By Dennis Norman, on February 8th, 2026

The St. Charles County real estate market experienced notable changes in January 2026. Homes sold for a median price of $344,900, marking a 2.19% increase from January 2025’s median of $337,500. However, this figure also reflects a 6.78% decrease from December 2025, when the median sold price was $370,000. The median list price in January 2026 was $446,345, a significant 23.98% rise from $360,000 in January 2025.

In terms of home sales, there were 270 transactions in January 2026, representing a 16.92% decrease from the 325 sales recorded in January 2025. The chart below, available exclusively from MORE, REALTORS®, provides Continue Reading →

By Dennis Norman, on January 8th, 2026

The St. Charles County real estate market continues its upward trajectory as of January 2026, with homes selling for a median price of $369,500 in December 2025. This marks a 5.59% increase compared to December 2024, when the median sold price was $349,950. Additionally, the December 2025 median sold price reflects a 2.64% rise from the previous month of November 2025, which had a median sold price of $360,000.

The median list price in December 2025 was $439,750, showcasing a significant 22.15% increase from $360,000 in December 2024. The market also experienced a boost in activity, with 474 homes sold Continue Reading →

By Dennis Norman, on December 8th, 2025

The St. Charles County real estate market witnessed notable changes in November 2025. Homes sold for a median price of $360,000, marking a 3.23% increase from $348,750 in November 2024. However, this price reflects a slight decrease of 1.37% compared to October 2025’s median sold price of $365,000. The median list price in November 2025 was $440,900, showing a significant 22.47% rise from $360,000 in November 2024. Additionally, home sales totaled 422, a 4.95% decrease from the 444 homes sold in November 2024.

For a detailed visual representation of these statistics, refer to the chart below, available exclusively from MORE, Continue Reading →

By Dennis Norman, on November 8th, 2025

The St. Charles County real estate market demonstrated steady growth in October 2025, with homes selling for a median price of $365,000. This marks a 1.39% increase from October 2024, when the median sold price was $360,000. Additionally, the current median sold price reflects a 2.82% rise compared to September 2025’s $355,000. The median list price also saw a significant increase, reaching $437,163, up 21.77% from $359,000 in October 2024.

The market activity in St. Charles County remained strong, with 517 homes sold in October 2025, a 1.77% increase from the 508 homes sold during the same period last year. Continue Reading →

By Dennis Norman, on October 8th, 2025

The St. Charles County real estate market has shown a slight upward trend in home prices as of September 2025. Homes sold for a median price of $355,000, marking a 1.43% increase from the median price of $350,000 in September 2024. However, this also represents a 1.39% decrease compared to August 2025, when the median sold price was $360,000. The median list price for homes was $353,769, reflecting a 2.54% rise from $345,000 in September 2024.

In terms of sales volume, there were 453 home sales in September 2025, which is a 3.00% decline from the 467 homes sold in Continue Reading →

By Dennis Norman, on September 8th, 2025

The St. Charles County real estate market experienced notable shifts in August 2025. Homes sold for a median price of $357,195, marking a 1.55% increase from the median price of $351,750 in August 2024. However, this figure represents a 2.80% decrease compared to July 2025, when the median sold price was $367,500. The median list price remained stable at $350,000, unchanged from August 2024.

In terms of sales volume, there were 475 home sales in August 2025, reflecting an 8.30% decline from the 518 homes sold in August 2024. For a visual representation of these trends, refer to the chart Continue Reading →

By Dennis Norman, on August 8th, 2025

The St. Charles County real estate market demonstrated a robust performance in July 2025, with the median home selling price reaching $367,500, marking a 2.08% increase from the previous year. This figure slightly dipped by 0.68% from June 2025’s median selling price of $370,000. Despite the month-to-month fluctuation, the overall trend indicates healthy growth, as reflected in the median listing price of $365,000, up by 2.82% compared to July 2024.

The volume of home sales also showed positive momentum, with 577 homes sold in July 2025, an increase of 6.65% from 541 sales in the same month last year. This Continue Reading →

By Dennis Norman, on July 8th, 2025

The St. Charles County real estate market has experienced subtle yet consistent growth as of June 2025. The median selling price of homes reached $373,200, marking a 0.86% increase from June 2024’s median of $370,000. This price also reflects a steady rise from May 2025, maintaining the same 0.86% growth rate. Prospective buyers saw a slight uptick in median list prices, which escalated to $369,995 in June 2025, up by 1.37% from the previous year.

Despite the rising prices, the volume of home sales showed a minimal decline. In June 2025, the county recorded 516 home sales, slightly down by Continue Reading →

By Dennis Norman, on June 18th, 2025

The St. Charles County real estate market experienced a notable increase in home prices in May 2025. The median sold price for homes reached $370,000, marking a 5.41% rise from May 2024’s median of $351,000. This increase also represents a 2.78% growth from April 2025, where the median sold price was $360,000. Meanwhile, the median list price saw an uptick to $373,950, which is 6.84% higher compared to the same period last year.

Despite the rise in prices, the number of homes sold in May 2025 slightly decreased by 3.26%, with 504 homes sold compared to 521 in May 2024. Continue Reading →

By Dennis Norman, on May 8th, 2025

The real estate market in St. Charles County has demonstrated robust growth as of May 2025, with significant increases in both median sold and list prices compared to the previous year. In April 2025, homes in St. Charles County sold for a median price of $375,000, marking a 4.17% increase from April 2024, when the median sold price was $360,000. This figure also represents a 1.35% rise from March 2025, where the median sold price was $370,000.

The median list price in April 2025 reached $374,400, up by 6.97% from $350,000 in April 2024. Additionally, the number of home sales Continue Reading →

By Karen Moeller, on April 24th, 2025

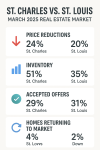

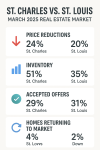

As the spring market picks up speed, St. Charles and St. Louis counties are showing some interesting contrasts in real estate activity — and for both buyers and sellers, the opportunities (and strategies) vary depending on where you’re standing.

We dug into the most recent local data comparing February to March 2025, and here’s what you need to know:

🔻 Price Reductions Are Dropping — And That’s a Seller Signal

In both St. Charles and St. Louis, the number of listings with price reductions declined noticeably:

St. Charles saw a 24% Continue Reading →

By Dennis Norman, on April 8th, 2025

The St. Charles County real estate market has experienced subtle shifts in pricing and activity as of March 2025. Homes in the area sold for a median price of $370,000, reflecting a slight decrease of 0.24% compared to March 2024, when the median sold price was $370,900. However, this price represents an increase of 1.71% from February 2025, where the median sold price stood at $363,779. The median list price also saw an upward trend, settling at $369,700 in March 2025, marking a 1.29% increase from the previous year’s $365,000.

In terms of sales volume, there were 342 home sales Continue Reading →

By Dennis Norman, on March 8th, 2025

The real estate market in St Charles County continues to show strength, with a median sold price of $362,559 in February 2025. This represents a 1.87% increase from the same time last year, when the median sold price was $355,900. Additionally, February’s median sold price is up 2.13% from January 2025, when it was $355,000.

According to the chart below, provided exclusively by MORE, REALTORS®, the median list price also saw a slight increase, going from $359,800 in February 2024 to $360,000 in February 2025. However, there were 233 home sales in February 2025, a decrease of 18.25% from the Continue Reading →

By Dennis Norman, on February 8th, 2025

The real estate market in St Charles County saw a slight increase in median sold price during January 2025, according to the latest data from MORE, REALTORS®. Homes sold for a median price of $350,000, which is a 3.40% increase from the same time last year when the median sold price was $338,500. However, this also represents a 2.78% decrease from December 2024, when the median sold price was $360,000.

The median list price also saw an increase, rising to $350,000 from $339,999 in January 2024. This shows a 2.94% year-over-year increase in list price. In terms of sales, there Continue Reading →

By Dennis Norman, on January 8th, 2025

As of December 2024, the real estate market in St Charles County has seen a slight increase in median sold price compared to the previous year. According to the latest data available exclusively from MORE, REALTORS®, homes in the area sold for a median price of $360,000, a 0.63% increase from December 2023 when the median sold price was $357,750.

However, there was a slight decrease in median sold price from the previous month, November 2024, when the median sold price was $362,500. This represents a decrease of 0.69% from the current month’s median sold price.

The median list price Continue Reading →

By Dennis Norman, on December 9th, 2024

The latest data from the St Charles County real estate market is in, and it’s showing positive signs for both buyers and sellers. According to the chart below, exclusively available from MORE, REALTORS®, the median sold price for homes in the update during November 2024 was $360,500. This represents a 3.00% increase from November 2023, when the median sold price was $350,000.

While the median sold price saw a slight decrease of 2.57% from October 2024, when it was $370,000, the overall trend is still on the rise. Additionally, the median list price for homes in the update was $359,900, Continue Reading →

By Dennis Norman, on November 8th, 2024

The real estate market in St Charles County continues to show strong growth as we head into the final months of 2024. According to the latest data from MORE, REALTORS®, the median sold price for homes in the St Charles County update during October 2024 was $370,000, representing a 5.74% increase from the same time last year. This also marks a 2.46% increase from September 2024, when the median sold price was $361,113.

The median list price for homes in the St Charles County update was $375,000, a 7.14% increase from October 2023. And with 406 home sales in October Continue Reading →

By Dennis Norman, on October 8th, 2024

The real estate market in St Charles County saw a slight increase in median sold price during September 2024. According to the latest data from MORE, REALTORS®, homes in the st charles county update sold for a median price of $365000, which is 1.53% higher compared to September 2023 when the median sold price was $359500.

This also marks a 0.00% increase from August 2024, when the median sold price was $365000. The median list price in September 2024 was $365000, showing a 2.47% increase from $356200 in September 2023. These numbers indicate a steady and strong market in St Continue Reading →

By Dennis Norman, on September 8th, 2024

As of August 2024, the St Charles County real estate market saw a slight decrease in median sold price compared to the same time last year. According to data exclusively available from MORE, REALTORS®, homes in the St Charles County update sold for a median price of $363,500, a 0.41% decrease from August 2023. This also represents a 2.94% decrease from July 2024, when the median sold price was $374,500.

However, the median list price for homes in St Charles County showed an increase of 1.36% from $360,000 in August 2023 to $364,900 in August 2024. This indicates that sellers Continue Reading →

By Dennis Norman, on August 8th, 2024

The real estate market in St Charles County continues to show steady growth as we enter the month of August. According to the latest data from MORE, REALTORS®, the median sold price for homes in the county was $375,000 in July 2024, a 4.17% increase from the same time last year. This also marks a slight decrease of 4.03% from June 2024.

The median list price for homes in St Charles County was $369,900, a 5.69% increase from July 2023. This indicates a strong demand for homes in the area, as sellers are able to list their homes at higher Continue Reading →

By Dennis Norman, on July 8th, 2024

The real estate market in St Charles County has continued to show strong growth and stability as of July 2024. According to the latest data from MORE, REALTORS®, the median sold price for homes in the county during June 2024 was $391,500, representing an increase of 7.26% from the same time last year when the median sold price was $365,000. This also marks a 6.41% increase from May 2024, when the median sold price was $367,900.

The median list price for homes in St Charles County was $379,900 in June 2024, a significant increase of 8.54% from $350,000 in June Continue Reading →

By Dennis Norman, on June 8th, 2024

The real estate market in St Charles County continues to show strength and growth, with the median sold price for homes increasing by 5.71% in May 2024 compared to the same time last year. According to the chart below, available exclusively from MORE, REALTORS®, the median sold price for homes in the St Charles County update was $370,000, up from $350,000 in May 2023. This also marks a 2.78% increase from April 2024, when the median sold price was $360,000.

The median list price for homes in St Charles County also saw an increase of 5.82% from May 2023, reaching Continue Reading →

By Dennis Norman, on May 15th, 2024

The real estate market in St Charles County, MO continues to show strength and stability as we head into the summer months. According to the latest data available exclusively from MORE, REALTORS®, the median sold price for homes in the St Charles County update was $360,000 in April 2024. This represents a 2.06% increase from April 2023, when the median sold price was $352,750.

While there was a slight decrease of 2.82% from the previous month, when the median sold price was $370,450, the overall trend for home prices in St Charles County remains positive. Additionally, the median list price Continue Reading →

By Dennis Norman, on April 18th, 2024

The St. Louis Business Journal today published an article with the headline “A hidden cost of homeownership is mounting — and approaching crisis levels”. The article began with “homeowners across the country are facing an insurance crisis — and it’s driving up housing costs”, and then quoted a study indicating that 72% of U.S. homeowners said the cost of their homeowners insurance had increased over the past year. Well, sometimes it’s better to not have ocean views, mountains, and the like, and to be situated in the middle of the country like we are here in St. Louis—and this would Continue Reading →

By Dennis Norman, on April 10th, 2024

The St. Louis MSA residential real estate market is experiencing a phase of transformation. While the sales volume has seen a downturn, median sale prices have held steady, indicating a resilient market underpinned by solid demand. The complete STL Market Reports for the entire metro area as a whole, as well as the major counties, are available exclusively from MORE, REALTORS® and are below.

Key Findings:

Sales Volume Decline: The St. Louis MSA experienced a 9.30% decrease in the number of homes sold during the 12-month period ending March 31, 2024, compared to the previous year. Median Sold Price Growth: Continue Reading →

By Dennis Norman, on April 10th, 2024

During the 12-month period ending February 29, 2024, there were 3,993 building permits issued for new single-family homes in the St. Louis area. This figure marks a 4.29% decrease from the previous 12-month period, which saw 4,172 permits issued, as per the latest data from the Home Builders Association of St. Louis & Eastern Missouri (St. Louis HBA). The downturn was observed in all counties except St Charles County, with three of them experiencing double-digit declines. Search St Louis Homes For Sale Search St Louis New Homes For Sale

St Louis New Home Building Permits – February 2024

Continue Reading →

By Dennis Norman, on March 27th, 2024

The St. Louis Metro residential real estate market in 2024 is showcasing diverse trends, indicating an evolving landscape for buyers, sellers, and industry professionals. The latest data, detailed in the STL Market Report exclusively from MORE, REALTORS®, offers a snapshot of these dynamics.

Contrasting Sales Trends:

There’s a notable decrease in home sales volume by 16.11% in the past year, with figures declining from 38,173 to 32,022 homes sold.

Home Value Resilience:

Despite the lower sales volume, median sold prices in the metro area nudged upward by 2.44%, moving from $246,000 to $252,000 year-over-year.

Price Per Square Foot (PPSF) Analysis:

Continue Reading →

By John Donati, on March 18th, 2024

In a recent informative video, Mike Ragan, a master electrician, and owner of R&M Electric in St. Charles MO, dispels several myths surrounding aluminum wiring, a subject that often causes apprehension among prospective homebuyers in the St. Louis area. With over 18 years of experience specializing in residential wiring and troubleshooting, Ragan brings a wealth of knowledge to the discussion. He offers crucial insights for anyone considering the purchase of a home equipped with aluminum wiring, providing a fresh perspective on what has traditionally been viewed as a potential dealbreaker. Continue Reading →

By Dennis Norman, on March 14th, 2024

The St. Louis Metro Area saw a continued population decline according to the latest U.S. Census Bureau estimates, which show the region’s population decreasing from 2,820,285 in April 2020 to 2,796,999 as of July 2023. This represents a loss of 23,286 residents, or a 0.83% decrease over the three-year period. Looking at the one-year change, the St. Louis MSA population fell by 3,246, or 0.12%, from 2,800,245 in July 2022 to 2,796,999 in July 2023. Despite these decreases, St. Louis maintained its position as the 21st largest MSA nationally from 2020 to 2023.

Drilling down to the county level reveals Continue Reading →

By Dennis Norman, on March 13th, 2024

The St. Louis Metropolitan Area continues to enjoy a fairly fast-paced sellers real estate market, with certain zip codes standing out for selling even faster than the current norm. According to the report below, available exclusively from MORE, REALTORS®, homes in the top 30 zip codes are selling at an impressive rate, with average days on market ranging from just 2 to 24 days. Leading the pack is zip code 63049 in Jefferson and St. Louis Counties, Missouri, where homes spend an average of only 2 days on the market. Close behind are zip codes in St. Clair County, Illinois Continue Reading →

|

Recent Articles

Helpful Real Estate Resources

|