States are in a negative equity situation. According to a Deutsche Bank research report, they are expecting 25 million homes to be in negative equity position.”

The second reason Dr. Sanders gave as the cause for such a bleak outlook for successful permanent loan modifications is the unemployment rate. He said “while 10 percent report(ed) unemployment rate is bad enough, the true unemployment rate (including wage and salary curtailment) is closer to 17.5 percent. “

I am glad to see testimony by these two professionals, and others, to help convince Congress that the loan modification plan, in it’s present form, is not effective. I think the evidence is overwhelming that negative equity is the major problem and must addressed in their “stimulus” and “recovery” programs.

By Dennis Norman, on December 7th, 2009

- Dennis Norman

For the first year or so of the real estate slump, it appeared to just be concentrated in the residential market, specifically homes and condos. However, over the past few months the attention has shifted more and more to the commerical and multi-family markets as well as the economy remains weak.

By Dennis Norman, on December 4th, 2009  Dennis Norman Last week the Treasury Department announced the Home Affordable Foreclosure Alternatives Program (HAFA), the latest program under the Home Affordable Modification Program (HAMP), designed to offer alternatives to homeowners facing foreclosure.

THE HAFA PROGRAM:

The Home Affordable Foreclosure Alternatives Program provides financial incentives to loan servicers as well as borrowers who do a short-sale or a deed-in-lieu to avoid foreclosure on an eligible loan under HAMP. Both of these foreclosure alternatives help the lender out by avoiding the Continue reading “Home Affordable Foreclosure Alternatives Program (HAFA) Launched“

By Dennis Norman, on December 2nd, 2009  St. Louis mortgage rates remained at near record-lows this week according to St. Louis-based Paramount Mortgage Company. St. Louis mortgage rates remained at near record-lows this week according to St. Louis-based Paramount Mortgage Company.

Lower interest rates, low prices and the extension and expansion of the home-buyer tax credit should be pretty tempting to buyers out there.

St. Louis Mortgage Rates – December 2, 2009 * Continue reading “St. Louis Real Estate News – St Louis mortgage rates unchanged this week“

By Dennis Norman, on December 1st, 2009  Lawrence Yun, Chief Economist, NAR Is the increase real or have the tax-credits created an “artificial” market that cannot be sustained?

Today the National Association of REALTORS(R) issued their Pending Home Sales Index Report for October showing pending sales in the U.S. rose again for the ninth consecutive month – marking the longest streak since since NAR began the pending home sale index in 2001.

As I have expressed previously, I’m somewhat cautious about getting too excited about these recent encouraging reports on the housing market as I feel we still have many challenges out there.

- Dennis Norman

For starters, the home-buyer tax credit which has clearly stimulated the market as buyers raced to buy a home to claim the credit before it expired on November 30, 2009 (it has since been extended to April 30, 2010) is just creating an “artificial” market in my opinion and we are still seeing nearly record numbers of foreclosures and mortgage delinquencies which are going to continue to put downward pressure on the market. An unemployment rate in excess of 10 percent isn’t helping either. Continue reading “Pending home sales rise for ninth consecutive month“

By Dennis Norman, on December 1st, 2009  Dennis Norman I have done several posts on the homebuyer tax credit and received and answered hundreds of questions about the tax credits on the various blogs I write for. There appears to be a lot of demand for the credits by homebuyers but also appears to be many questions. If you have questions about the homebuyer tax credit I would suggest you check out the comments/questions and answers to a post I did at www.RealEstateConsumerNews.com.

In addition, the National Association of Home Builders has just updated their informative video on the newly extended and expanded tax credit progrm. The video is below. Continue reading “Helpful homebuyer tax credit video from NAHB“

|

Recent Articles

|

St. Louis mortgage rates inreased again this week bringing 30 year rates above 5 percent according to St. Louis-based Paramount Mortgage Company.

St. Louis mortgage rates inreased again this week bringing 30 year rates above 5 percent according to St. Louis-based Paramount Mortgage Company.

the “rate” of new home sales paints a realistic picture of the market. I think this holds especially true when we have artificial forces affecting the housing market such as tax credits and other incentives. This can create unseasonal bursts or declines in sales that don’t really have anything to do with the underlying fundamentals of the housing market.

the “rate” of new home sales paints a realistic picture of the market. I think this holds especially true when we have artificial forces affecting the housing market such as tax credits and other incentives. This can create unseasonal bursts or declines in sales that don’t really have anything to do with the underlying fundamentals of the housing market.

The initiative includes:

The initiative includes:

Third Quarter 2009 Commercial and Multifamily Mortgage Delinquency Report

Third Quarter 2009 Commercial and Multifamily Mortgage Delinquency Report