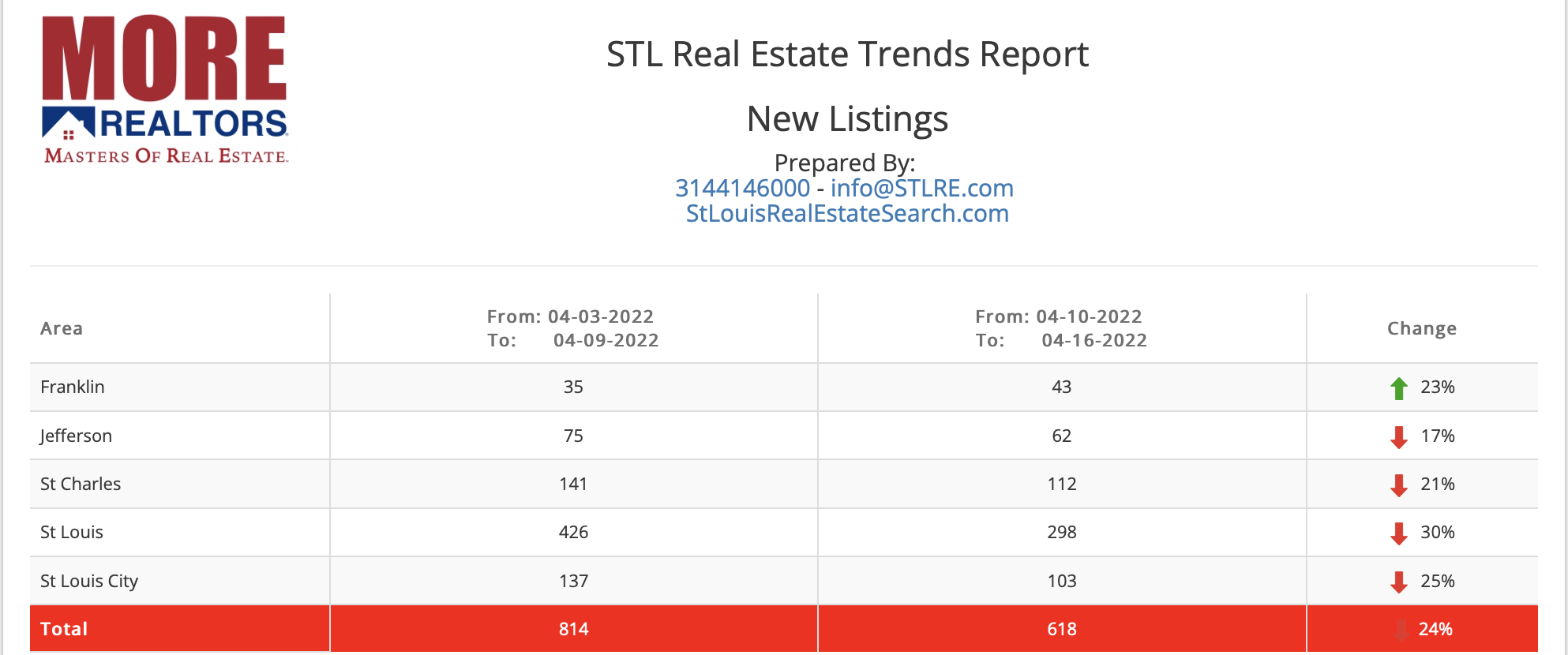

By Dennis Norman, on June 16th, 2022 For the first three weeks of June there were 1,475 new listings of homes for sale in the St Louis 5-county core market, according to the STL Real Estate Trends Report from MORE, REALTORS®. During the same period, there were 1,194 new contracts written on homes for sale resulting in a new listing to new contract ratio of 1.25. This ratio of listings to new sales is higher than it was 3 weeks ago when I shared the last update from the STL Real Estate Trends report and it was 1.05 at that time for the period reported which was the first 3 weeks of May.

It was at the end of last week that the mortgage bond market blew apart forcing mortgage interest rates up so when our new report for this week is release next Thursday we’ll see what effect that had on the market.

Continue reading “New Listings To New Contracts Ratio Increases This Month“

By Dennis Norman, on June 15th, 2022 After over 40 years in the real estate business in St Louis I’ve seen many times just how fast a good, or even great housing market can turn sour as well as the other way around. Two years ago, economic conditions relevant to the housing market included:

Today, the above conditions are:

Does this mean St Louis home prices will come crashing down?

First off, I’m not an economist, in fact I didn’t even attend college and I certainly don’t have a crystal ball showing me the future, but I am a data junkie that has lived through a variety of markets spanning more than 4 decades. My experience as well as my study of past markets as well as current indicators of things to come certainly give me an opinion. In times past, my opinions on the market have been spot on, almost to the point that I even surprised myself (such as in October 2006, at the peak of the housing boom when I predicted the collapse) and other times I’ve been wrong, sometimes way wrong. The reality is that the housing market is affected, or can be affected by so many different economic factors, as well as social issues, consumer sentiment and more that I don’t believe anyone can predict what it’s going to do accurately consistently.

Continue reading “Will Home Prices Come Crashing Down?“

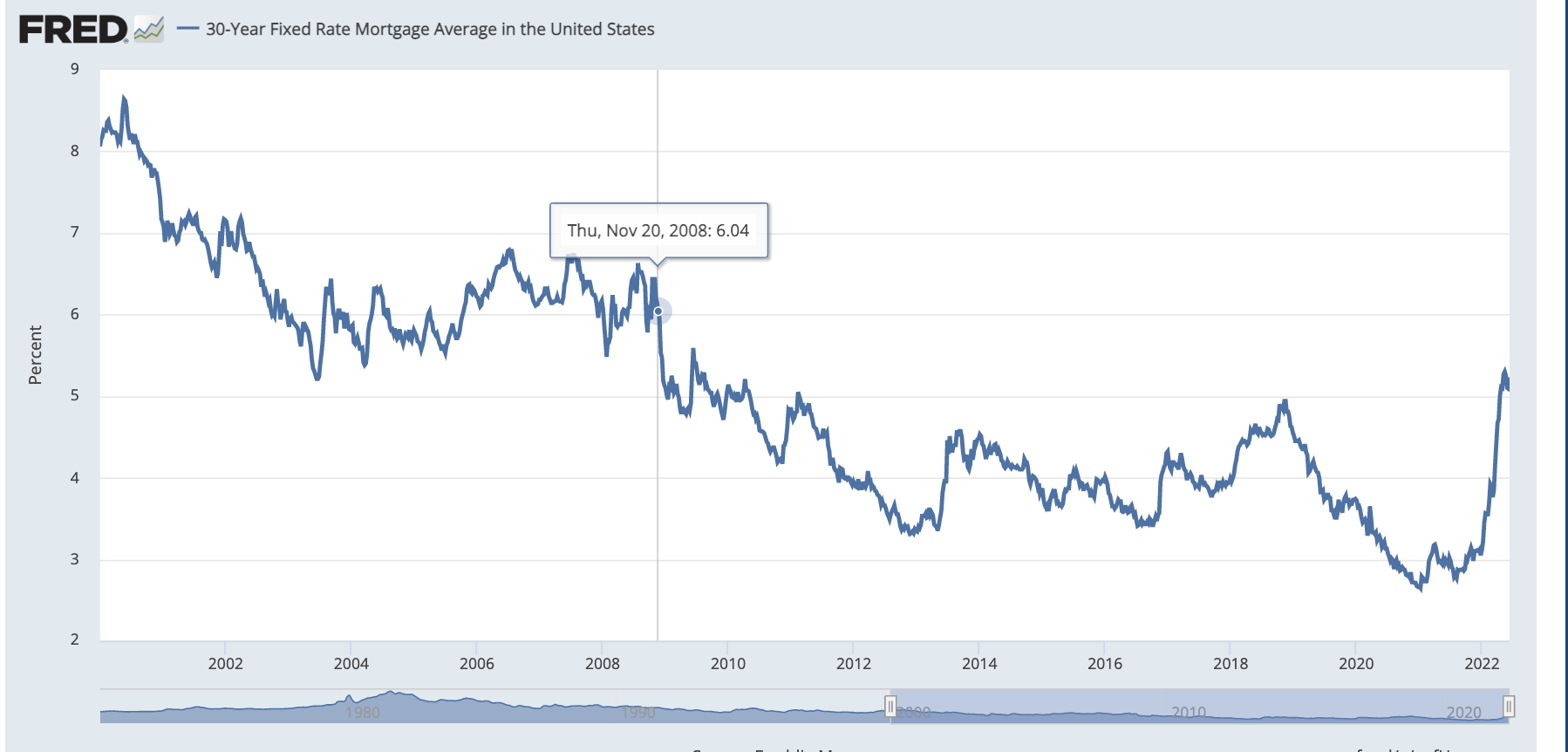

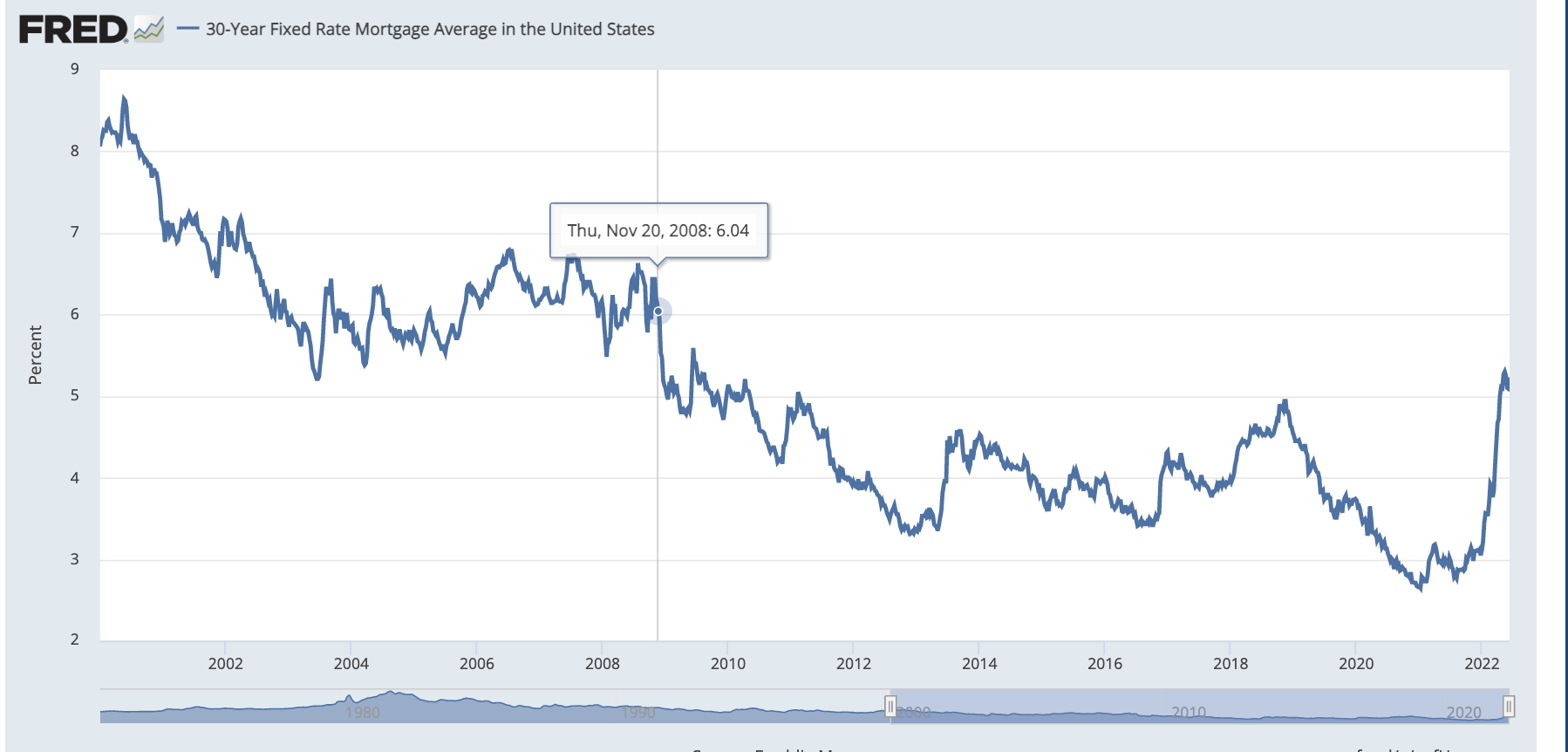

By Dennis Norman, on June 14th, 2022 The bond market had one of the worst days in history yesterday resulting in mortgage interest rates on a 30-year fixed rate mortgage hitting 6.0% and above. This is the highest rates have been since November 20, 2008 when the mortgage interest rates were 6.04%, according to Freddie Mac’s Primary Mortgage Market Survey®.

Is there a silver-lining to the higher interest rates?

Given that the reason for the higher interest rates has to do with our high inflation rates and declining economic conditions, it’s hard to find much positive to say about what is happening. Having said that, the one thing that comes to mind is these rate increases will no doubt slow down the rapid price growth on homes we’ve seen over the past couple of years. This will likely cause home prices to flatten and the premiums buyers have paid over and above what the buyer, seller and agents involved knew the home was actually worth are history in my opinion.

So, while as a buyer, you will be facing higher interest rates than you would have a year ago, you should receive some relief in the price not being as high as it would have if the low rates were still here, less competition due to some buyers leaving the market and being able to purchase a home without paying a significant premium above the value to get it.

Mortgage Interest Rates – 2000-Present- 30-year fixed rate mortgage

(click on chart for live, interactive chart)

By Dennis Norman, on June 10th, 2022 With the bidding wars we’ve seen on listings resulting in sold prices that exceed the asking price in St Louis over the past couple of years, it’s hard to imagine that home values could be lower today than a year ago. Now, before you call me crazy, I’m not saying that St Louis homes are SELLING for LESS now than a year ago. As our STL Market Chart below shows, the median price of homes sold in the St Louis 5-county core market was $254,950 in May 2021 and $270,000 last month, for an increase in sales price of 5.9%. However, given that, as the chart at the bottom shows, the inflation rate has increased 8.6% during the past 12-months, St Louis home prices have not increased as much as inflation, thereby leaving them worth less today than they were worth a year ago after adjusting for inflation.

Home prices last month would have needed to be $276,829 to keep pace with inflation…

In order to keep pace with inflation and make a median-priced St Louis home worth the same in today’s dollars as it was worth a year ago it would have be worth $276,829 today at the current rate of inflation.

If we look farther back it gets better….

Continue reading “St Louis Home Values Declined In Past 12-Months After Inflation“

By Dennis Norman, on May 9th, 2022 There have been a lot of reports over the past month about rising interest rates (mortgage rates on a 30-year fixed-rate mortgage hit 5.27% last week) as well as rising inflation rates (8.5% in March) and the effect these things will have on the housing market. It’s no doubt they will have some affect on home prices and sales and I have been watching the data on St Louis home prices and sales closely and so far there does not appear to be much impact.

St Louis home sales increase in April from March…

There are two ways we analyze home sales at MORE, REALTORS®; the traditional manner, which is what almost all public reports are based upon, closed sales (which are really indicative of what the market was like 1-2 months previously since that is when the contracts were typically written) and then by use of our STL Real Estate Trends Report, which gives us a better idea of the current activity. Our trends report shows the number of new contracts written on listings, so current sales activity as well as the number of new listings entering the market. The good news is, when looking at St Louis home sales activity for April, both closed sales and newly written contracts increased from the month before.

As our chart below shows, there were 2,134 homes sold in St Louis (5-county core market) during April, a 6.4% increase from March when there were 2,005 homes sold. As the STL Real Estate Trends Report shows, there were 3,279 new contracts written on homes during April in the St Louis 5-county core market, an increase of 5% from the prior month when there were 3,124 contracts written.

Continue reading “St Louis Home Sales Doing Well In Spite of Rising Interest Rates & Inflation“

By Dennis Norman, on April 27th, 2022 The past several days have not been good for the National Association of REALTORS® (NAR) from a legal perspective at least.

First, last Friday, April 22, 2022, Stephen R. Bough, a Federal Judge for in the Western District of Missouri, certified a lawsuit against NAR as a class action suit.The suit, known as the “Sitzer” suit as the original plaintiffs were Joshua Sitzer and Amy Winger, alleges that the defendant, the National Association of REALTORS® “created and implemented anticompetitive rules which require home sellers to pay commission to the broker representing the home buyer“. The plaintiffs in the suit also allege that the other defendants, which include Realogy Holdings Corp, Homeservices of America, Inc., Re/MAX LLC and Keller Williams Realty, Inc., “enforce those rules through anticompetitive practices.” I believe this action by the court was expected and likely did not come as a surprise to anyone but it was not good news for NAR or the other defendants. In the coming days I’ll be doing an in-depth article on this one.

Then, yesterday, the United States Court of Appeals for the 9th Circuit delivered another and this time, a likely unexpected, blow to the National Association of REALTORS® in the form of a reversal of a suit against NAR that had been dismissed previously by a lower court. The suit, PLS.com v. the National Association of REALTORS®, is another suit alleging anti-trust violations by NAR and the other defendants which are all MLS’s. The suit was brought originally by PLS.com as a result of NAR enacting its “Clear Cooperation Policy” which for all intents and purposes, dictates to agents and brokers how and when they can market their listings. I’ve written several articles specifically on this policy in the past which can be found using the following links:

Continue reading “Appellant Court Overturns Lower Court Dismissal of Anti-Trust Lawsuit Against the National Association of REALTORS®“

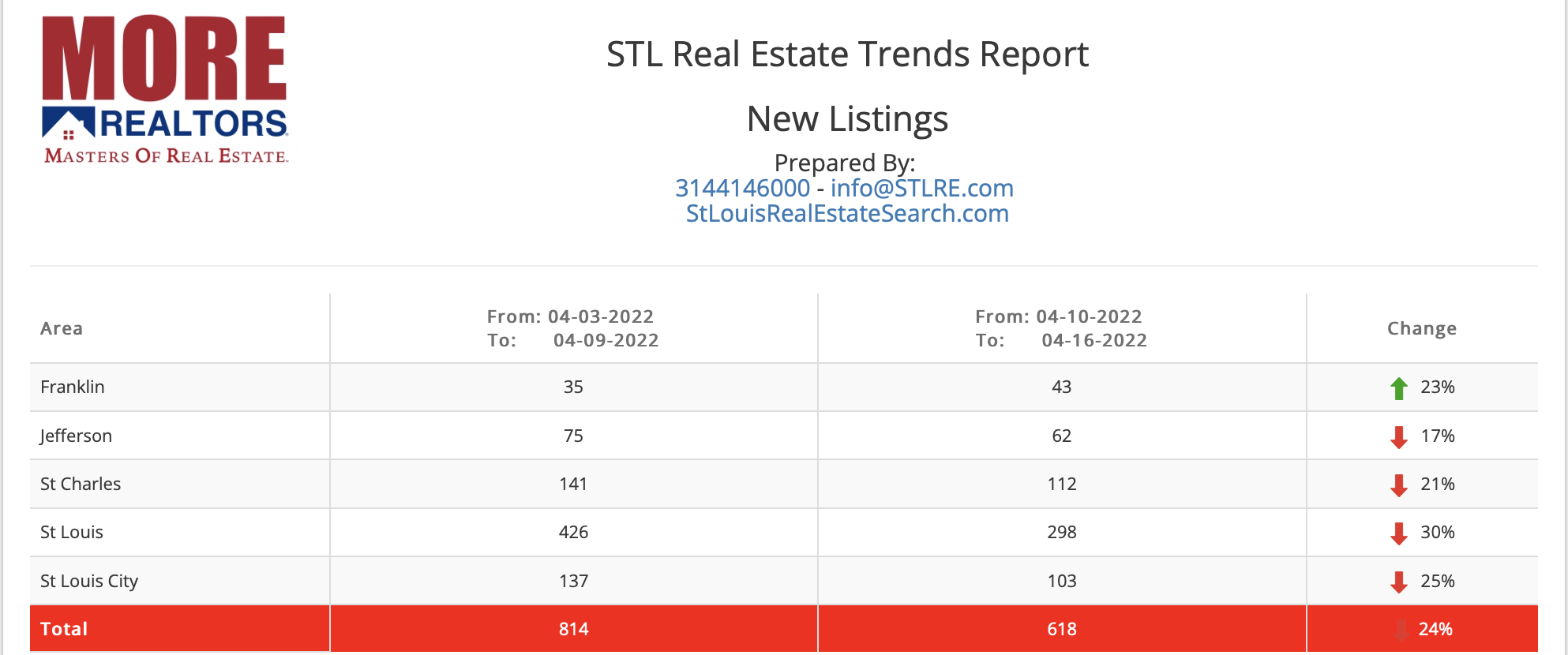

By Dennis Norman, on April 19th, 2022 Even with the high rate of inflation, rising interest rates and general unrest in the economy, during the past two weeks there were more new contracts written on listings than there were new listings. According to the STL Real Estate Trends Report, exclusively available from MORE, REALTORS®, during the last two weeks there were 1,496 new contracts accepted on listings in the St Louis 5-County core market while there were 1,432 new listings during the same period. While there were only 4.5% more sales than listings, given the fact we are already in a low-inventory market, this is fairly significant.

STL Real Estate Trends Report

(click on report for current report)

By Dennis Norman, on April 15th, 2022 Yesterday, I wrote an article addressing the high rate of inflation just reported and its impact on the St Louis housing market. In it, I promised to take a deeper look into the effect of the current events related to the economy on St Louis home prices which I will do in this article.

Before I go further, I should mention I’m not an economist nor a fortune teller. I am, however, a real estate broker and data nerd that has spent over 40 years in the St Louis real estate industry. I try my best to use my knowledge and experience to anticipate changes in the market and use this to help our agents and clients use this information to their advantage.

History always repeats itself..

I find the above old adage to be pretty accurate when it comes to the real estate market. Therefore, in trying to get my head around what impact a high inflation rate may have on home prices, I started by going back to prior periods of high inflation rates.

The first chart below shows the rate of inflation, interest rates, and the St Louis home price index. I’ve made some notes on it to show prior inflationary periods and the effect on home prices. The first period, the early 80s was much worse than today as inflation was higher and interest rates were in the stratosphere hitting 18%. The more recent period around 2007-2009 was not as severe and therefore the impact on home prices was not as dramatic as the former either. As you can see on the far right side of the chart, home prices have increased in the past several months at a sharp rate with the change from a year ago being greater than the last inflationary period but not as great as the one from the early ’80s.

The next chart shows the relationship between home prices and rent. When home prices outpace rent, home prices decline, when rent outpaces home prices, prices rise. As the chart shows, these two lines have converged indicating a reasonable balance between home prices and rent.

During the period of 2007 – 2011 home prices fell over 17% during a four year period before finally bottoming out.

Today is different though…

Continue reading “How Much Will St Louis Home Prices Be Impacted By Inflation?“

By Dennis Norman, on April 14th, 2022 This week it was announced that the U.S. inflation rate in March had increased to a staggering 8.5% the highest rate in over 40 years as illustrated by the chart below. The last time the inflation rate was higher than this was in December 1981 when it hit 8.9%. The “inflation rate” that I’m referring to, and is the most commonly reported, is based upon the Consumer Price Index for All Urban Consumers (CPI-U): U. S. city average. One of the categories included in the CPI-U is “shelter”. The report shows the shelter inflation rate at 5% which, on the surface sounds low however, the median price of homes sold in St Louis in March was $250,000 an increase of just over 4% from March 2021 when the median sold price was $240,000.

What does an inflation rate of 8.5% mean for the real estate market?

With everything going on in our economy, country and world now I think it’s literally impossible to predict what is going to happen on any front with any level of accuracy however, a good guide would be what has happened in the past during similar times. With this in mind, lets look at what the market looked like the last time inflation was at this level, December 1981:

- Mortgage interest-rates on a 30-year fixed mortgage were an average of 17%-18% (see chart below)

- The inflation rate actually reached a peak of 14.4% in March of 1980

- St Louis home prices peaked during the 1st quarter of 1979 then declined until bottoming-out during the 2nd quarter of 1981 (see chart at bottom)

Continue reading “Inflation Rate Increases to 8.5 Percent in March…What will the effect be on home prices?“

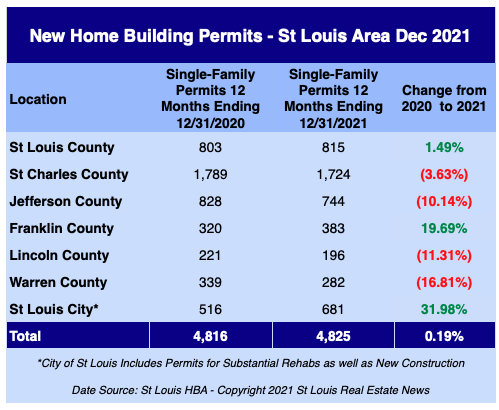

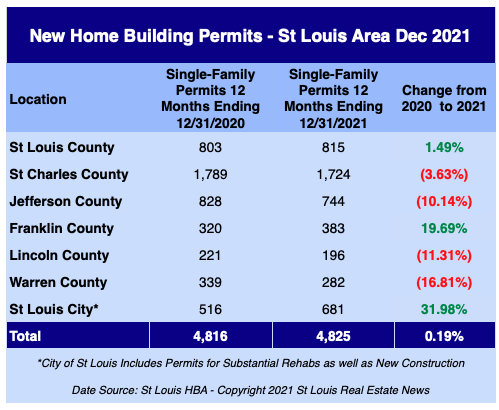

By Dennis Norman, on February 2nd, 2022 There were 4,825 building permits issued for new single-family homes in the St Louis area during 2021 which is 9 more permits than were issued in 2020, according to the latest data from the Home Builders Association of St. Louis & Eastern Missouri (St Louis HBA). For the past few years, St Louis has experienced a strong seller’s market due to the low supply of homes for sale.

This demand certainly seems to be something that would encourage builders to increase the number of homes being built significantly. However, there are many challenges facing St Louis builders today that prevents this. The challenges include a shortage of developed lots, or even ground in areas of demand, as well as increased construction costs, a result of regulatory issues, material prices and construction worker’s wages. If the builder can deal with the increased prices, then there are supply chain issues and labor shortages to deal with as well. Selling new homes is pretty easy today, the challenge is developing them.

St Louis New Home Building Permits -December 2021

By Dennis Norman, on January 23rd, 2022 Most anyone that is interested in buying or selling a home is pretty much aware of two things: there is a low inventory of homes for sale and prices have increased a fair amount as a result. That part is likely largely a result of basic economics related to supply and demand. When the demand is greater than the supply, prices will increase. In St Louis, home prices have done just that. As the chart below (exclusively available from MORE, REALTORS®) illustrates, the median price of homes sold in January 2020 was $221, 200 and in January 2021 was $245,000, an increase of 10.8%.

Interest rates are the other part of the equation with regard to the “cost” of a home…

Since the overwhelming majority of home buyers that purchase a typical home in St Louis do so utilizing a mortgage or home loan, the interest rate on that home loan has a direct impact on what that home “costs” the homeowner in terms of the monthly payment. When buyers get pre-approved for a home loan, as well as consider how much they can afford to or want to, spend on a home, it all pretty much usually starts with the house payment. Therefore, we can’t underestimate the impact interest rates can have on home prices.

As the mortgage interest rate chart below shows, the average interest rate on a 30-year conforming conventional home loan in January 2021 was 2.811% and today has increased to 3.744%.

The change in the “cost” of a typical St Louis home in the past year…

So, if we look at the increase in the price of a typical St Louis home and then factor in the increase in the interest rates we find that the actual “cost” of a typical St Louis home (in terms of house payment) increased 25% n the past year. To keep things simple, I based this on a loan amount of 90% of the purchase price so the cost will vary depending upon downpayment of course and I’m only computing principal and interest so I’m not including escrows for property taxes or homeowners insurance.

- Typical payment on a typical St Louis home January 2021 – $ 805.00

- Typical payment on a typical St Louis home January 2022 – $ 1,009.00

Is it too late to buy since the cost has increased so much?

Continue reading “Typical St Louis Home Price Increased Nearly 11 Percent In Past Year – Payment On The Home Increased 25%“

By Dennis Norman, on January 12th, 2022 As the STL Market Report (available exclusively from MORE, REATLORS®) below illustrates, there were 30,197 homes sold in the St Louis 5-county core market during 2021, an increase of 3.86% from 2020 when there were 29,075 homes sold. The median sales price of homes sold in the St Louis 5-county core market was $250,000 during 2021, an increase of 9.17% from 2020 when the median price of homes sold in St Louis was $229,000. The 5-county core St Louis market is comprised of the city and county of St Louis, along with the counties of Jefferson, Franklin, and St Charles. The St Louis core market is responsible for over 7y0% of all homes sold in the 17-county St Louis MSA market.

Housing inventory remains low…

As the last row of the report shows, there is still just a 0.6 month supply of homes for sale in the St Louis 5-county core market and the median time on the market is 64 days.

Continue reading “St Louis Home Sales in 2021 Tops Year Before By Nearly 4 Percent – Prices Up Over 9 Percent“

By Dennis Norman, on December 11th, 2021 As you’ve probably heard by now, the most recent inflation news was not good. As the chart below illustrates, the Consumer Price Index (CPI) for all products in the U.S. (city average) for November 2021 was 303.4, an increase of 6.88% from a year ago when it was 284.1. This is the highest 12-month increase in inflation we have seen in over 39 years, since June 1982.

What effect will this record-setting increase in inflation have on home prices?

The second chart below depicts the percentage change in the inflation rate from a year ago (the blue line) as well as the percentage change in the St Louis home price index from a year ago (the red line). As you look at the chart and reference the marked-up one I have below it, you will see a pattern. Historically, when inflation rates increase significantly and consistently from a year ago, lower home prices follow. Will this happen this time as well? It’s hard to say right now as we still have an incredibly low supply of homes on the market, which tends to fuel higher prices, and we’ll need to see if the rise in inflation is sustained over the next few months. For the time being, I’ll make the prediction that in 2022 we will see, at a minimum, a flattening of home prices…so maybe not a decline, but a pause on the rate of increase. Time will tell.

[xyz-ips snippet=”Foreclosures-For-Sale-and-Homes-For-Sale”]

Continue reading “Inflation Has Largest One-Year Increase In Over 39 Years – Will Home Prices Suffer?“

By Dennis Norman, on December 8th, 2021 Even though you wouldn’t know it by today’s forecasted high in St Louis of 50 degrees, we are entering the winter housing market. Every year, year after year, the St Louis winter housing market reacts pretty much the same way with home prices dropping a little and sales slowing followed by an uptick in both come spring. With that in mind, the declines we see in home prices in the chart and report below, available exclusively from MORE, REALTORS®, could be attributed to the seasonal change but are a little early for that, and different than last year.

Sold home price per square foot declined for 2nd month in a row in November…

The price per foot a home sells for is a relatively accurate indicator of rising home prices and typically will decline in the winter months as I mentioned above. However, if you look at the chart below, you will see the red line, which depicts the sold price per square foot of homes sold in the St Louis area, peaked in June at $172/foot, then dropped in July to $171/foot where it stayed though September before dropping to $165 in October and then remaining there in November. The result was a 4.0% decline in the price per foot of homes sold in St Louis from the peak in June to October.

If you look at the same period last year, you will see the price per foot peaked in July at $152 than stayed at $152 until dropping to $151 in October, then up to $153 in November and back to $152 in December. So, least year, the change from the peak to November was actually a slight increase compared with this year’s decrease of 4.%.

I’m not saying last years price behavior was the norm, I’m just pointing out that this years price activity is different than last year so it may be indicative of a change in the market.

Current listing prices reflect slower price appreciation…

Below the chart is the STL Market Report for November which shows home sales in the St Louis 5-county core market were up nearly 6% for the 12-month period ended November 30th from a. year ago and prices were up over 10% during the same period. However, if you look down to the second row of the report, you will see the price per foot homes sold at during the most recent 12-month period were sold at a price of $164.70 per foot (and in November as well) and the price per foot of homes currently listed is $168, so an increase of about 2% from the median price in the past 12-months. Granted, many of the current listings will likely sell for more than asking price, but this trend still indicates St Louis home price appreciation is slowing.

Continue reading “St Louis Home Price Appreciation Slowing“

By Dennis Norman, on November 24th, 2021 As the charts below illustrate, at the beginning of this year, mortgage interest rates for a 30-year conforming conventional loan were at 2.771%, FHA loans were at 2.703%, and VA loans were at 2.372%. As of yesterday, those rates have increased to 3.357%, 3.468%, and 3.101% respectively.

While conforming 30-year conventional loans have seen an increase of 21% in rates (from 2.771% to 3.357%), FHA loans have seen an increase of 28% (from 2.703% to 3.468%) and VA loans have seen an increase of 30% (from 2.372% to 3.101%).

What does this mean in terms of the cost of a home?

To make the comparison simple, I’ll just base my comparison on the price of a “typical” home in the St Louis 5-county core market using the median price of homes sold in October which was $234,900. Downpayments will vary based upon loan type from no downpayment being required on a VA loan, to a minimum of 3% on a conventional and 3.5% on an FHA but based upon a loan amount equal to the median price of $234,900, below are the differences in the monthly payment on that amount by loan type from the beginning of this year until now:

- Conventional – $948 to $1,023

- FHA – $939 to $1,038

- VA – $898 to $990

If we factor in the increase in home prices, it gets worse.

In the “to add insult to injury” category, home prices have increased significantly since January as well, In January the median price was $215,000, so between then and October the median price of a St Louis home increased 9.2%. With the interest rates increasing at the same time the cost of a typical St Louis home increased fairly significantly as shown below:

- Conventional – $867 to $1,023 (+18%)

- FHA – $859 to $1,038 (+21%)

- VA – $821 to $990 (+21%)

The moral of the story…don’t wait to buy.

While I certainly can’t predict the future, especially given all the uncertainty in our economy with inflation, employment issues, etc, if I were in the market to buy a home I don’t think I would wait “until things get better”. The reason for my opinion is, as I’ve illustrated here, the true “cost” of a home (assuming you are not paying cash for it) is a combination of price and interest rate. So, even if home prices see an adjustment or the seasonal dip we often see during winter if interest rates continue to rise, is the higher cost of borrowing going to offset the lower price? I think that is a possibility. Or, the flip side, if interest rates go down but then prices go up, is the savings in lower rates lost?

To benefit from waiting, in terms of the cost of the home, we would need interest rates to stay the same, or decline and home prices to decline or interest rates to drop and home prices stay the same. Right now I don’t see either of the two aforementioned scenarios likely to happen.

Continue reading “Mortgage Rates Have Increased Significantly This Year“

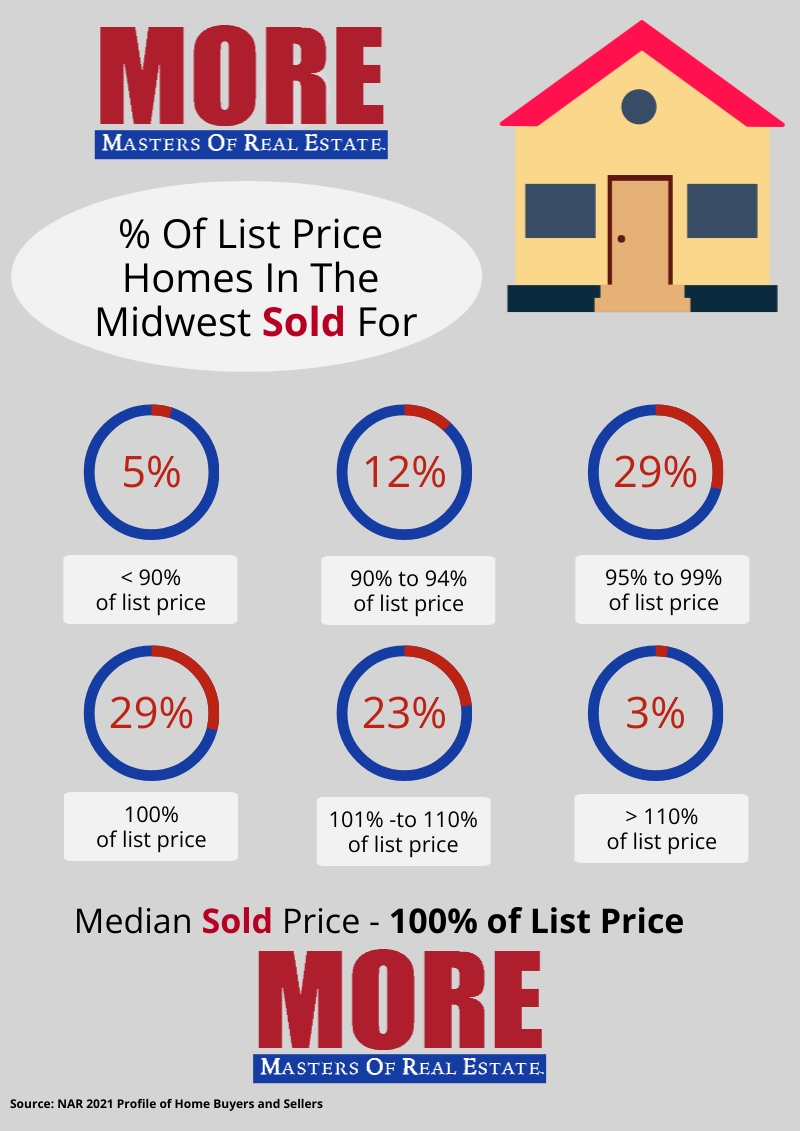

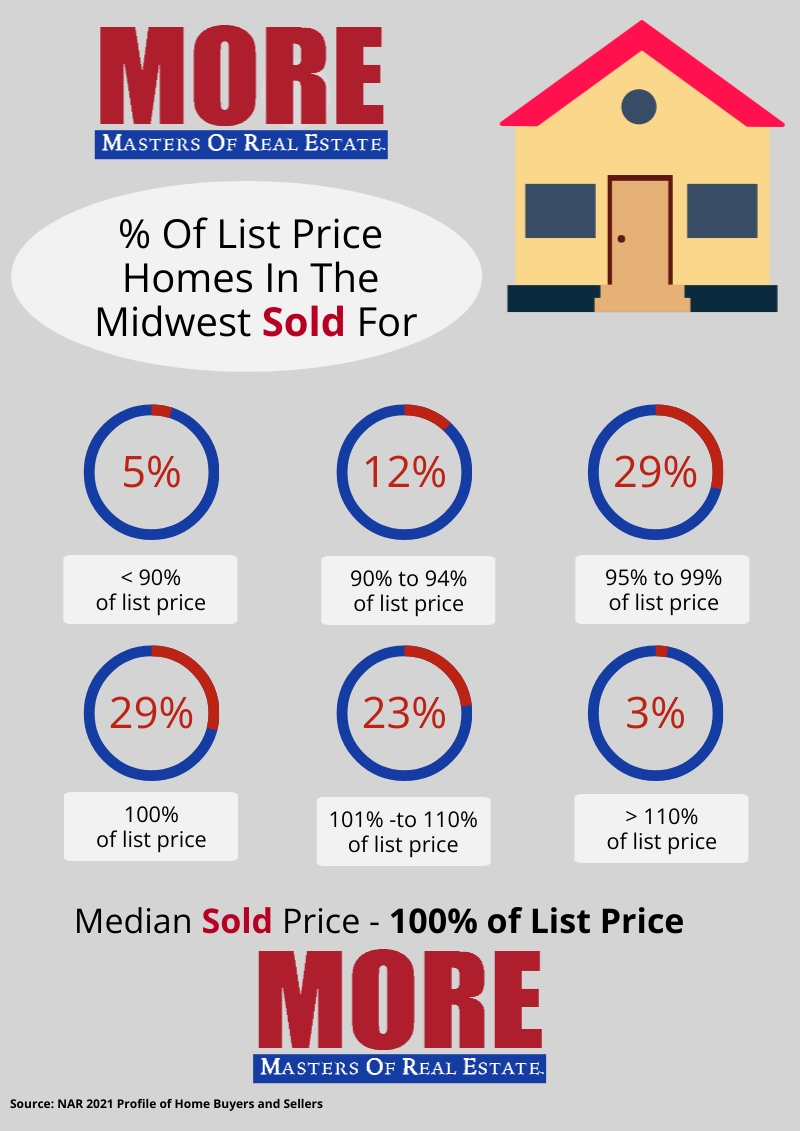

By Dennis Norman, on November 17th, 2021 Last week I published an infographic in an article illustrating that 65% of the homes sold in St Louis sold at or above the list price. As the infographic below shows, this is a significantly higher percentage than was experienced in the midwest region as a whole where 55% of the homes sold at or above full price.

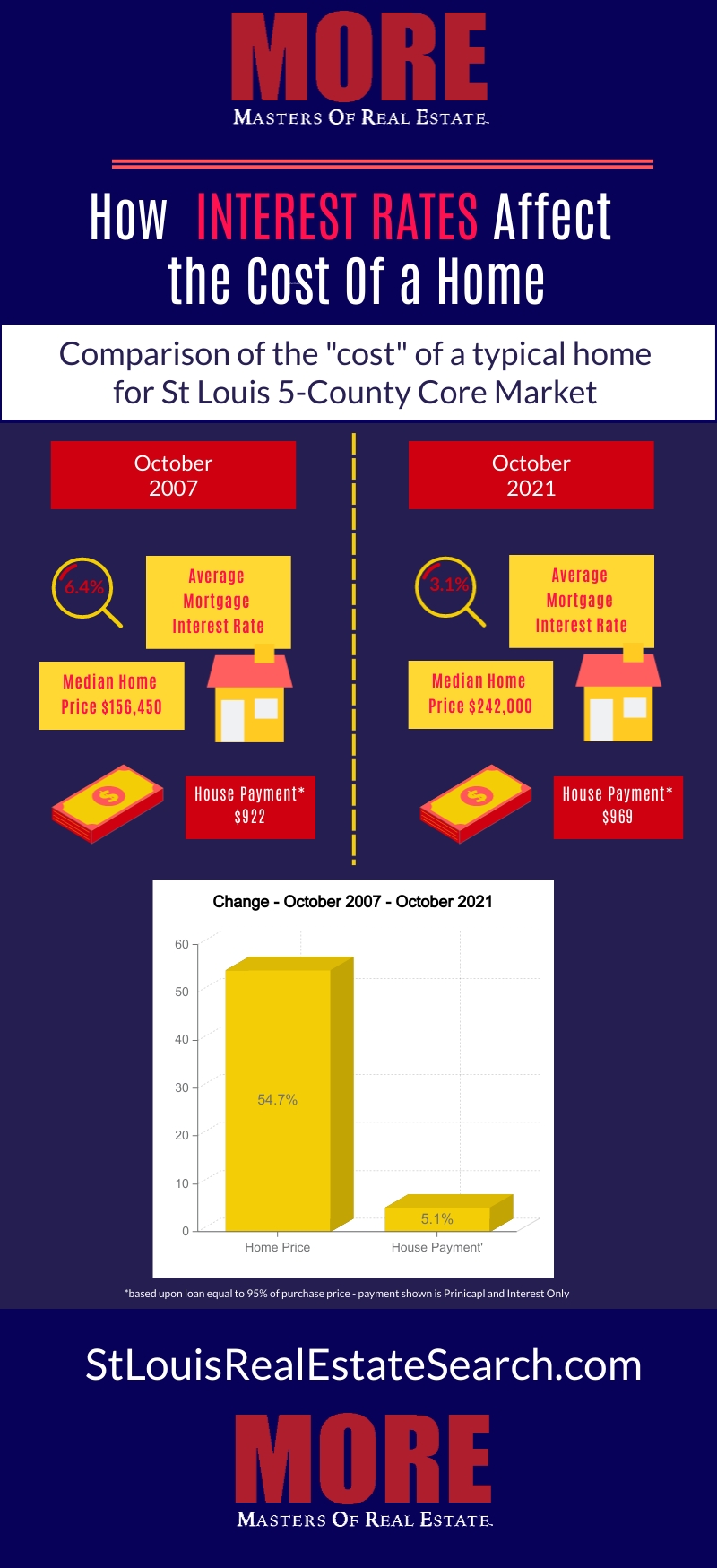

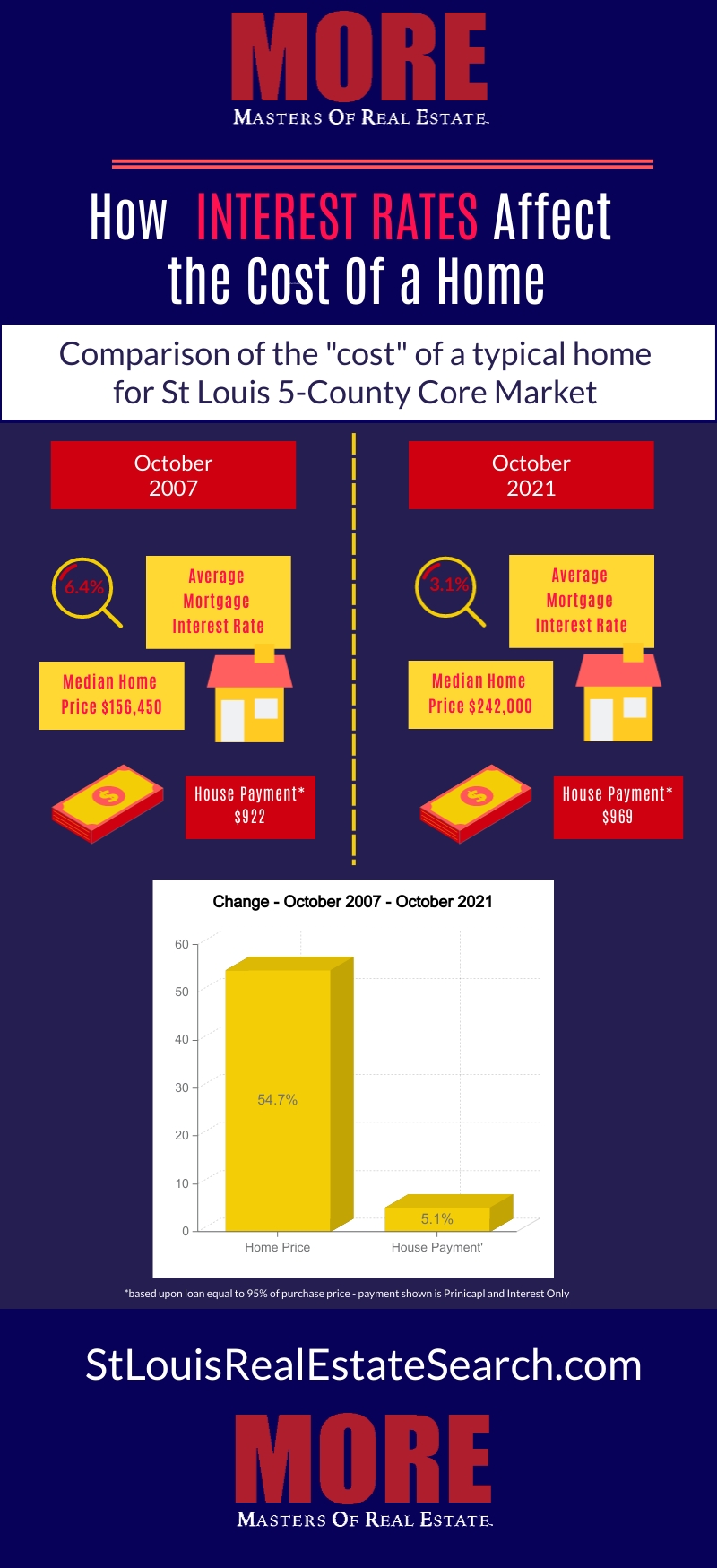

By Dennis Norman, on November 13th, 2021 Anyone paying even a little attention to the St Louis real estate market will likely be aware of the fact that we have been in a strong seller’s market for the past couple of years and St Louis home prices, as a result, have increased significantly. In fact, as the infographic below shows (exclusively available from MORE, REALTORS®) the median home price for a St Louis home has increased more than 50% in the past 14 years. However, the good news is that during that same period mortgage interest rates have fallen and remained low resulting an increase in the house payment on a typical home increase just over 5% during the same period!

[xyz-ips snippet=”Homes-For-Sale-and-Listings-With-Virtual-Tours”]

By Dennis Norman, on November 11th, 2021 Two-thirds of the homes sold in the St Louis 5-County core market (St Louis city and the counties of St Louis, St Charles, Jefferson, and Franklin) during October sold for the asking price or above. As the infographic below shows (exclusively available from MORE, REALTORS®) there were 2,888 homes sold during October in the St Louis 5-County core market with 65% of them selling at the list price or above. One thing to remember about home prices though, and something you won’t hear from too many people reporting prices, is that not all sold prices are the “real” price.

[xyz-ips snippet=”Homes-For-Sale-and-Listings-With-Virtual-Tours”]

Continue reading “Two-Thirds Of Homes Sold In St Louis Core Market In October Sold At Or Above List Price“

By Dennis Norman, on October 31st, 2021 For the past few years now, we’ve experienced quite the seller’s market in St Louis fueled, in part, by a low supply of homes for sale. As a result, St Louis home prices have increased over the past few years at rates close to double the historic norm. Of late, we’ve heard a lot from people within, and outside of, the real estate industry expressing concern that home prices have gotten too high and even some have made comparisons to 2008 when the housing market saw the bubble burst. Being the data nerd I am, I’ve tried to keep emotion out of it and instead turn to the data to see if there were indications that perhaps St Louis home prices have increased too much and we are in for a correction. Up until now, the data has led me to believe that St Louis home prices were ok and can be sustained. However, based upon current data, I have a little different opinion as I write this.

So what has changed in the data to indicate home prices are too high?

For starters, I haven’t said St Louis home prices are too high yet, I’ve just said that the current data has changed my opinion. Having said that, prices may in fact reached levels that cannot be sustained and may need a downward correction to put them back in line or they may have just peaked and will remain rather flat for a period of time to allow the market to “catch up” with the prices. And, of course, data over the next month or two could change for the positive and show we’re not there yet and home prices can still go higher without a problem. For now, I’m going to say that, based upon the data as well as the normal seasonal adjustments we see this time of year, I’m going to expect to see St Louis home prices to decline somewhat during the winter months like normal, but then perhaps remain relatively flat come spring rather than increase in the spring like normal.

My opinion is based upon several pieces of data that, collectively, are indicating a coming adjustment in home prices to me. I have the charts below that illustrate this point and here’s my recap on them:

Continue reading “Have St Louis Home Prices Finally Increased Too Much?“

By Dennis Norman, on October 21st, 2021 Like the majority of real estate companies in St Louis, our firm, MORE, REALTORS® is a member of the National Association of REALTORS®. One of the things that go along with membership is to agree to abide by the Code of Ethics. Within the code of ethics, is Article 12 which states, in part, “REALTORS® shall be honest and truthful in their real estate communication and shall present a true picture in their advertising, marketing, and other representations.” As with every article in the code of ethics, there are “standards of practice” to serve as examples of how that article should be applied. For this article there is Standard of Practice 12-2 which states “REALTORS® may represent their services as “free” or without cost even if they expect to receive compensation from a source other than their client provided that the potential for the REALTOR® to obtain a benefit from a third party is clearly disclosed at the same time.”

I have always taken exception to that standard of practice for a couple of reasons, including:

- I don’t believe the statement is true.

- I think good buyer’s agents work hard, know the value they bring to their clients and earn what they are paid. To think that an agent has to represent that their services are free in order to get a client to use them I feel is an insult to a professional agent.

The reason behind my first issue above is that while in a traditional home sale, the buyer may not directly pay the agent representing them (the buyer’s agent) they pay them indirectly. Typically, when a home is listed and sold using a REALTOR®, the seller agrees to pay commission to their agent (the seller’s agent) as well as to the Buyer’s agent. Why would a seller agree to do this? Well, they basically have no choice as, if they want their home listed in the REALTORS® MLS system (who doesn’t?), they must offer a commission to the agent that sells the home as it’s a rule. So, like it or not, the seller is going to “agree” to pay the buyer’s agent’s commission. To say the total commission the seller is paying does not affect the price they accept I think would be disingenuous. So, if the commission the seller has to pay affects the price they will accept from a buyer and the commission the seller is paying includes the buyer’s agents commission, I think it’s safe to say the buyers agents services to the buyer are not “free”.

The Department of Justice must feel the same way…

Clearly, I’m not the only one out there that feels this way. Last November the DOJ (Department of Justice) and NAR (National Association of REALTORS®) entered into a settlement agreement to end an investigation. One of the things NAR had to agree to was to no longer permit buyers agents to advertise that their services were free. Recently, this agreement fell apart and the DOJ and NAR are involved in legal battles now so we’ll see where that goes.

Why a good buyer’s agent is more than worth the cost…

So now I’ll get to my second point. A good, professional buyer’s agent is worth every dollar they make on a transaction and, quite frankly, often don’t really get paid enough. Before you roll your eyes and think I’m just another one of those people that have “drank the REALTOR® KOOL-AID®”, stick with me. I assure you I’m not one of those, I hate KOOL-AID®, avoid sugar as much as I can, and I don’t like hypocrites. I like to tell it like it is. Often, I’m very supportive of the real estate industry, the people in it the practices, etc, however, there are times I am not. But, getting back to buyer’s agents, I want to add another caveat…note the adjectives I used; “good and professional”. I’m not in any way saying all agents are created equal nor that all agents are worth what they get paid. However, there are a lot of great ones that are very dedicated to their profession, love serving their clients, do so in an exceptional way and more than earn the commission they make. I feel blessed in that in our firm, MORE, REALTORS® I’m literally surrounded by agents like that.

What are you going to do for me that makes you worth the price I’m going to pay for your representation? This is a good question to ask an agent you are considering to represent you as a buyer’s agent. If it were me, here are some of the things I would like to hear in the response as well as be convinced that this is what past clients have experienced and what I can expect from the agent:

- Their knowledge and experience of the local market. They should know what the housing market is like, the prices, the trends, the inventory, etc.

- Their knowledge of the type of real estate you are looking for. For example, if you love older homes, such as the 80+-year-old ones that exist in Kirkwood, Webster Groves, you are going to want an agent with extensive knowledge of older homes. This will be invaluable to you when evaluating the condition of the home, reviewing your building inspection, etc. If you are looking for a mid-century modern, it would help to have an agent that knows what you are talking about as well as where to find that style of home.

- Their knowledge of the process and guidance they will give you. Today, we are very much in a seller’s market and buyers are having to compete with often a dozen or more offers on a home. You want an agent that is detailed, knows the process, the contract, and has a great grasp on how to best prepare you so that, when the time comes, your offer is seen in the best light possible by the seller. A good agent will not leave anything to chance in this area.

- Their relationship and reputation in the industry. There is a fine line on this one, as you don’t ever want to choose an agent that is more concerned with what the agent on the other side of the deal thinks of them rather than fearlessly representing your best interests. However, you don’t want an agent that has a bad reputation in the industry or is known as someone that is impossible to work with. I would want to find one that I’m convinced will always have MY best interest in mind, that understands their fiduciary obligation to me, and is well respected by their peers.

- Their commitment to my best interest. I would want an agent that is laser-focused on my interests and is going to work to do their best to get me what I want under the best terms and price. But, at the same time, someone that is confident and professional enough to also “stand up to me” if necessary to set me on the right track or to keep me from shooting myself in the foot.

When you take the time to go through some of the things above with an agent and find one that stands out as the best and most professional to represent you, I can almost guarantee that you are more than getting your money’s worth. I see it time and time again with our agents, where through knowledge and advice, negotiation or strategy, they save their clients not only money (and likely often more than the agent is being paid) but also time and frustration.

So, as my headline says, Buyer’s Agents AREN’T Free and as the things I point out above nor should they be.

Now it’s time for a shameless plug…do you want to be connected with a great, professional agent that is a Master of Real Estate? Just give me a call at 314.332.1012 or email me at Dennis@stlre.com and after I understand your wants and needs, I’ll connect you with the perfect agent for you!

By Dennis Norman, on October 18th, 2021 I’ve written a couple of articles lately addressing the news reports about the housing market cooling down. As I’ve addressed in those articles, there has not really been much data supporting a significant cooling in the St Louis real estate market. Additionally, I’ve noted that, due to the seasonality of the housing market, and the fact we are headed toward winter, a cooling of the market would be the seasonal norm.

So today, I decided to pick an easier question to answer, “has the St Louis real estate market peaked?” The short answer is yes, I believe it has. This statement, by itself, is not all bad as it would NOT be good for St Louis home prices to continue to increase at the rates they have over the past couple of years. Not to mention, if we stay in this low-inventory market strongly favoring sellers much longer, many buyers are going to just give up and shelf the idea of buying for a while.

As usual, I’ll let the data speak for itself. I have several charts and tables below (available exclusively from MORE, REALTORS®) that I believe support that we have probably seen the St Louis market peak.

Continue reading “Has the St Louis Real Estate Market Peaked?“

By Dennis Norman, on October 13th, 2021 The St Louis housing market appears to be cooling off slightly with fewer home sales last month than a year ago in 3 of the 5 St Louis area counties that make up the St Louis 5-county core real estate market. As the charts below illustrate, the decline in the overall St Louis market was very slight, with 3,164 homes sold last month just 11 sales fewer than September last year when there were 3,715 homes sold in the St Louis5-county core market. The charts have complete details but below is a recap of home sales and prices by county for last month versus September 2020:

- St Louis City & County – These two counties combined are the only in the core market to see an increase in sales last month from a year ago. Last month there were 1,710 homes sold, an increase of 4.6% from a year ago when there were 1,634 homes sold. Last month the median price of homes sold was $247,000 and increase of nearly 7.5% from last year when it was $229,900.

- Franklin County – Last month there were 127 homes sold, a decrease of 13.6% from a year ago when there were 147 homes sold. Last month the median price of homes sold was $227,050 and increase of nearly 14.5% from last year when it was $198,300.

- Jefferson County – Last month there were345 homes sold, a decrease of 6.8% from a year ago when there were 370 homes sold. Last month the median price of homes sold was $229,000 and increase of nearly 9.0% from last year when it was $210,000.

- St Charles County – Last month there were 617 homes sold, a decrease of 10.8% from a year ago when there were 684 homes sold. Last month the median price of homes sold was $303,000 and increase of nearly 12.2% from last year when it was $270,000.

[xyz-ips snippet=”Homes-For-Sale”]

Continue reading “St Louis Area Housing Market Report For September“

By Dennis Norman, on September 14th, 2021 There continue to be conversations by St Louis REALTORS® as well as other industry professionals as to whether or not the market is cooling off somewhat or slowing down. I keep watching the data closely to look for signs of a substantive change and while there are some, the market adjustments appear to be somewhat insignificant at this point. Last month, in an article about July’s market, I pointed out a slight slowing of the trend in July. Now, I’m taking a look at August, specifically, the number of new listings that came on the St Louis real estate market during that month versus the number of new sales during the month.

More new listings in August than a year ago, fewer new sales:

As the STL Real Estate Trends Reports below show (exclusively available from MORE, REALTORS®) 3,702 new listings came on the market in the St Louis 5-County core during August, an increase in new St Louis listings of 3.2% from a year ago when there were 3,586 new listings. Conversely, there were 3,861 new sales of homes last month, a decrease in St Louis home sales of 2.2% from a year ago when there were 3,949 new contracts written.

New contracts written exceeded listings again but not by as much margin:

During August 2020, the number of new contracts written on listings exceeded new listings in St Louis by about 10 percent (10.1%). Last month, new sales of St Louis listings only exceed the number of new listings by just over 4 percent (4.2%).

So, as I mentioned, the change in trend is slight, but something worth keeping an eye on.

[xyz-ips snippet=”Homes-For-Sale”]

Continue reading “St Louis Home Sales Trend Slows Slightly In August“

By Dennis Norman, on July 13th, 2021 What an interesting real estate market we’ve experienced in St Louis over the past few years! Seller’s fully expect their homes to sell the first weekend after hitting the market, with a feeding frenzy by buyer’s and bidding wars that drive the price above the list price. Buyer’s come to realize if they are going to be successful in buying a home they have to think fast, take chances and move quick! Heck, with a market like this, it’s no wonder a lot of folks, particularly sellers, don’t necessarily see a need for a real estate agent.

However, the reality is that sellers and buyers need a great agent now more than ever. Yes, I emphasized great as, like in any profession, there are varying levels of knowledge, experience and professionalism among real estate agents. In addition to having a great agent that agent needs timely, accurate market data, along with an understanding of the market resulting in complete market knowledge. Unfortunately, this combination is not easy to find.

So what’s the actual price, $270,000 or $250,000?

[xyz-ips snippet=”Homes-For-Sale”]

Continue reading “The Value of Good Data Coupled With a Good Agent“

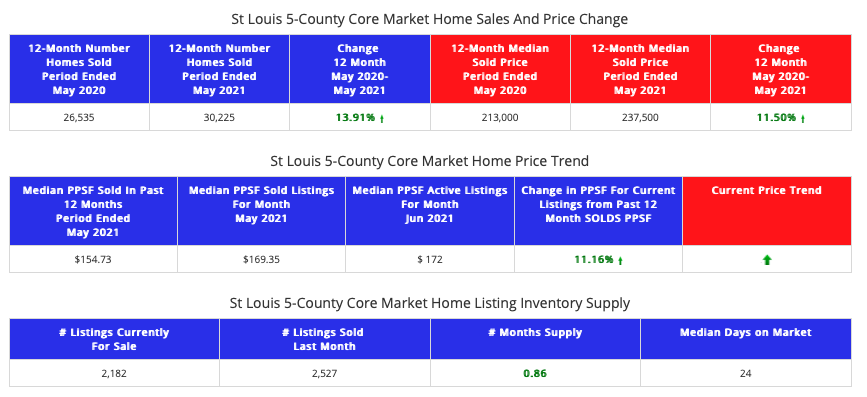

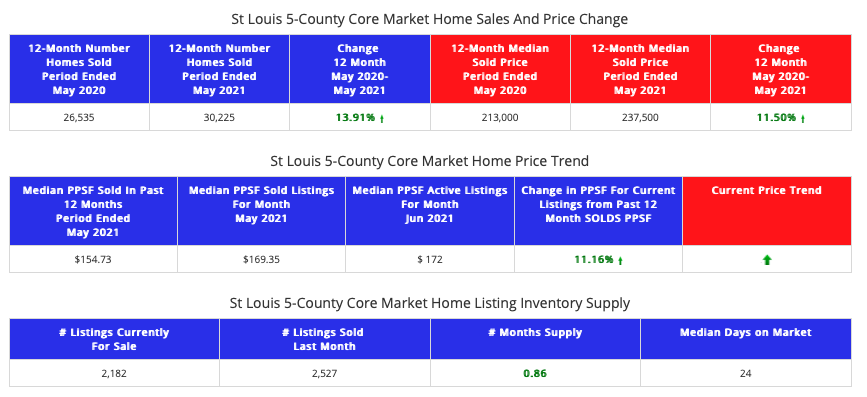

By Dennis Norman, on June 18th, 2021 For the 12-month period ended May 31, 2021, there were 30,225 homes sold within the St Louis 5-County core market, an increase in home sales of 13.91% from the prior 12-month period, according to the STL Market Report below, available exclusively from MORE, REALTORS®. During the same period, St Louis home prices increased 11.5% from a median of $213,000 to $237,500. As the report also shows, the current supply of listings for sale is low at 0.86 months.

[xyz-ips snippet=”Homes-For-Sale”]

STL Market Report For the St Louis 5-County Core Market

(click on report for live, complete report)

By Dennis Norman, on June 14th, 2021

[xyz-ips snippet=”Homes-For-Sale”]

By Dennis Norman, on June 2nd, 2021 It’s no secret how competitive the St Louis housing market is currently. In effort to get their offer accepted, homebuyers are waiving financing contingencies, building inspections and doing everything they can to convince the seller to take their offer. However, in addition to those aforementioned things, while it’s not necessarily the most important thing, price is pretty close to the top of the list.

As a result of everything mentioned above, almost two-thirds of the homes sold in the St Louis 5-County core market (St Louis city and the counties of St Louis, St Charles, Jefferson and Franklin) during the past 12 months sold for the asking price or above. As the infographic below shows (exclusively available from MORE, REALTORS®) there were 34,225 homes sold during the past 12-months in the St Louis 5-County core market with 63% of them selling at the list price or above. One thing to remember about home prices though, and something you won’t hear from too many people reporting prices, is that not all sold prices are the “real” price.

[xyz-ips snippet=”Homes-For-Sale-and-Listings-With-Virtual-Tours”]

Continue reading “Sixty-Three Percent Of St Louis Homes Sold In Past 12 Months Sold At Or Above List Price“

By Dennis Norman, on May 27th, 2021 While most of the current real estate market is doing quite well, and has for some time, the St Charles County real estate market has been on fire lately! Highlights from the the reports and charts below include (which are available exclusively from MORE, REALTORS):

- For the 12-month period ending April 30, 2021 there were 6,620 homes sold in St Charles County, an increase of 13% from the prior 12-month period.

- For the most recent period noted above, the median price of homes sold in St Charles County was $271,240, and an increase of nearly 9% from the prior period.

- Currently, there is just under a one-half of one month’s supply of homes for sale in St Charles County.

- The trend chart below does a good job of illustrating how, after over 3 years with a fairly flat trend, 10 of the 11 prior months have seen an increase in the home sales trend (12-month) for St Charles County.

- The STL Real Estate Trends Report below for new contracts and new listings is the absolute best way to spot where the market is headed and with new contracts written on listings increasing 50% in the most recent week from the prior week and new listings declining 6% in the same period, it looks like the inventory of homes for sale in St Charles is headed even lower.

[xyz-ips snippet=”Homes-For-Sale-and-Listings-With-Virtual-Tours”]

[xyz-ips snippet=”Seller-Resources—Listing-Targeted”]

Continue reading “St Charles County Real Estate Market On Fire!“

By Dennis Norman, on May 13th, 2021 Every month Fannie Mae surveys consumers about owning and renting a home as well as about other issues related to the housing market and economy and from the results publish their Home Purchase Sentiment Index® (HPSI). One of the components of the index is what the sentiment is on whether now is a good time to buy a home or sell a home. In the April 2021 HPSI 49% of consumers felt home prices would go up in the next 12-months and 54% felt interest rates would increase in the next 12-months.

[xyz-ips snippet=”Homes-For-Sale”]

[xyz-ips snippet=”Interest-Rates-and-Mike-McCarthy-Promo”]

Continue reading “About Half of Consumers Surveyed Think Home Prices and Interest Rates are Going Up“

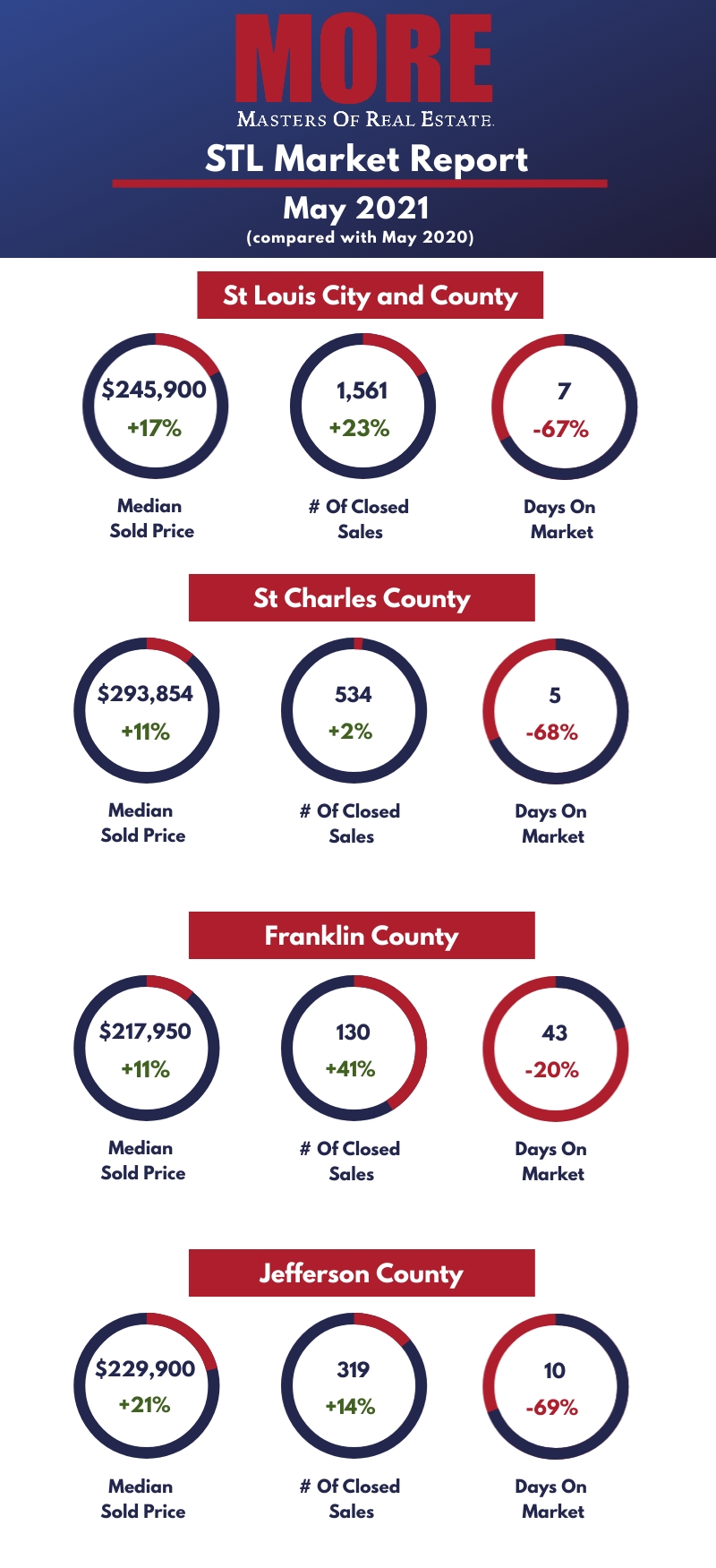

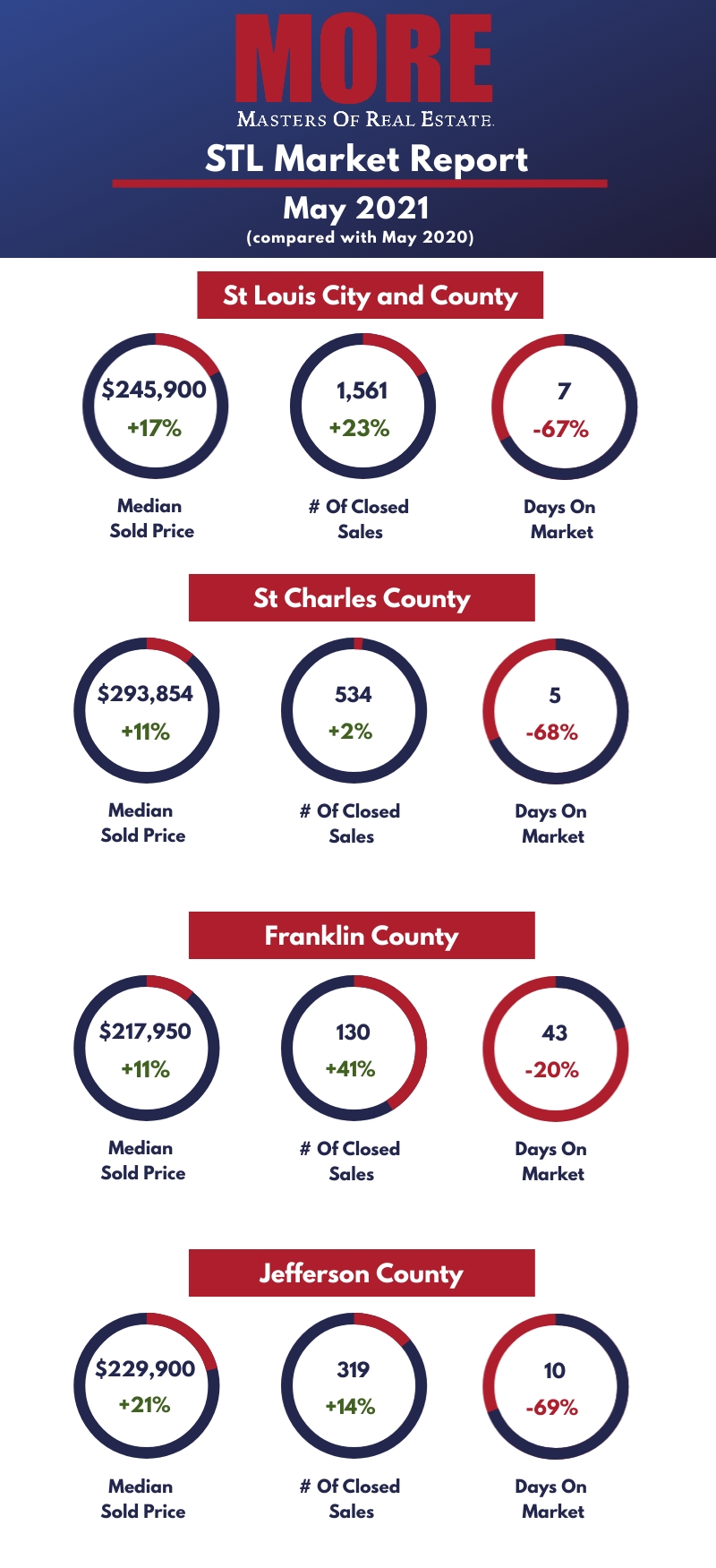

By Dennis Norman, on May 12th, 2021 In spite of the challenge of a low-inventory housing market, St Louis City and County, St Charles County and Franklin County all saw double-digit increases in the number of homes sold in April while Jefferson County saw a double digit decline. As the charts below illustrate, the median price of homes sold in those counties increased from a year ago in all the counties, two of them in the double digits.

Not all housing data is the same….nor accurate for that matter…

One thing worth noting is that there are housing market reports out there from many different sources, including many credible ones that may or may not be accurate. In most cases this is not due to an error on the part of the person or entity sharing the data but a result of either bad data, inaccurate data or misinterpreted data. For example, when preparing to write this article I noticed two different reports on “St Louis” home prices for homes sold in April. One, which indicated it was for St Louis City and County combined, reported $250,000 and one which reported the “St Louis area” was $266,000. In the case of the latter, my first guess was that they were reporting data for the St Louis MSA but when I checked that the actual sold price in April was only $223,750 so I have no idea where the data came from. For the former, the $250,000 median price is not only higher than the median price for St Louis City and County, it’s higher than the median price for the whole MSA and while the source is indicated, I’m not sure how this number was arrived at.

So what does it matter?

In the crazy market we are in where buyers are getting in bidding wars to get a home, I think it’s more important than ever to have good, relevant and accurate data available to your agent so your agent can help you make an informed decision. You ultimately may decide to pay above what you think the current value of the home is but it would help to know what the real value is. If you look at my chart below for St Louis City and County you’ll see the median price of homes sold in April was $230,000 which is quite different than the $250,000 price and $266,000 I saw reported elsewhere. Would being $20,000 – $36,000 off on the value matter to you? I think it might.

So how do I know I’m right?

Well, for starters I’m a data junky and for the past dozen or so years I’ve probably spent, on average about a dozen hours a week or more studying market data for St Louis. In addition, for the past 6 or 7 years we have worked to develop our own proprietary software to compile and report housing data and are constantly checking and double checking the output. Finally, we have a very credible source for data, the REALTOR® MLS and we constantly update and check the data. Put all of this together and while there’s no way to say it’s 100% correct, but I’m confident it’s about as close as you can get.

[xyz-ips snippet=”Homes-For-Sale”]

Continue reading “St Louis Area Housing Market Report For April“

|

Recent Articles

|