By Dennis Norman, on September 9th, 2016 For couples planning to get married before you spend the time doing the bridal registry thing at stores, picking out housewares, china and perhaps some other things you don’t really need or won’t use, consider putting a house on your list! Well, maybe a house itself is a little much, but how about a downpayment for one? This gives friends and families an opportunity to have their gift make much more of a long and lasting impact than a typical wedding gift.

How it works…

FHA has a program available whereby couples can contact a participating lender, such as the lender I would recommend, Mike Huber, with Movement Mortgage, and request that a bridal registry account be established in their names. Then, friends and relatives can give funds to the couple for their account, or deposit funds directly into the Bridal Registry account. When it’s all said and done the couple is NOT required to use all of the funds, or even part of the funds, for downpayment however, if they choose to do so, FHA will allow those funds to be used to satisfy the downpayment requirement on a home mortgage. If the couple has changed their mind about buying, they would simply withdraw the funds and do what they want with them.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Find The Fastest Selling Cities In St Louis Here – Updated Daily!

Get a Market Report with LIVE up to date Home Sales, Prices and Inventory for ANY St Louis Area HERE

By Dennis Norman, on April 23rd, 2016 Earlier this month, General Counsel for the U.S. Department of Housing and Urban Development (HUD) issued guidance on the “Application of Fair Housing Act Standards to the Use of Criminal Records by Providers of Housing and Real Estate-Related Transaction“. This guidance has caused concern among many landlords as many, in an effort to assure safe housing for their tenants, do criminal background checks on prospective tenants and have a policies against renting to applicants with a criminal background, a practice that, according to this guidance, may very well be considered to be discriminatory now.

Do landlord have to rent all all convicted felons?

While the guidance does not appear to remove a landlord’s ability to establish some restrictions on who they rent to with regard to prior convictions, however does say:

By Dennis Norman, on January 18th, 2016  Today, as we celebrate the life of Dr. Martin Luther King, Jr., I wanted to focus on the dramatic change for the good that was brought about in the area of housing as a result of the efforts of Dr. King and the movement he started. Today, as we celebrate the life of Dr. Martin Luther King, Jr., I wanted to focus on the dramatic change for the good that was brought about in the area of housing as a result of the efforts of Dr. King and the movement he started.

Through the efforts of the civil rights movement, Dr. King and others were able to get the attention of our nation resulting in President John F. Kennedy, in a nationally televised address on June 6, 1963, urging the nation to ” take action toward guaranteeing equal treatment of every American regardless of race.” Shortly after his address to the nation, President Kennedy proposed that Congress consider civil rights legislation that would address rights in many areas such as voting, public accommodations, school desegregation but not housing at the time. Even though President Kennedy was assassinated on November 22, 1963, his efforts beforehand still resulted in the Civil Rights Act of 1964 when, then President, Lyndon Johnson, signed into law on July 2, 1964. Continue reading “Remembering Dr. Martin Luther King, Jr. and His Impact On Fair Housing“

By Dennis Norman, on November 11th, 2015 Today most, if not all, landlords are aware of the Federal Fair Housing Act with regard to making various types of discrimination illegal when it comes to housing and, even if they don’t have a thorough understanding of all of the nuances of the act, at least have a basic understanding of it. However, today, a lack of a thorough understanding of the law, as well as the risks associated with violating it, or even being accused of violating it, can be quite costly to a landlord. Therefore, if you are considering becoming a landlord, or perhaps are already in the midst of building your real estate empire, spending time studying and understanding the Federal Fair Housing Act and how it applies to you would be time well spent and it would also be a great move to align yourself with a real estate professional with a good understanding of it that can help you navigate the regulatory waters a landlord must navigate today.

The Case of HUD vs Pebble Beach Apartments –

In July 2013 there was a fair housing violation complaint filed against the owner and manager of the Pebble Beach Apartments alleging they discriminated against a tenant based on familial status in violation of the Fair Housing Act.

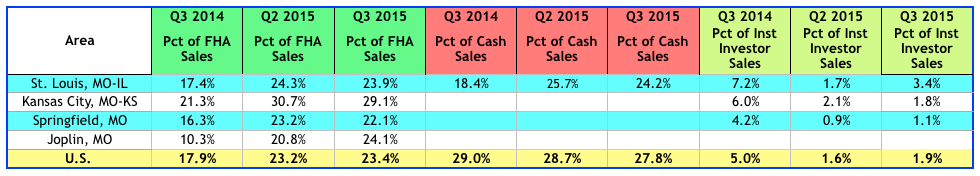

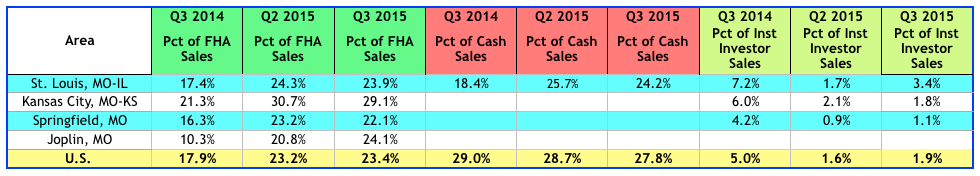

By Dennis Norman, on November 5th, 2015 Nearly one in every 4 home sales in St Louis (23.9%) during the 3rd quarter of 2015 were financing with an FHA loan, according to data just released by RealtyTrac. This is a slight decrease from the quarter before when 24.3% of the homes sold were financed with an FHA loan, but is an increase of 30% from a year ago when FHA financing was used on just 17.45 of the homes purchased in St Louis.

FHA financing has more lenient credit requirements, as well as a required downpayment of just 3.5 percent of the sales price, making home financing available to home buyers that cannot meet the more stringent credit and/or downpayment requirements of conventional financing.

At the other end of the spectrum….

As the table below shows, nearly one in four (24.2%) of the homes sold in St. Louis during the quarter were cash sales. Like FHA financing, cash sales’ share of the market dropped slightly during the 3rd quarter of 2015 from the quarter before but increased 32.6% from a year ago.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

5 Key Strategies To Assure A Quick Home Sale At The Maximum Price

Data Source: RealtyTrac Copyright 2015 St Louis Real Estate News

By Dennis Norman, on October 8th, 2015 Since the real estate market bubble burst in 2008, the number of foreclosed homes that the U.S. Department of Housing and Urban Development (HUD) has had to manage and sell to investors and new home owners has increased significantly, averaging around 100,000 homes sold per year and hitting a peak of 111,416 HUD homes sold during fiscal year 2013. As a result, HUD has proposed several changes with regard to the disposition of REO properties, or, in plain terms, how they sell HUD homes. According to HUD, these changes “seek to provide greater efficiency in the administration of HUD’s property disposition program for REO properties….and provide flexibility in anticipation of future changes to the property disposition program for REO properties.”

Highlights of Proposed Rule Changes By HUD With Respect To The Disposition, or Sale of HUD Homes:

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Want to Learn MORE About Buying HUD Homes?

Search ALL St Louis Homes For Sale

See ALL Homes That Will Be Open In St Louis This Weekend

Continue reading “Rule Changes For HUD Home Sales Proposed By HUD“

By Dennis Norman, on August 12th, 2015 In case you are concerned that the real estate industry is not subject to enough regulation, do not let your heart be troubled as new regulations imposed by the Dodd–Frank Wall Street Reform and Consumer Protection Act, which was signed into law back in 2010, affecting home mortgages go into effect October 3, 2015. There has been much talk in the industry about the changes, which are fairly wide-sweeping including changes in the timing of, and type of required disclosures to the borrower as well as a brand new combination loan disclosure form and closing statement. Below, is an overview of some highlights of the changes that I think will most affect St Louis home buyers and sellers as well as links to several additional resources as well.

The New TRID…

Presently, a home buyer, at closing, receives a Truth In Lending Disclosure as well as a HUD-1 closing statement. The former provides the details of the loan including interest rate, APR, costs associated with the loan as well as other details to comply with the Truth in Lending Act (TILA) CFPB Guide (TILA) and the latter provides a summary of the home purchase transaction such as purchase price, credits or charges to the buyer as well as other details required by the Real Estate Settlement Procedures Act (RESPA).

Beginning October 3, 2015, the two forms above will be combined into one, consumer-friendly, TRID (TILA-RESPA Integrated Disclosure) form. The new TRID will present all the important financial details of the loan and home purchase into one form which will be much easier for the typical consumer to benefit form than the current forms.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

5 Key Strategies To Assure A Quick Home Sale At The Maximum Price

Continue reading “How Will Implementation of Dodd-Frank Affect The Real Estate Market?“

By Dennis Norman, on July 15th, 2015 Within the last few days, STL Today published an article titled “The affordability crisis in the St Louis rental market“, based upon a study recently released by the Urban Institute, revealing that “there is literally no affordable, non-subsidized housing available to St. Louis low-income families.” While the focus of the article was non-subsidized affordable rentals, it also discussed the increasing number of extra-low-income families forced to pay over 50% of their income on rent. I was surprised to hear this as I know federal spending on assistance programs has increased significantly over the last decade and I keep hearing that the economy is improving, unemployment is down, etc, so I would have expected a better report. This prompted me to look into it a little further.

Missouri’s Low-Income Families and Rental Housing-

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Continue reading “Only About One Third Of Low Income Missourians In Need Receive Federal Rent Assistance“

By Dennis Norman, on July 2nd, 2015 St Louis bank and government owned home sales are down as banks and government enterprises such as Fannie Mae, FHA, VA and Freddie Mac whittle down their inventory of foreclosed homes while, at the same time, new mortgage delinquencies and foreclosure rates continue to decline. While this is good for the St Louis real estate market, it makes it tough on investors, as well as owner occupants, who are looking for a deal on a distressed sale, as the competition is growing fierce driving prices up and opportunities down.

St Louis Bank and Government owned home sales down over 30% from year ago:

As the charts below show, year to date, through the end of May, there have been a total of 1,598 bank or government owned homes sold in the St Louis 5-county core market (the city of St Louis and counties of St Louis, St Charles, Jefferson and Franklin), according to data available from MARIS, the REALTORS® MLS for the area, which is a decline of 31.4% from the same time a year ago when there were 2,100 bank and government owned home sales.

St Louis Distressed Home Sales Selling At Record Percentage of List Price:

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Want be successful buying distressed property? Check out my video on how to buy distressed sales here. Continue reading “Bank and Government Owned Home Sales Down But Selling For Record Percentage of List Price“

By Dennis Norman, on June 5th, 2015 The other day I had a client, who was planning on using FHA financing, as me if I thought she would be able to negotiate as good of a deal as if she was obtaining a conventional loan. The concern was that, as an FHA buyer, would she be perceived as a weaker buyer in the seller’s eyes since FHA’s credit and income guidelines are not as stringent as Fannie Mae, and FHA requires a smaller downpayment as well.

This prompted me to do some research to see if I could determine if there was any merit tot he concern that a buyer going FHA may not be able to negotiate as good of a deal as a buyer putting more money down and going conventional. To determine this, I looked at homes sold in St Louis County during the month of May with financing terms reported to the MLS and then looked at the percentage of the list price that FHA buyers paid versus the percentage of list price conventional buyers paid and here are my findings:

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend

Continue reading “Do Conventional Buyers Get Better Deals Than FHA Buyers?“

By Dennis Norman, on June 1st, 2015 There were 437,000 new homes sold (single-family) in the U.S. last year, down from a peak of 1,283,000 in 2005. Roughly ten percent of the single-family homes sold were attached homes (44,000) and the remaining ninety-percent (393,000) were detached homes, according to data just released by the U.S. Census Bureau.

Facts and Figures For New Homes Sold In The Midwest During 2014:

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]See St Louis New Homes For Sale – Click HERE

Search St Louis Homes For Sale HERE

See ALL Homes That Will Be Open In St Louis This Weekend Continue reading “Characteristics Of New Homes Built In 2014“

By Dennis Norman, on May 26th, 2015 New home sales here in the midwest region of the U.S. occurred in April at an adjusted annual rate of 78,000 homes, an increase of 36.8 percent from the month before when new home sales activity was at the rate of 57,000 homes per year and an increase of 20 percent from April 2014 when new homes were selling at the rate of 65,000 homes a year, according to data just released by the U.S. Census Bureau and HUD.

New home inventory is down…

According to the report, in April 2015, there was a 4.8 month supply of new homes for sale in the U.S., a decline of 5.9% from the month before and a decline of 14.3% from a year ago when there was a 5.6 month supply.

New home sales prices increased over 8%…

The median price of new homes sold in the U.S. during April 2015 was $297,300, an increase of 8.3% from a year ago when the median price was $274,500.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Homes For Sale HERE

Search St Louis New Homes For Sale

See ALL Homes That Will Be Open In St Louis This Weekend

By Dennis Norman, on May 5th, 2015 Paula Anderson, a landlord who owns a two-bedroom home in Santa Fe, New Mexico, was charged with discrimination by HUD after HUD’s investigation revealed that there was cause to believe Anderson had violated the Federal Fair Housing act as follows:

As described in paragraphs 7 to 25 above, Respondent Anderson violated 42 U.S.C. §§ 3604(f)(1) and (f)(2) as defined by 42 U.S.C. § 3604(f)(3)(B) because she discriminated in the terms, conditions, or privileges of Complainant’s tenancy and made her dwelling unavailable by refusing to allow Complainant to live with her assistance animal and daughter at the subject property when such accommodations were necessary to afford Complainant an equal opportunity to use and enjoy her dwelling. 42 U.S.C. §§ 3604(f)(1), (f)(2), and (f)(3)(B); 24 C.F.R. §§ 100.202(a), 100.202(b), and § 100.204(a).

The interesting thing about this case is that the “assistance animal” is a cat and while many landlords may be familiar with service dogs, particularly as used by visually impaired people, the claim by a tenant that a cat is a service animal may seem like a stretch and not be taken serious by a landlord but this case proves that it needs to be taken seriously.

Read the entire case here – The Secretary, United States Department of Housing and Urban Development vs Paul Anderson

By Dennis Norman, on January 9th, 2015 Yesterday, President Obama announced that he will, by executive order, direct FHA to lower the mortgage insurance premium charged on FHA loans to home buyer from 1.35 percent to .85 percent, lowering home buyer’s house payments by about $900 per year on average. Chris Polychron, the President of the National Association of REALTORS® (NAR) showed his organizations support of the President’s action and highlighted the positive impact NAR felt it would have on the housing market stating “we (NAR) are optimistic that more affordable FHA loans will have a positive impact on first-time buyers who have been entering the market at a lower than normal rate.” NAR has stated that the lower cost of an FHA loan would add 90,000 to 140,000 additional annual home purchases.

The cost of the mortgage insurance premium on an FHA loan was .90% back in 2010, increased to 1.15% in 2011, then to 1.25% in 2012 and finally 1.35% in 2013. NAR first addressed this issue back in April 2014 when, then President, Steve Brown wrote a letter to Carol Galante, the Assistant Secretary for Housing at the time, to draw her attention to the impact the higher fees were having on the housing market and urging her to take action to lower the premiums. In the NAR letter, it was pointed out in 2014 FHA fees accounted for nearly 20 percent of a homeowners monthly mortgage payment.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Continue reading “FHA To Lower Fees Opening The Door To Around 100,000 Home Buyers“

By Dennis Norman, on January 6th, 2015 As a result of the real estate market crash in 2008 and the subsequent downturn in the economy, many homeowners with prior stellar payment records on their mortgages ended up losing their homes in foreclosure or being forced to do a short sale to get out from under it. Most of these former homeowners then became renters but have the desire to buy a home again once back on their feet. However, depending upon just how severely their credit was impacted as well as whether they had a foreclosure, short sale or bankruptcy, they may have to wait as long as 7 years to obtain a home loan again. However, thanks to an FHA program called “Back to Work”, which, surprisingly, has received little attention, there is hope for these homeowners including the opportunity to obtain a home loan again without the normal waiting period if their problems were related to a job loss and they meet certain criteria.

The Back to Work program allows borrowers that may be otherwise ineligible for an FHA-insured mortgage due to FHA’s waiting period for bankruptcies, foreclosures, deeds-in-lieu, and short sales, as well as delinquencies and/or indications of derogatory credit, including collections and judgments, to be eligible for an FHA-insured mortgage if the borrower meets certain guidelines, which include:

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Continue reading “Program To Help Short Sellers and Foreclosed Owners Buy Again“

By Dennis Norman, on December 23rd, 2014 St Louis New Home Sales in November 2014 increased 12.5% from November 2013 and, as would be expected given the time of year, decreased about 8% from the month before. New home sales in St Louis out performed new home sales in the Midwest Region as a whole as the region saw 4,000 new home sales in November 2014, the same as a year ago, and a decrease of 20% from the month before, according to the latest data available from the U.S. Census Bureau and HUD.

The median price of new homes sold in November 2014 was $235,900, an increase of 15% from the month before when the median price was $205,000, and was up about 1% from November 2013 when the median new home sale price was $237,450.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on December 5th, 2014

In 2010, in an effort to “help responsible homeowners who owe more on their mortgage than the value of their property”, the U.S. Department of Housing and Urban Development (HUD) began a program that allowed lenders to offer refinancing options to underwater borrowers that included a reduction in the principal amount of their mortgage to get it more in line with the current value.

This program, called the “FHA Refinance of Borrowers in Negative Equity Positions (Short Refi) Program”, has helped only about 4,000 people or so reduce their loan balances, in spite of the fact that when announced in 2010 David Stevens, the FHA Commissioner at the time, testified before the Committee on Financial Services that this program was designed to help some of the “1.5 million borrowers who owe more not their mortgages than their homes are worth..”.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Continue reading “Help For Underwater Homeowners-FHA Short Refinance“

By Dennis Norman, on November 26th, 2014 St Louis New Home Sales in October 2014 slipped 3.8% behind October 2013 but increased a little over 16% from the month before. The St Louis new home sales activity followed suit with the Midwest Region of the U.S. which saw a 15.8% increase in new home sales activity in October from the month before but a decline of 2.9% from October 2013, according to data just released by the U.S. Census Bureau and HUD.

As the chart below shows, the median price of new homes sold in St Louis in October 2014 was $205,000 a decline of 4.7% from a year ago when the median new home sale price in St Louis was $215,000 and is 3% below September’s median new home price of $211,500.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis New Home Sales Slip Slightly In October“

By Dennis Norman, on November 19th, 2014 New Home Construction in the Midwest Region of the U.S. slowed in October with new home building permits being used at a seasonally-adjusted annual rate of 102,000 homes, a decline of 3.8% from September but a 4.1% increase from October 2014, according to data released today by the U.S. Census Bureau and HUD. Year to date for 2014, through October, there have been 89,100 permits issued for new homes, down very slightly from the same time last year when there had been 89,400 new home permits issued.

New Home Starts Fall Dramatically In The Midwest In October-

Construction began on new homes in the midwest in October at a seasonally-adjusted annual rate of 94,000 homes, down 21% from September and down 7.8% from October 2013.

New Home Completions Decline In The Midwest In October-

New homes were completed in the midwest region in October at a seasonally-adjusted annual rate of 99,000 homes, down 6.6% from the month before and down 2% from October 2013.

On a national level, new home permits were issued in October at a seasonally adjusted annual rate of 640,000 homes, an increase of 1.4% from the month before and an increase of 2.4% from October 2013. Year to date for 2014, there have been 541,300 building permits issued for new single-family homes nationwide, an increase of 1.4% from the same time last year.

Looking for a new home in St Louis? Click here to see all for sale

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on October 21st, 2014 Some property owners elect to sell or lease out a home or condo without engaging the services of a professional real estate agent or broker without fully understanding all the risk they are taking on. Granted, being a licensed real estate broker, I’m a little partial here, but I can honestly say that, given all the laws, rules and regulations that pertain to the sale or leasing of residential real estate, as well as the hefty fines, or even criminal charges, that can result in non-compliance, for most owners I would not suggest to go it alone. One of the more significant risks an owner faces is to violate Title VIII of the Civil Rights Act of 1968 or, as it is more commonly known, the Fair Housing Act.

The Fair Housing Act, as originally passed, prohibited discrimination in the sale, rental and financing of dwellings based on race, color, religion, sex or national origin. In 1989, it was amended to also prohibit discrimination based on disability or on familial status. While I believe the number of people that deliberately violate this act is small, I see many “accidental” or unintentional violations of it on a regular basis not only by private homeowners or landlords but even by licensed real estate professionals. The most common form of violation I see has to do with advertising residential property for sale or lease and then often as a result of a choice of words.

The reason so many violations occur in advertising I believe is that it is easy to make an honest mistake in this area without realizing you are violating the Fair Housing Act. For example, if your home has a large, level rear yard that is fenced, has a large sandbox and one of those fancy monster-sized playground sets, you do NOT have a “good yard for kids” or at least you cannot advertise it that way as it could be taken to be a preference with regard to familial status. Get the picture? Yes, it’s like a minefield out there and all I’m talking about here is advertising. This is such an easy area to make an innocent, but still a potentially costly mistake in that I made a short, 2-minute video for real estate agents with “Do’s and Don’ts” of advertising under the Fair Housing Act. The video is below for all you owners that decide you want to try it on your own or, perhaps, want a better understanding of why your agent cannot promote or advertise your home in a particular way that you feel is significant, such as by telling everyone about the great yard for kids or the parish you are in, that your home is within a short walk to a temple, etc.

By Dennis Norman, on October 9th, 2014 Today, the U.S. Department of Housing and Urban Development (HUD) released it’s Fair Market Rent amounts for 2015 which are used for several purposes including computation of section 8 rents in a given area. The table below shows the fair market rents for 2015 for all Missouri Counties as well as Missouri Metropolitan Areas.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Continue reading “HUD Releases Fair Market Rent Amounts for 2015 For Missouri“

By Dennis Norman, on October 9th, 2014

The U.S. Department of Housing and Urban Development (HUD) just announced that Wells Fargo Home Mortgage has agreed to a $5 Million settlement to resolve allegations that Wells Fargo discriminated against women who were pregnant, or had recently given birth, and were on maternity leave. (Click HERE for settlement agreement)

There have been a total of 190 maternity leave discrimination complaints filed with HUD against lenders in the past 4 years and those complaints have resulted in 40 settlements for a total of $1.5 million, prior to today’s settlement with Wells Fargo.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

StLouisMLS.com

Continue reading “Wells Fargo Agrees To $5 Million Settlement of Claim Of Discrimination of Pregnant Women & Women On Maternity Leave“

By Dennis Norman, on September 23rd, 2014 The City of St Louis was at the top of a list that you don’t really want to be on, the “Top 50 Counties with the Highest Prevalence of Man-Made Environmental Hazards“, just released this morning by RealtyTrac. The city of St Louis scored a 87.2, more than triple the score of Philadelphia (27.8) which occupies the number 2 spot on the list.

In scoring locations for this list, RealtyTrac only looked at counties with a population of 100,000 or more and then ranked them based upon the % of bad air quality days, the number of Superfund sites on National Priority List per square mile and other environmental hazards per square mile. The City of St Louis experiences bad air quality days 7.89% of the time, about 45% higher than the national average of 5.43%, has 5.35 Superfund sites on the the National Priority list, 178 times the national average of .03 and has 13.3 other environmental hazards per square mile, 147 times the national average of .09.

This is yet another example of how the City of St Louis, by not being part of St Louis County and instead being treated as it’s own county, ends up on the short end of the stick (or perhaps exhaust stack in this case) on national statistics. Normally, a city within a metropolitan area is going to be more likely to have environmental hazards than the suburbs but the stats don’t look as bad with the cities’ data is mixed in with that of the suburbs, which is not the case here in St Louis.

Speaking of St Louis County, as the table below shows, it made the list also, coming in at #15 on the list.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Continue reading “City of St Louis Tops List of Places with Man-Made Environmental Hazards“

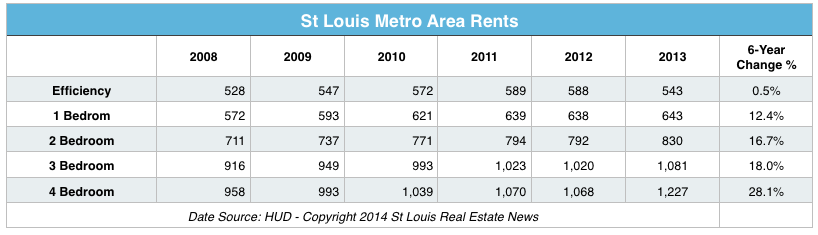

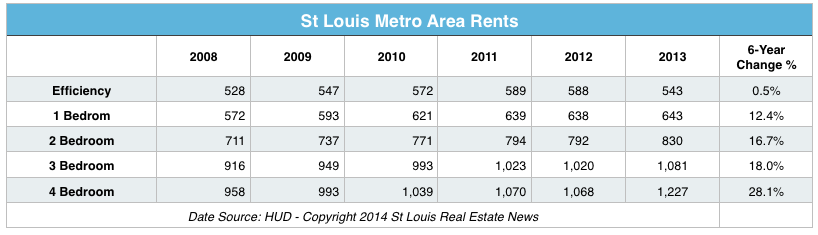

By Dennis Norman, on March 6th, 2014 St Louis rents have risen 18% since the real estate bubble burst (based upon HUD fair market rents for 3 bedrooms) while median home prices have fallen 12% during the same period. Part of the reason behind has been the increased demand for rentals as a result of many homeowners who, after the real estate bubble burst, lost their homes in foreclosure or were forced to do a short sale and then had to seek a rental while they rebuild their credit. This, couple with almost no new apartment construction for several years has created the right environment for increasing rents.

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ] Continue reading “St Louis Rents Rose While Home Prices Declined Post Boom“

By Tyler Frank NMLS # 942420, on January 3rd, 2014  Tyler Frank,

Paramount Mortgage

NMLS ID 942420 The Federal Housing Authority (FHA) has made some changes for 2014, which took effect January 1 and affect FHA home loans. First and foremost, you will see a drop in the maximum allowable loan. In the St. Louis metro area, for example, the new max loan amount for a single-family home has been lowered to $271,050 from $281,250.

Other items of note regarding FHA have not changed; so as a refresher let’s look at FHA qualifications and rules:

- Borrower must put 3.5% down based on sales price. 100% of the buyer’s contribution can be in the form of a gift. There are no reserve requirements; however, reserves can help to build a stronger case for a “tight” loan.

- The seller can contribute 6% of the sales price towards closing cost, points and pre-paid items.

- There is an up-front mortgage insurance premium (UFMIP) of 1.75% for all loan terms and amounts added to the base loan amount.

Some underwriting items include: Continue reading “Important Changes to FHA Home Loans Now In Effect“

By Tyler Frank NMLS # 942420, on December 13th, 2013  Tyler Frank,

Paramount Mortgage

NMLS ID 942420 On January 10, 2014 the mortgage world is going to go through some changes. These changes will affect consumers and their ability to qualify for a home loan. Is it doom and gloom? Not really.

A “Qualified Mortgage” or QM, is something we at Paramount Mortgage have been doing for a while. It is all about the consumer having the ability to repay the loan and verifying, to the best of our ability, through paperwork, all the facets of a loan approval. It is very possible additional paperwork may be requested from the borrower to accomplish verification going forward. Is it the end of the world? No. We as a team, agent and loan officer, need to relay that information to the client.

We, for the most part, have already been doing that.

The biggest change will be the stringent enforcement of the debt-to-income ratio at 43%. This will be Continue reading “What is QM?“

By Dennis Norman, on December 4th, 2013  Midwest new home sales in October were at a seasonally adjusted annual rate of 63,000 homes, a 34.0 percent increase from September and an increase of 21.2 percent from a year ago, according to data just released by the U.S. Census Bureau and HUD. Nationally, new home sales in October were at an annual rate of 444,000 homes, an increase of 25.4 percent from the month before and an increase of 21.6 percent from a year ago. Midwest new home sales in October were at a seasonally adjusted annual rate of 63,000 homes, a 34.0 percent increase from September and an increase of 21.2 percent from a year ago, according to data just released by the U.S. Census Bureau and HUD. Nationally, new home sales in October were at an annual rate of 444,000 homes, an increase of 25.4 percent from the month before and an increase of 21.6 percent from a year ago.

New homes sold during the month of October 2013 were sold for a median price of $245,800, a decrease of 4.5 percent from the month before.

See St Louis New Homes For Sale – Click HERE

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

By Dennis Norman, on October 7th, 2013  As we enter the 7th day of the government shut down, concern grows among home buyers and sellers as to how this may affect the transactions here in St Louis. The short answer is that, fortunately, it appears the impact will be minimal for the most part. This morning at a meeting of the St Louis Industry Forum, which I chair, this topic was discussed and from the input of the real estate-related professions represented, it appears the impact of the government shutdown on real estate transactions here will be minimal. As we enter the 7th day of the government shut down, concern grows among home buyers and sellers as to how this may affect the transactions here in St Louis. The short answer is that, fortunately, it appears the impact will be minimal for the most part. This morning at a meeting of the St Louis Industry Forum, which I chair, this topic was discussed and from the input of the real estate-related professions represented, it appears the impact of the government shutdown on real estate transactions here will be minimal.

Shelly Clark, President of Cardinal Surveying, said that there should not be any impact on obtaining a survey, however there will be some impact for homes located in a flood zone Continue reading “How Will The Government Shut Down Affect The St Louis Real Estate Market?“

By Dennis Norman, on October 3rd, 2013

Agency relationships between a buyer or seller of a home and the real estate agent are probably one of the most confusing aspects of the real estate transaction for consumers and for many real estate agents as well for that matter. Dual agency takes the confusion to a whole new level though for the parties involved as the issue gets quite complex. At the very basic level, dual agency exists when the same real estate agent represents both the buyer and seller in the same real estate transaction (a bad idea in my humble opinion). At a more complicated level, state law states that dual agency also exists if the agent representing the buyer is with the same firm as the agent representing the seller then dual agency exists as well.

The point of this article is not actually to explain all the nuances of agency relationships, it’s really about a “dual” going on presently between the National Association of REALTORS (NAR) and the The National Association of Exclusive Continue reading “The Dual Agency Dual“

By Dennis Norman, on September 25th, 2013  New home sales in the midwest in August were at a seasonally adjusted annual rate of 61,000 homes, a 19.6 percent increase from July and an increase of 15.1 percent from a year ago, according to data just released by the U.S. Census Bureau and HUD. On a national level, new home sales in August were at the annual rate of 421,000 homes, a 7.9 percent increase from the month before and a 12.6 percent increase from a year ago. New home sales in the midwest in August were at a seasonally adjusted annual rate of 61,000 homes, a 19.6 percent increase from July and an increase of 15.1 percent from a year ago, according to data just released by the U.S. Census Bureau and HUD. On a national level, new home sales in August were at the annual rate of 421,000 homes, a 7.9 percent increase from the month before and a 12.6 percent increase from a year ago.

New homes sold during the month of August 2013 were sold for a median price of $254,600, a slight decrease from the month before when the median new home sales price was $256,300.

See St Louis New Homes For Sale – Click HERE

[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

|

Recent Articles

|

Today, as we celebrate the life of Dr. Martin Luther King, Jr., I wanted to focus on the dramatic change for the good that was brought about in the area of housing as a result of the efforts of Dr. King and the movement he started.

Today, as we celebrate the life of Dr. Martin Luther King, Jr., I wanted to focus on the dramatic change for the good that was brought about in the area of housing as a result of the efforts of Dr. King and the movement he started.

Midwest new home sales in October were at a seasonally adjusted annual rate of 63,000 homes, a 34.0 percent increase from September and an increase of 21.2 percent from a year ago, according to data just released by the U.S. Census Bureau and HUD. Nationally, new home sales in October were at an annual rate of 444,000 homes, an increase of 25.4 percent from the month before and an increase of 21.6 percent from a year ago.

Midwest new home sales in October were at a seasonally adjusted annual rate of 63,000 homes, a 34.0 percent increase from September and an increase of 21.2 percent from a year ago, according to data just released by the U.S. Census Bureau and HUD. Nationally, new home sales in October were at an annual rate of 444,000 homes, an increase of 25.4 percent from the month before and an increase of 21.6 percent from a year ago. As we enter the 7th day of the government shut down, concern grows among home buyers and sellers as to how this may affect the transactions here in St Louis. The short answer is that, fortunately, it appears the impact will be minimal for the most part. This morning at a meeting of the St Louis Industry Forum, which I chair, this topic was discussed and from the input of the real estate-related professions represented, it appears the impact of the government shutdown on real estate transactions here will be minimal.

As we enter the 7th day of the government shut down, concern grows among home buyers and sellers as to how this may affect the transactions here in St Louis. The short answer is that, fortunately, it appears the impact will be minimal for the most part. This morning at a meeting of the St Louis Industry Forum, which I chair, this topic was discussed and from the input of the real estate-related professions represented, it appears the impact of the government shutdown on real estate transactions here will be minimal.