By Dennis Norman, on February 12th, 2014 The mortgage delinquency rate for homeowners 60 days or more delinquent on their mortgages fell below 4 percent during the last quarter of 2013, the first time the delinquency rate has been below 4% since 2008, according to TransUnion. According to the report, every state in the U.S. saw a decline in mortgage delinquency rates from to the 4th quarter of 2012 to the 4th quarter of 2013 with only two, New Jersey and New York, not seeing a double digit decline. See the info graphic below for more info. Continue reading “Mortgage Delinquency Rate Falls To Lowest Level In 5 Years“

By Dennis Norman, on October 21st, 2013  The foreclosure rate in St Louis fell to 1.04 percent for the month of August, a decline of 33.5 percent from a year ago when the St Louis foreclosure rate was 1.55 percent, according to a report just released by CoreLogic. The national foreclosure rate for August at 2.36 percent was over twice as high as the St Louis rate. Other good news for the St Louis real estate market contained in the report was that the St Louis mortgage delinquency rate (90 days or more late) was 3.78 percent, a decrease of 16.6 percent from a year ago when the rate was 4.53 percent. The foreclosure rate in St Louis fell to 1.04 percent for the month of August, a decline of 33.5 percent from a year ago when the St Louis foreclosure rate was 1.55 percent, according to a report just released by CoreLogic. The national foreclosure rate for August at 2.36 percent was over twice as high as the St Louis rate. Other good news for the St Louis real estate market contained in the report was that the St Louis mortgage delinquency rate (90 days or more late) was 3.78 percent, a decrease of 16.6 percent from a year ago when the rate was 4.53 percent.

(We work hard on this and sure would appreciate a “Like”)[iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Search St Louis Foreclosures For Sale Continue reading “St Louis Foreclosure Rate Declines“

By Dennis Norman, on September 17th, 2013

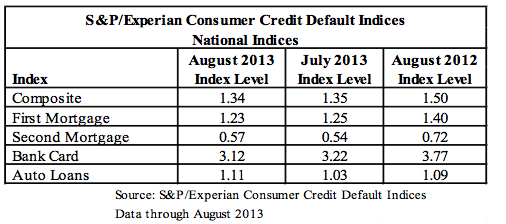

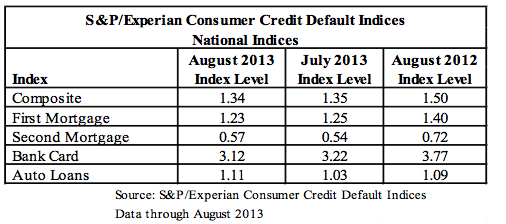

The housing market continues to show signs of recovery, today with the report by S&P/Experian showing that their credit default index for first mortgages fell by 12 percent in the past year and by over 20 percent (20.8%) for second mortgages during the same period. While this may not be that exciting of a topic or seem like such a big deal to some, given the fact that mortgage delinquencies are a leading indicator of foreclosures and, over the past few years, foreclosures have pommelled some neighborhoods all but destroying home values, this is really huge from a big picture standpoint.

By Dennis Norman, on July 23rd, 2013

The St Louis foreclosure rate fell in May to 1.16 percent, down 33 percent from a year ago when the St Louis foreclosure rate was 1.75 percent, according to newly released data from Corelogic. More good news in the data is the fact that the St Louis mortgage delinquency rate declined in May as well, falling to 3.88 percent of all mortgage loans, down 17 percent from a year ago when the St Louis mortgage delinquency rate was 4.7 percent.

For Advice on How to Buy St Louis Foreclosures From A 2000+ Home Buyer Investor click here. (would you consider a “LIKE” in exchange?) [iframe http://www.facebook.com/plugins/like.php?href=https%3A%2F%2Fwww.facebook.com%2FStLouisRealEstateNews&send=false&layout=standard&width=50&show_faces=false&font&colorscheme=light&action=like&height=35&appId=537283152977556 100 35 ]

Continue reading “St Louis Foreclosure Rate Declined By One-Third In Past Year“

By Dennis Norman, on July 10th, 2013  Foreclosures and Shadow Inventory are each down double digits from a year ago as the market continues to improve. In May there were 52,000 foreclosures completed in the U.S., a decline of 27 percent from 71,000 completed foreclosures a year ago, according to a new report from CoreLogic. The shadow inventory (foreclosed homes that are bank owned but not listed for sale) l falling below one million homes in April, a decline of 34 percent from it’s peak in 2010, when it reached 3 million homes. Foreclosures and Shadow Inventory are each down double digits from a year ago as the market continues to improve. In May there were 52,000 foreclosures completed in the U.S., a decline of 27 percent from 71,000 completed foreclosures a year ago, according to a new report from CoreLogic. The shadow inventory (foreclosed homes that are bank owned but not listed for sale) l falling below one million homes in April, a decline of 34 percent from it’s peak in 2010, when it reached 3 million homes.

Mortgage delinquencies are improving as well with less than 2.3 million mortgages (5.6 percent of total mortgages) being seriously delinquent as of the end of May. This is the lowest level for mortgage delinquencies since December 2008. Continue reading “Foreclosures and Shadow Inventory Decline By Double Digits“

By Dennis Norman, on July 8th, 2013  The number homeowners in a negative equity position (owing more on their mortgage than the current value of their home) during the first quarter of this year fell to just 7.3 million homeowners in the U.S. or less than 15 percent of all homeowners with a mortgage, according to the most recent data from Lenders Processing Services (LPS). This represents a decline of almost 50 percent in the number of negative equity homeowners from a year ago. The number homeowners in a negative equity position (owing more on their mortgage than the current value of their home) during the first quarter of this year fell to just 7.3 million homeowners in the U.S. or less than 15 percent of all homeowners with a mortgage, according to the most recent data from Lenders Processing Services (LPS). This represents a decline of almost 50 percent in the number of negative equity homeowners from a year ago.

More good news in the LPS data was the fact that the number of homeowners that are delinquent on their mortgages fell again in May to a rate of 6.08 percent of homeowners with a mortgage, marking a decline of more than 15 percent since the end of 2012, the largest year-to-date decline in the mortgage delinquency rate since 2002.

| Total U.S. loan delinquency rate: |

6.08% |

| Month-over-month change in delinquency rate: |

-2.11% |

| Total U.S. foreclosure presale inventory rate: |

3.05% |

| Month-over-month change in foreclosure pre-sale inventory rate: |

-3.91% |

| States with highest percentage of non-current* loans: |

FL, NJ, MS, NV, NY |

| States with the lowest percentage of non-current* loans: |

MT, AK, WY, SD, ND |

Source: LPS

By Dennis Norman, on June 25th, 2013

St Louis Foreclosures fell in April to 1.2 percent of all St Louis homes with a mortgage, a decline of 33 percent from a year ago when the rate was 1.78 percent and is now at the lowest rate in well over 3 years, according to a report just released by CoreLogic. This puts St Louis foreclosures less than half the national rate for April of 2.65 percent.

In addition, the report reveals that St Louis mortgage delinquencies are also down significantly for April 2013 which 3.96 percent of St Louis mortgage being 90 days or more delinquent, a decline of 16 percent from a year ago when the St Louis mortgage delinquency rate was 4.74 percent.

By Dennis Norman, on April 24th, 2013  The housing market continues to show signs that a recovery is underway with today’s report from LPS showing that mortgage delinquencies in March 2013 fell 3.13 percent from the month before and were down 3.03 percent from a year ago, according to a report just released by LPS. The foreclosure inventory rate fell slightly (0.41 percent) from the month before but was down almost 20 percent (19.61)from a year ago. The housing market continues to show signs that a recovery is underway with today’s report from LPS showing that mortgage delinquencies in March 2013 fell 3.13 percent from the month before and were down 3.03 percent from a year ago, according to a report just released by LPS. The foreclosure inventory rate fell slightly (0.41 percent) from the month before but was down almost 20 percent (19.61)from a year ago.

Almost all the data on the housing market, including the St Louis housing market, has been encouraging lately and pointing toward signs that a recovery is underway. Woo hoo!

Continue reading “Mortgage Delinquencies and Foreclosures Continue To Decline“

Tyler Frank,

Paramount Mortgage

NMLS ID 942420 Free Credit Scores are Not Part of the Free Annual Credit Report Consumers Currently Receive

Consumers currently have the right to request their free credit report once a year, but a credit report does not include free credit scores. These two items are often confused to be the same, which they are not.

You generally must pay to see your credit score. It’s a three-digit grade that predicts how risky you are to a lender.

Earlier this month, bills were introduced in the House and Senate to allow all consumers free access to credit scores once a year. The Free Access to Credit Scores Act was authored by U.S. Sen. Bernie Sanders of Vermont and U.S. Rep. Steve Cohen of Tennessee.

Continue reading “Free Credit Scores As A Result of New Act“ Continue reading “Free Credit Scores As A Result of New Act“

By Dennis Norman, on February 27th, 2013  The St. Louis foreclosure rate declined in December 2012 to 1.29 percent of outstanding home loans, a 25 percent drop from a year ago when the foreclosure rate was 1.72 percent, according to a newly released report from Corelogic. In addition, the St. Louis mortgage delinquency rate for December was 4.39 percent, down 12.5 percent from the year before when 5.02 percent of the outstanding St. Louis home loans were 90 days or more delinquent. See the chart below for foreclosure rate by zip code in the St. Louis area. The St. Louis foreclosure rate declined in December 2012 to 1.29 percent of outstanding home loans, a 25 percent drop from a year ago when the foreclosure rate was 1.72 percent, according to a newly released report from Corelogic. In addition, the St. Louis mortgage delinquency rate for December was 4.39 percent, down 12.5 percent from the year before when 5.02 percent of the outstanding St. Louis home loans were 90 days or more delinquent. See the chart below for foreclosure rate by zip code in the St. Louis area.

Continue reading “St Louis Foreclosure and Mortgage Delinquency Rates Down from a year ago“ Continue reading “St Louis Foreclosure and Mortgage Delinquency Rates Down from a year ago“

By Dennis Norman, on January 29th, 2013  The St. Louis foreclosure rate in November 2012 was 1.27 percent of all outstanding home mortgages, a decrease of 26.6 percent from a year before when the rate was 1.73 percent, according to a report just released by Corelogic. Foreclosure rates in St. Louis were well above the national foreclosure rate for November 2012 of 2.97 percent. In addition, mortgage delinquency rates declined in November 2012 as well falling to 4.39 percent of all mortgage loans (90 days + delinquent), down from 5.00 percent in November 2011. The St. Louis foreclosure rate in November 2012 was 1.27 percent of all outstanding home mortgages, a decrease of 26.6 percent from a year before when the rate was 1.73 percent, according to a report just released by Corelogic. Foreclosure rates in St. Louis were well above the national foreclosure rate for November 2012 of 2.97 percent. In addition, mortgage delinquency rates declined in November 2012 as well falling to 4.39 percent of all mortgage loans (90 days + delinquent), down from 5.00 percent in November 2011.

By Dennis Norman, on January 14th, 2013  The foreclosure inventory in the U.S. dropped to 3.51 percent in November, a decline of 2.84 percent from the month before, according to the November Mortgage Monitor report released by Lender Processing Services. This trend may not continue though as, during the same period, the mortgage delinquency rate (the precursor to foreclosures) increased 1.2 percent from the month before and has increased 3.7 percent since August. Continue reading “Foreclosure Inventory On The Decline But Trend May Be Short-Lived“ The foreclosure inventory in the U.S. dropped to 3.51 percent in November, a decline of 2.84 percent from the month before, according to the November Mortgage Monitor report released by Lender Processing Services. This trend may not continue though as, during the same period, the mortgage delinquency rate (the precursor to foreclosures) increased 1.2 percent from the month before and has increased 3.7 percent since August. Continue reading “Foreclosure Inventory On The Decline But Trend May Be Short-Lived“

By Robert Fishel, on December 12th, 2012  After the problems we have seen over the past few years in the real estate, mortgage and banking industries, it is not surprising we have seen significant changes in the loan process making it more challenging for a home-buyer to obtain a mortgage. Some of the changes borrowers see when they attempt to obtain a mortgage to buy or refinance a home include: After the problems we have seen over the past few years in the real estate, mortgage and banking industries, it is not surprising we have seen significant changes in the loan process making it more challenging for a home-buyer to obtain a mortgage. Some of the changes borrowers see when they attempt to obtain a mortgage to buy or refinance a home include:

Continue reading “Changes in the Mortgage Industry; St Louis Mortgage Interest Rate Update“ Continue reading “Changes in the Mortgage Industry; St Louis Mortgage Interest Rate Update“

By Dennis Norman, on November 27th, 2012  In October 7.03 percent of homeowners with a mortgage were delinquent on their loan payments, this is a decline of almost 5 percent from the month before and 7.19 percent less than the year before, according to Lenders Processing Services’ First Watch report. Foreclosure pre-sales (borrowers somewhere in the foreclosure process but have not yet lost their homes) declined 6.77 percent from the month before and was down 15.99 percent from a year ago. LPS does not break out data specific to St. Louis but recent data from RealtyTrac showed that St Louis foreclosure activity increased over 10 percent in October from the month before and was up over 7 percent from a year ago, so St Louis may be lagging behind the national trend in terms of improvement in foreclosure rates. In October 7.03 percent of homeowners with a mortgage were delinquent on their loan payments, this is a decline of almost 5 percent from the month before and 7.19 percent less than the year before, according to Lenders Processing Services’ First Watch report. Foreclosure pre-sales (borrowers somewhere in the foreclosure process but have not yet lost their homes) declined 6.77 percent from the month before and was down 15.99 percent from a year ago. LPS does not break out data specific to St. Louis but recent data from RealtyTrac showed that St Louis foreclosure activity increased over 10 percent in October from the month before and was up over 7 percent from a year ago, so St Louis may be lagging behind the national trend in terms of improvement in foreclosure rates.

Continue reading “Mortgage Delinquencies and Foreclosures Decline in U.S.; St Louis may be lagging behind“

By Dennis Norman, on November 13th, 2012  During the third quarter of 2012, 3.71 percent of St Louis homeowners with a mortgage were 60+ days delinquent on their mortgage, a slight decline from the prior quarter when the rate was 3.88 percent and a decline of over 10 percent from a year ago when the St Louis mortgage delinquency rate was 4.13 percent, according to TransUnion. This marks the third consecutive quarter the St Louis mortgage delinquency rate has declined. During the third quarter of 2012, 3.71 percent of St Louis homeowners with a mortgage were 60+ days delinquent on their mortgage, a slight decline from the prior quarter when the rate was 3.88 percent and a decline of over 10 percent from a year ago when the St Louis mortgage delinquency rate was 4.13 percent, according to TransUnion. This marks the third consecutive quarter the St Louis mortgage delinquency rate has declined.

St. Louis mortgage delinquency rates are significantly below the national delinquency rate which was 5.41 percent in the third quarter of this year. Additionally, the St Louis mortgage delinquency rates are falling faster than the national average as the national mortgage delinquency rate was down just shy of 8 percent in the past year, well behind St Louis’ ten percent decline.

By Dennis Norman, on October 29th, 2012 The St. Louis foreclosure rate fell to 1.55 percent in August 2012, the lowest rate since August 2010 when the rate was 1.54 percent, according to a report released by CoreLogic. Other encouraging news in the report was that the mortgage delinquency rate fell in August to 4.52 percent, the lowest it has been in well over two years!

By Dennis Norman, on October 5th, 2012  Strategic defaults are something I’ve written about several times over the past few years and is something that there are very strong feelings within the industry at opposite ends of the spectrum on in terms of whether they are OK to do or not. A strategic default is essentially when someone that has the ability to pay their mortgage but, usually because they are “underwater” (meaning they owe more than the property is worth), choose to “walk away” and allow the home to go into foreclosure. Almost one-third (32 percent) of Americans think there is nothing wrong with doing a strategic default, according to survey results just released by ID Analytics. Continue reading “Survey shows thirty-two percent of Americans say it’s ok to strategically default on a mortgage“ Strategic defaults are something I’ve written about several times over the past few years and is something that there are very strong feelings within the industry at opposite ends of the spectrum on in terms of whether they are OK to do or not. A strategic default is essentially when someone that has the ability to pay their mortgage but, usually because they are “underwater” (meaning they owe more than the property is worth), choose to “walk away” and allow the home to go into foreclosure. Almost one-third (32 percent) of Americans think there is nothing wrong with doing a strategic default, according to survey results just released by ID Analytics. Continue reading “Survey shows thirty-two percent of Americans say it’s ok to strategically default on a mortgage“

By Dennis Norman, on July 27th, 2012

Over one in four homeowners in the U.S. with a mortgage are “underwater” meaning they owe more on their homes than they are currently worth and, according to data just released from a survey by Zillow, 75 percent of them are underwater by 40 percent or more meaning it will most likely be many years until they even have the hope of seeing equity in their home again. Nonetheless, this has not deterred the majority of these underwater homeowners from “staying the course” as 59 percent said would not consider a strategic default in order to get out from under their home. Continue reading “Should you consider a strategic default if you are underwater on your mortgage?“

By Dennis Norman, on July 17th, 2012  More good news on the real estate market arrived this morning in the S&P/Experian report on credit defaults which revealed that mortgage default rates on first mortgages fell to 1.41 percent in June bringing it to it’s lowest level since May 2007. This is significant as this is the “leading indicator” for foreclosures which have hammered home prices for the past 5 years plus this represents a significant decline from when the mortgage default rate peaked at 5.67 percent in May 2009. Continue reading “Mortgage default rates fall back to May 2007 level“ More good news on the real estate market arrived this morning in the S&P/Experian report on credit defaults which revealed that mortgage default rates on first mortgages fell to 1.41 percent in June bringing it to it’s lowest level since May 2007. This is significant as this is the “leading indicator” for foreclosures which have hammered home prices for the past 5 years plus this represents a significant decline from when the mortgage default rate peaked at 5.67 percent in May 2009. Continue reading “Mortgage default rates fall back to May 2007 level“

By Dennis Norman, on July 10th, 2012  According to a report just released by Lender Processing Services, the foreclosure inventory in the U.S. remains near all-time highs, with 4.12 percent of all active mortgages in the foreclosure pipeline in addition to the 3.2 percent that are 90 days or more delinquent but have not yet begun the foreclosure process. Foreclosures put an immense amount of downward pressure on home prices and until the foreclosure rate recedes back toward normal levels it is going to be hard for home prices to have a sustainable recovery. On a good note, the high foreclosure levels are, for the most part in states that require a judicial foreclosure (a lengthier process) where 6.5 percent of all loans are in some state of foreclosure as opposed to states with non-judicial foreclosures where only 2.5 percent of loans in in the foreclosure process. Both percentages are considerably higher than the pre-real estate meltdown average of 0.5 percent. Continue reading “Foreclosure inventory remains near all-time high“ According to a report just released by Lender Processing Services, the foreclosure inventory in the U.S. remains near all-time highs, with 4.12 percent of all active mortgages in the foreclosure pipeline in addition to the 3.2 percent that are 90 days or more delinquent but have not yet begun the foreclosure process. Foreclosures put an immense amount of downward pressure on home prices and until the foreclosure rate recedes back toward normal levels it is going to be hard for home prices to have a sustainable recovery. On a good note, the high foreclosure levels are, for the most part in states that require a judicial foreclosure (a lengthier process) where 6.5 percent of all loans are in some state of foreclosure as opposed to states with non-judicial foreclosures where only 2.5 percent of loans in in the foreclosure process. Both percentages are considerably higher than the pre-real estate meltdown average of 0.5 percent. Continue reading “Foreclosure inventory remains near all-time high“

By Dennis Norman, on June 29th, 2012  According to a report released today by CoreLogic, there were 63,000 completed foreclosures in the U.S. in May 2012, down from 62,000 the month before and down almost 20 percent (18.18) from May 2011. Since the real estate market meltdown began in September 2008 there have been about 3.6 million homes that had forecloses completed upon. Continue reading “Foreclosures in May down almost 20 percent from year ago“ According to a report released today by CoreLogic, there were 63,000 completed foreclosures in the U.S. in May 2012, down from 62,000 the month before and down almost 20 percent (18.18) from May 2011. Since the real estate market meltdown began in September 2008 there have been about 3.6 million homes that had forecloses completed upon. Continue reading “Foreclosures in May down almost 20 percent from year ago“

By News Desk, on June 27th, 2012 The percentage of first-lien mortgages that were current and performing at the end of the first quarter of 2012 increased to the highest levels in three years, according to a report published today by the Office of the Comptroller of the Currency. Continue reading “Mortgage Delinquencies Fall to Three-Year Low“

By Dennis Norman, on June 25th, 2012  Today, the U.S. Department of Housing and Urban Development and U.S. Census Bureau released new home sales data for May 2012 showing an increase of 7.6 percent from the month before, and an increase of 19.8 percent from a year ago. The seasonally-adjusted new home sales rate for May was 369,000 homes, up from a revised rate of 343,000 homes the month before. The supply of new homes on the market decreased to a 4.7 month supply from a revised 5.0 months the month before. The median new home price decreased slightly to $234,500 from a revised median price of $236,000 the month before and increased 5.6 percent from a year ago when the median new home price was $222,000. Continue reading “New home sales increase again in May; Inventory continues to decline“ Today, the U.S. Department of Housing and Urban Development and U.S. Census Bureau released new home sales data for May 2012 showing an increase of 7.6 percent from the month before, and an increase of 19.8 percent from a year ago. The seasonally-adjusted new home sales rate for May was 369,000 homes, up from a revised rate of 343,000 homes the month before. The supply of new homes on the market decreased to a 4.7 month supply from a revised 5.0 months the month before. The median new home price decreased slightly to $234,500 from a revised median price of $236,000 the month before and increased 5.6 percent from a year ago when the median new home price was $222,000. Continue reading “New home sales increase again in May; Inventory continues to decline“

By Dennis Norman, on June 23rd, 2012

The mortgage delinquency rate (the percentage of home loans 30 or more days past due) increased in May 1.1 percent from the month before according to the latest “First Watch Report” from Lenders Processing Services (LPS). While it’s a modest increase, this marks the second consecutive month we’ve seen an increase in mortgage delinquency rates reversing the downward trend for the 9 months prior which is not good. Since delinquent mortgages are the precursor to forelcosures and foreclosures have wreaked havoc on home prices, this is something we definitely want to keep an eye on. Continue reading “Mortgage delinquencies increase for second-consecutive month“

By News Desk, on May 25th, 2012

But Negative Equity is a Paper Loss for Most, As 90% of Underwater Homeowners Pay Mortgage on Time

Nearly one-third (31.4 percent) of U.S. homeowners with mortgages – or 15.7 million – were underwater on their mortgage in the first quarter of 2012, despite rising home values, according to the first quarter Zillow® Negative Equity Report[1]. Collectively, underwater homeowners owed $1.2 trillion more than their homes were worth. Negative equity rose slightly from 31.1 percent in the fourth quarter, and declined from 32.4 percent one year ago.

Continue reading “Despite Home Value Gains, Underwater Homeowners Owe $1.2 Trillion More than Homes’ Worth“

By Dennis Norman, on May 25th, 2012  Today, the U.S. Department of Housing and Urban Development and U.S. Census Bureau released new home sales data for April 2012 showing an increase of 3.3 percent from the month before, and an increase of 9.9 percent from a year ago. The seasonally-adjusted new home sales rate for April was 343,000 homes, up from a revised rate of 332,000 homes the month before. The supply of new homes on the market decreased to a 5.1 month supply from a revised 5.2 months the month before. The median new home price increased slightly to $235,700 from a revised median price of $234,000 the month before and increased 4.4 percentfrom a year ago when the median new home price was $224,700. Today, the U.S. Department of Housing and Urban Development and U.S. Census Bureau released new home sales data for April 2012 showing an increase of 3.3 percent from the month before, and an increase of 9.9 percent from a year ago. The seasonally-adjusted new home sales rate for April was 343,000 homes, up from a revised rate of 332,000 homes the month before. The supply of new homes on the market decreased to a 5.1 month supply from a revised 5.2 months the month before. The median new home price increased slightly to $235,700 from a revised median price of $234,000 the month before and increased 4.4 percentfrom a year ago when the median new home price was $224,700.

To see new homes for sale in the St Louis area click here.

Continue reading “New home sales and prices on the rise in April“

By Dennis Norman, on May 22nd, 2012

The mortgage delinquency rate (the percentage of home loans 30 or more days past due) increased in April 0.4 percent from the month before according to the latest “First Watch Report” from Lenders Processing Services (LPS). While this is a modest increase, it temporarily reverses the trend we have seen for the past 9 months of declining mortgage delinquency rates. The mortgage delinquency rate in April, at 7.12 percent of all loans, is down 10.6 percent from a year ago however. The foreclosure rate for April was 4.14 percent, the same as the month before as well as the year before so, at least the foreclosure rate is remaining flat and not increasing. Continue reading “Mortgage delinquencies increase in April; first increase in nine months“

By Dennis Norman, on May 11th, 2012  More good news on the housing market! The national mortgage delinquency rate (borrowers that are 60 or more days past due) declined for the first 3 months of 2012, coming in at 5.78 percent according to a report issued by TransUnion. This is after increases in the delinquency rate in the prior 2 quarters and is the lowest rate since the 1st quarter of 2009. Continue reading “Mortgage loan delinquencies drop to lowest rate since 2009“ More good news on the housing market! The national mortgage delinquency rate (borrowers that are 60 or more days past due) declined for the first 3 months of 2012, coming in at 5.78 percent according to a report issued by TransUnion. This is after increases in the delinquency rate in the prior 2 quarters and is the lowest rate since the 1st quarter of 2009. Continue reading “Mortgage loan delinquencies drop to lowest rate since 2009“

By Dennis Norman, on April 24th, 2012  Today, the U.S. Department of Housing and Urban Development and U.S. Census Bureau released new home sales data forMarch 2012 showing a decrease of 7.1 percent from the month before, and an increase of 7.5 percent from a year ago. The seasonally-adjusted new home sales rate for March was 328,000 homes, down from a revised rate of 353,000 homes the month before. It’s worth noting that February’s sales were originally reported by the Commerce Department to be 313,000, so the revision to 353,000 was significant. So, in the end, March may not look so bad either if the revised numbers follow suit with the month before. Continue reading “New home sales and prices slip in March; both still better than a year ago“ Today, the U.S. Department of Housing and Urban Development and U.S. Census Bureau released new home sales data forMarch 2012 showing a decrease of 7.1 percent from the month before, and an increase of 7.5 percent from a year ago. The seasonally-adjusted new home sales rate for March was 328,000 homes, down from a revised rate of 353,000 homes the month before. It’s worth noting that February’s sales were originally reported by the Commerce Department to be 313,000, so the revision to 353,000 was significant. So, in the end, March may not look so bad either if the revised numbers follow suit with the month before. Continue reading “New home sales and prices slip in March; both still better than a year ago“

By Dennis Norman, on April 16th, 2012  FICO, a provider of analytics and decision management technology to the banking industry, today announced results from its latest quarterly survey of bank risk professionals which showed that almost half (46 percent) expect the volume of strategic defaults in 2012 to surpass 2011 levels as a result of more than 25 percent of U.S. homeowners owe more on their mortgages than their homes are worth. FICO, a provider of analytics and decision management technology to the banking industry, today announced results from its latest quarterly survey of bank risk professionals which showed that almost half (46 percent) expect the volume of strategic defaults in 2012 to surpass 2011 levels as a result of more than 25 percent of U.S. homeowners owe more on their mortgages than their homes are worth.

“After five years of a brutal housing market, many people now view their homes more objectively and with less sentimentality,” said Dr. Andrew Jennings, chief analytics officer at FICO and head of FICO Labs. “Regardless of legal or ethical issues around strategic defaults, lenders must account for this risk when they evaluate mortgage applications in declining markets. Many homeowners who find themselves upside down on mortgages in the future are likely to consider strategic default as an acceptable exit strategy.” Continue reading “Survey shows banks expect strategic defaults to increase in 2012“

|

Recent Articles

|

The foreclosure rate in St Louis fell to 1.04 percent for the month of August, a decline of 33.5 percent from a year ago when the St Louis foreclosure rate was 1.55 percent, according to a report just released by CoreLogic. The national foreclosure rate for August at 2.36 percent was over twice as high as the St Louis rate. Other good news for the St Louis real estate market contained in the report was that the St Louis mortgage delinquency rate (90 days or more late) was 3.78 percent, a decrease of 16.6 percent from a year ago when the rate was 4.53 percent.

The foreclosure rate in St Louis fell to 1.04 percent for the month of August, a decline of 33.5 percent from a year ago when the St Louis foreclosure rate was 1.55 percent, according to a report just released by CoreLogic. The national foreclosure rate for August at 2.36 percent was over twice as high as the St Louis rate. Other good news for the St Louis real estate market contained in the report was that the St Louis mortgage delinquency rate (90 days or more late) was 3.78 percent, a decrease of 16.6 percent from a year ago when the rate was 4.53 percent.

The number homeowners in a negative equity position (owing more on their mortgage than the current value of their home) during the first quarter of this year fell to just 7.3 million homeowners in the U.S. or less than 15 percent of all homeowners with a mortgage, according to the most recent data from Lenders Processing Services (LPS). This represents a decline of almost 50 percent in the number of negative equity homeowners from a year ago.

The number homeowners in a negative equity position (owing more on their mortgage than the current value of their home) during the first quarter of this year fell to just 7.3 million homeowners in the U.S. or less than 15 percent of all homeowners with a mortgage, according to the most recent data from Lenders Processing Services (LPS). This represents a decline of almost 50 percent in the number of negative equity homeowners from a year ago.

The St. Louis foreclosure rate declined in December 2012 to 1.29 percent of outstanding home loans, a 25 percent drop from a year ago when the foreclosure rate was 1.72 percent, according to a newly released report from Corelogic. In addition, the St. Louis mortgage delinquency rate for December was 4.39 percent, down 12.5 percent from the year before when 5.02 percent of the outstanding St. Louis home loans were 90 days or more delinquent. See the chart below for foreclosure rate by zip code in the St. Louis area.

The St. Louis foreclosure rate declined in December 2012 to 1.29 percent of outstanding home loans, a 25 percent drop from a year ago when the foreclosure rate was 1.72 percent, according to a newly released report from Corelogic. In addition, the St. Louis mortgage delinquency rate for December was 4.39 percent, down 12.5 percent from the year before when 5.02 percent of the outstanding St. Louis home loans were 90 days or more delinquent. See the chart below for foreclosure rate by zip code in the St. Louis area.

The foreclosure inventory in the U.S. dropped to 3.51 percent in November, a decline of 2.84 percent from the month before, according to the November Mortgage Monitor report released by Lender Processing Services. This trend may not continue though as, during the same period, the mortgage delinquency rate (the precursor to foreclosures) increased 1.2 percent from the month before and has increased 3.7 percent since August.

The foreclosure inventory in the U.S. dropped to 3.51 percent in November, a decline of 2.84 percent from the month before, according to the November Mortgage Monitor report released by Lender Processing Services. This trend may not continue though as, during the same period, the mortgage delinquency rate (the precursor to foreclosures) increased 1.2 percent from the month before and has increased 3.7 percent since August.  After the problems we have seen over the past few years in the real estate, mortgage and banking industries, it is not surprising we have seen significant changes in the loan process making it more challenging for a home-buyer to obtain a mortgage. Some of the changes borrowers see when they attempt to obtain a mortgage to buy or refinance a home include:

After the problems we have seen over the past few years in the real estate, mortgage and banking industries, it is not surprising we have seen significant changes in the loan process making it more challenging for a home-buyer to obtain a mortgage. Some of the changes borrowers see when they attempt to obtain a mortgage to buy or refinance a home include:

According to a report just released by Lender Processing Services, the foreclosure inventory in the U.S. remains near all-time highs, with 4.12 percent of all active mortgages in the foreclosure pipeline in addition to the 3.2 percent that are 90 days or more delinquent but have not yet begun the foreclosure process. Foreclosures put an immense amount of downward pressure on home prices and until the foreclosure rate recedes back toward normal levels it is going to be hard for home prices to have a sustainable recovery. On a good note, the high foreclosure levels are, for the most part in states that require a judicial foreclosure (a lengthier process) where 6.5 percent of all loans are in some state of foreclosure as opposed to states with non-judicial foreclosures where only 2.5 percent of loans in in the foreclosure process. Both percentages are considerably higher than the pre-real estate meltdown average of 0.5 percent.

According to a report just released by Lender Processing Services, the foreclosure inventory in the U.S. remains near all-time highs, with 4.12 percent of all active mortgages in the foreclosure pipeline in addition to the 3.2 percent that are 90 days or more delinquent but have not yet begun the foreclosure process. Foreclosures put an immense amount of downward pressure on home prices and until the foreclosure rate recedes back toward normal levels it is going to be hard for home prices to have a sustainable recovery. On a good note, the high foreclosure levels are, for the most part in states that require a judicial foreclosure (a lengthier process) where 6.5 percent of all loans are in some state of foreclosure as opposed to states with non-judicial foreclosures where only 2.5 percent of loans in in the foreclosure process. Both percentages are considerably higher than the pre-real estate meltdown average of 0.5 percent.